Chapter: 11th Accountancy : Chapter 13 : Final Accounts of Sole Proprietors-II

Illustration Problems with Solutions - Adjustment entries and accounting treatment of adjustments

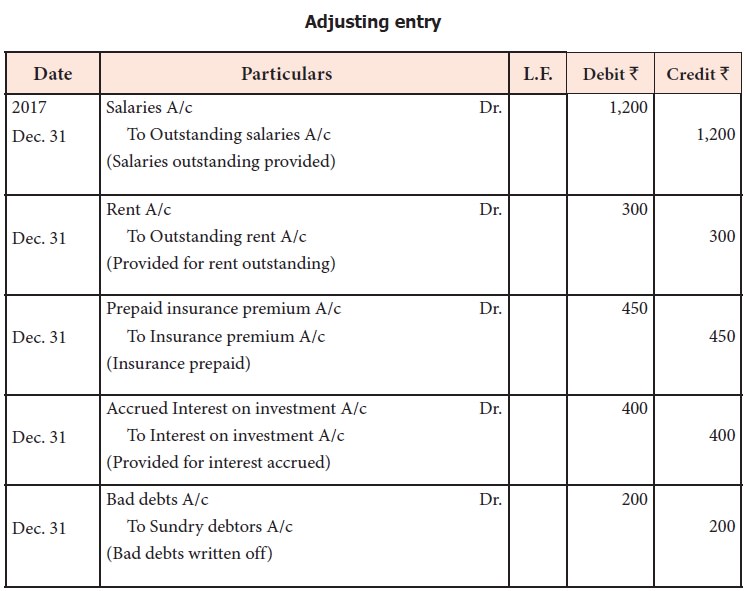

Illustration 1

Show necessary entries to adjust the following on 31st December, 2017.

i.

Outstanding

salaries Rs. 1,200

ii.

Outstanding

rent Rs. 300

iii.

Prepaid

insurance premium Rs. 450

iv.

Interest

on investments accrued Rs. 400

v.

Bad debts

written off Rs. 200

Solution

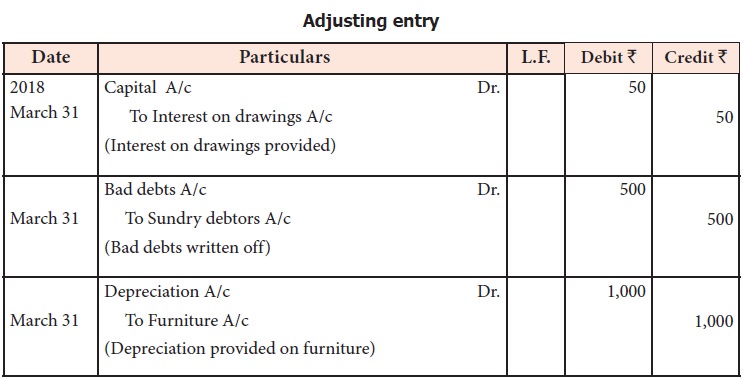

Illustration 2

Pass adjusting entries for the

following on 31st March, 2018.

i.

Charge

interest on drawings at Rs. 50

ii.

Write off

bad debts by Rs. 500

iii.

Depreciate

furniture by Rs. 1,000

Solution

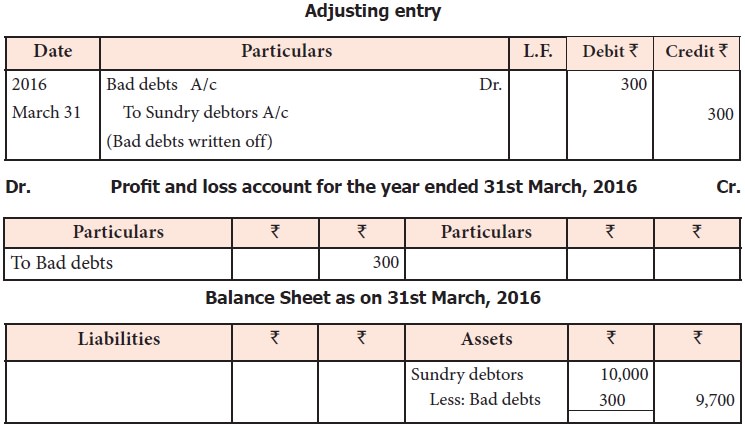

Illustration 3

Sundry debtors as per trial balance as on 31st March, 2016

is Rs. 10,000.

