Chapter: 11th Accountancy : Chapter 13 : Final Accounts of Sole Proprietors-II

Adjustment entries and accounting treatment of adjustments

Adjustment entries and accounting

treatment of adjustments

1. Meaning of adjustment entries

Adjustment entries are the journal entries made at the end of the

accounting period to account for items which are omitted in trial balance and

to make adjustments for outstanding and prepaid expenses and revenues accrued

and received in advance.

2. Purpose of adjustment entries

The main purpose of adjustment entries are to match current year revenue

with the expenses incurred to earn these revenues. Other purposes are:

i.

To

exhibit true and fair view of profitability

ii.

To

exhibit true and fair view of financial status.

3. Need for adjustment entries

The need arises to pass adjusting entries for the following reasons:

i.

To record

omissions in trial balance such as closing stock, interest on capital, interest

on drawings, etc.

ii.

To bring

into account outstanding and prepaid expenses.

iii.

To bring

into account income accrued and received in advance.

iv.

To create

reserves and provisions.

4. Adjustments and adjustment entries

The following are the common adjustments and adjustment entries which

are made while preparing the final accounts.

i.

Closing

stock

ii.

Outstanding

expenses

iii.

Prepaid

expenses

iv.

Accrued

income

v.

Income

received in advance

vi.

Interest

on capital

vii.

Interest

on drawings

viii.

Interest

on loan

ix.

Interest

on investment

x.

Depreciation

xi.

Bad debts

xii.

Provision

for bad and doubtful debts

xiii.

Provision

for discount on debtors

xiv.

Income

tax paid

xv. Manager’s commission

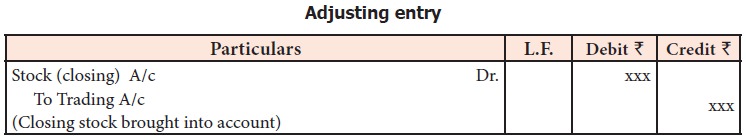

(i) Closing stock

The unsold goods in the business

at the end of the accounting period are termed as closing stock. As per AS-2

(Revised), the stock is valued at cost price or net realisable value, whichever

is lower.

Presentation in final accounts

Tutorial note

Closing stock is the opening stock for the next accounting period. At

the beginning of the next accounting period this entry is reversed to bring

into account the opening stock.

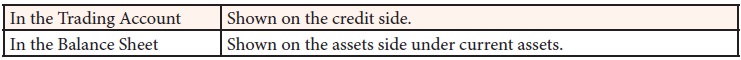

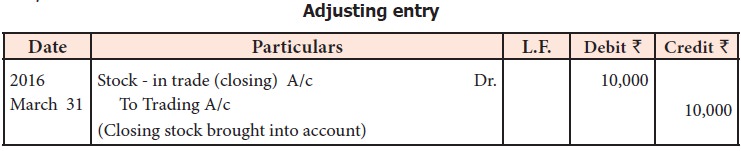

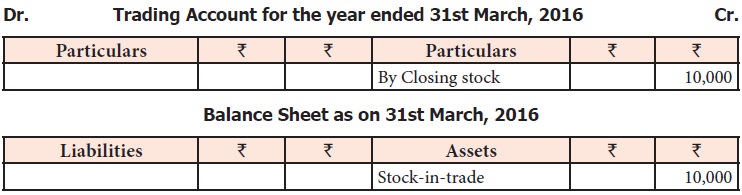

Example

The value of closing stock shown as adjustment on 31st March, 2016 is Rs. 10,000. The adjusting

entry is:

Adjusting entry

In final accounts, it is presented

as follows:

Tutorial note

If closing stock is already

adjusted, adjusted purchases account and closing stock will appear in trial

balance. Adjusted purchases account will be shown on the debit side of the

trading account and closing stock will be shown on the assets side of the

balance sheet.

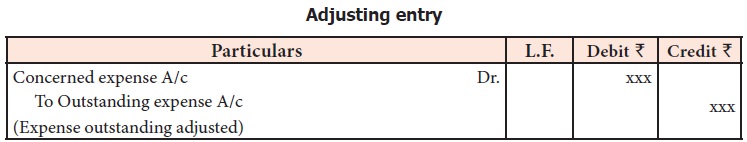

(ii) Outstanding expenses

Expenses which have been incurred in the accounting period but not paid

till the end of the accounting period are called outstanding expenses. In other

words, if certain benefits or services are received during the year but payment

is not made for the services received and utilised, these are termed as

outstanding expenses. Outstanding expense account is a representative personal

account and expense account is a nominal account.

Presentation in final accounts

Tutorial note

· If outstanding expenses account appears in the trial balance with credit balance, it means that journal entry has been made already for outstanding expenses. Hence, the outstanding expenses account will be shown only in the liabilities side of balance sheet. No adjustment is therefore necessary in expenses account as already expenses would have been adjusted.

·

At the beginning of the next accounting period the

above entry is reversed to bring into account outstanding expenses at the

beginning so that it is reduced from amount of expense of next year.

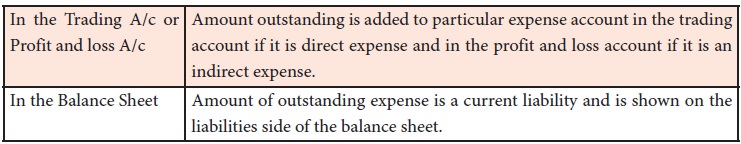

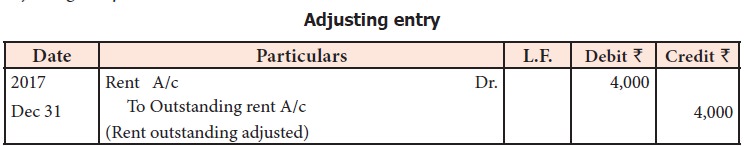

Example

For the year 2017, rent is payable @ Rs. 2,000 p.m. and during the year Rs. 20,000 is paid on

account of rent.

Total rent for the year 2017 is Rs. 24,000 i.e., 2,000 p.m. x 12 months. The difference between total rent

payable and actual rent paid Rs. 4,000 (

i.e. Rs. 24,000 - Rs. 20,000)

is outstanding rent. The adjusting entry is:

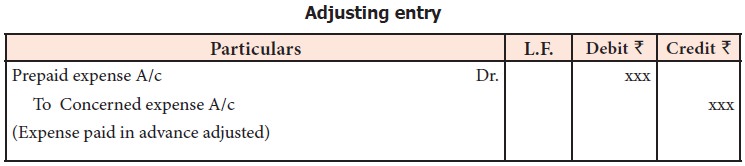

(iii) Prepaid Expenses

Prepaid expenses refer to any

expense or portion of expense paid in the current accounting year but the

benefit or services of which will be received in the next accounting period.

They are also called as unexpired expenses. Though these expenses are paid in

the accounting period, they are not incurred during the accounting period.

Prepaid expense account is a representative personal account. Expense account

is a nominal account.

Presentation in final accounts

Tutorial note

·

If prepaid expense already appears in trial balance

it means that it is already adjusted and journal entry has already been made.

Hence, prepaid expense is shown only in balance sheet.

·

At the beginning of the next accounting period, the

above entry is reversed to bring into account prepaid expenses at the beginning

so that it is added to amount of expense of next year.