Adjustment: Write off bad debts

amounting to Rs. 300.

Give adjusting entry and show how

these appear in the final accounts as on 31st March, 2016.![]()

Solution

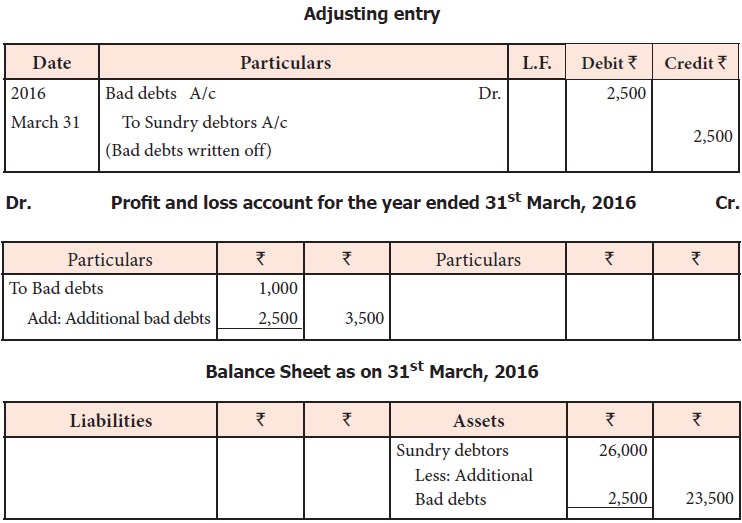

Illustration 4

Sundry debtors as per trial

balance Rs. 26,000

Bad debts as per trial balance Rs. 1,000

Adjustment: Additional bad debts

amounted to Rs. 2,500

Give adjusting entry and show how

these appear in the final accounts on 31st March, 2016.

Solution

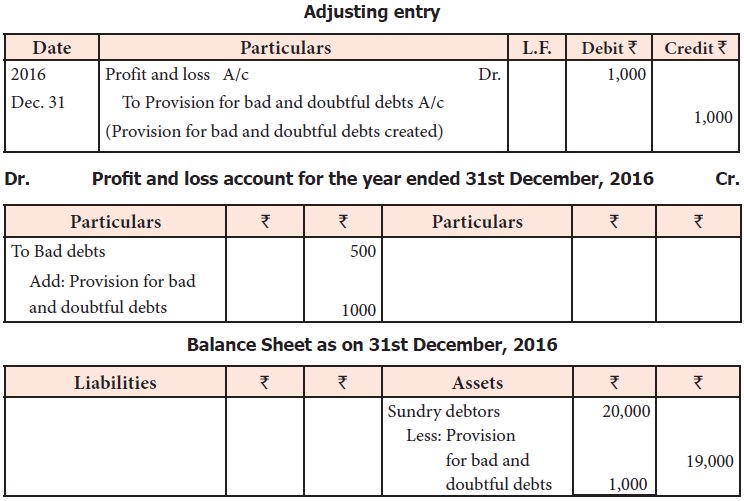

Illustration 5

An abstract of the trial balance

as on 31st December, 2016 is as follows:

Particulars Rs.

Sundry Debtors 20,000

Bad debts 500

Adjustment: Create a provision

for bad and doubtful debts @ 5% on sundry debtors. Pass the adjusting entry and

show how these items will appear in final accounts.

Solution

Provision for bad and doubtful

debts = Rs. 20,000 x 5/100 = Rs. 1,000

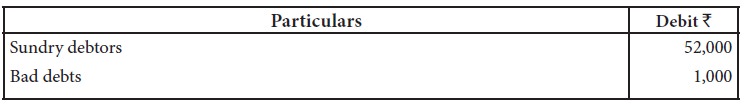

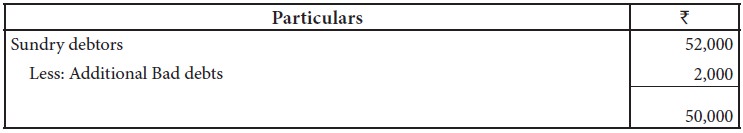

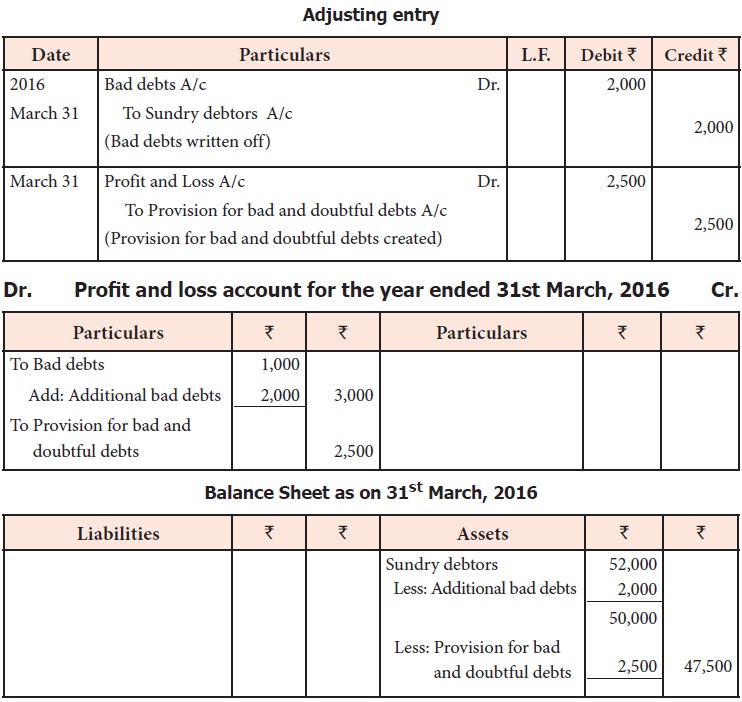

Illustration 6

Abstracts from the trial balance

as on 31st March, 2016:

Adjustments:

i.

Additional

bad debts Rs. 2,000

ii.

Create 5%

provision for bad and doubtful debts

You are required to pass

necessary adjusting entries and show how these items will appear in final

accounts.

Solution

Working note:

Provision for bad and doubtful debts = ` 50,000 x 5/100 = Rs. 2,500

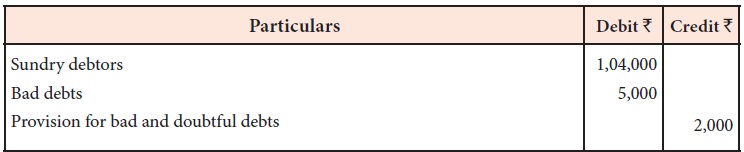

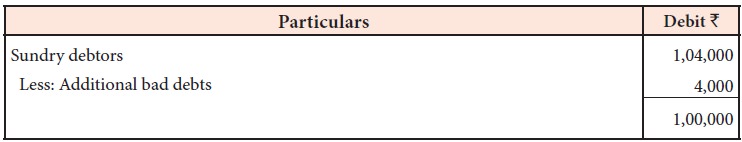

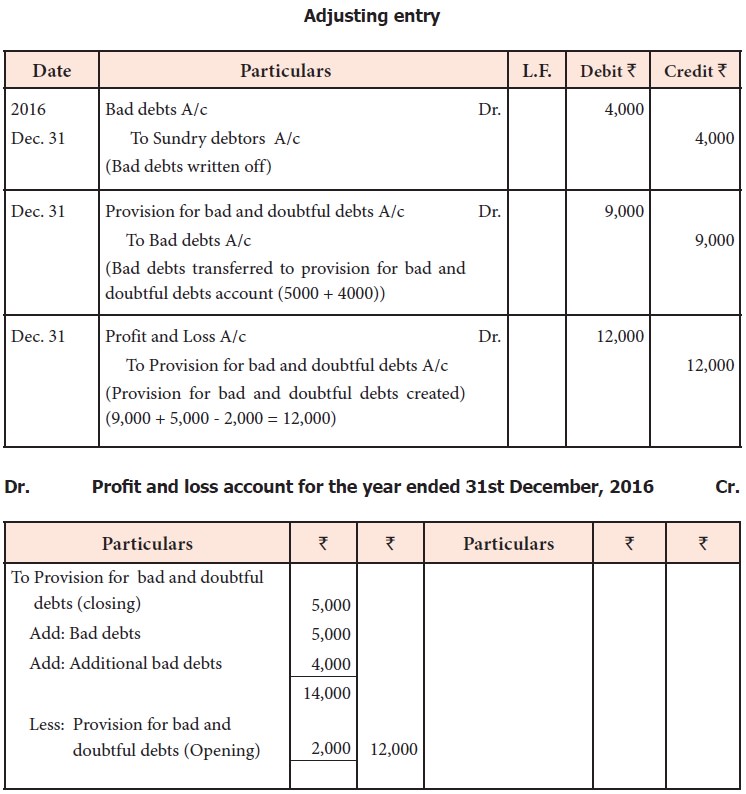

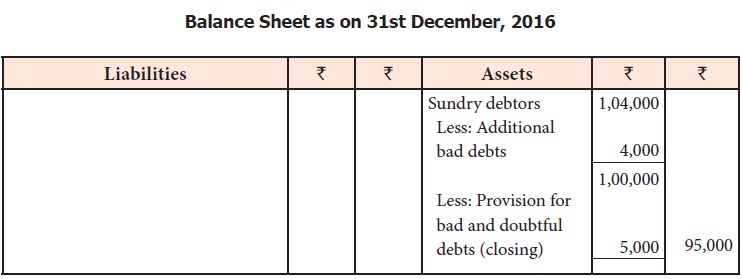

Illustration 7

Abstracts from the trial balance

as on 31st December, 2016:

Adjustments:

i.

Additional

bad debts amounted to Rs. 4,000.

ii.

Create a

provision for bad and doubtful debts @ 5% on sundry debtors.

Pass necessary adjusting entries

and show how the different items appear in final accounts.

Solution

Working note:

Provision for bad and doubtful

debts = Rs. 1,00,000 x 5/100 = Rs. 5,000

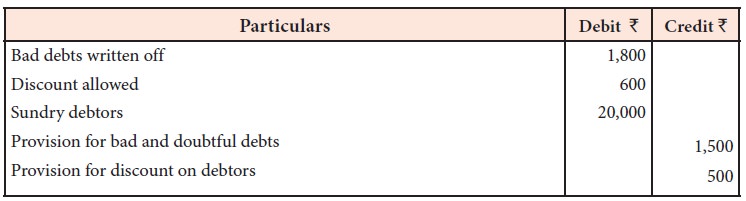

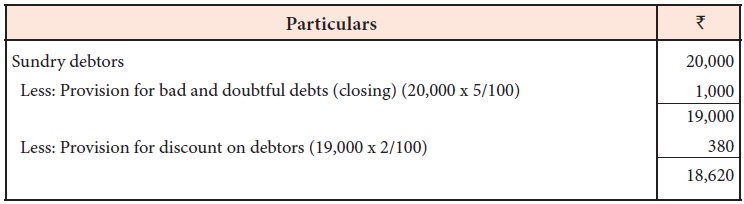

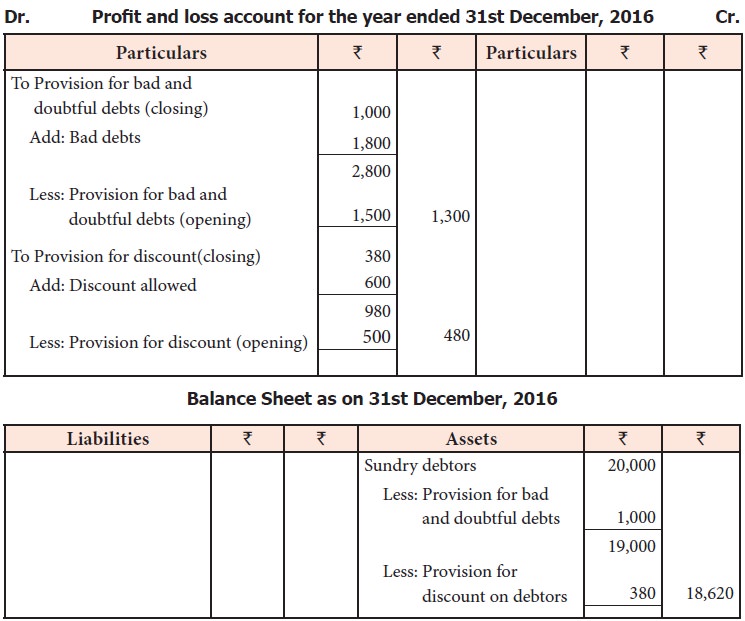

Illustration 8

Abstracts from trial balance as

on 31st December, 2016 are as follows:

A provision for doubtful debts @

5% and a provision for discount @ 2% on sundry debtors are to be maintained by

the trader. Show how these items would appear in the final accounts.

Solution

Working note:

Related Topics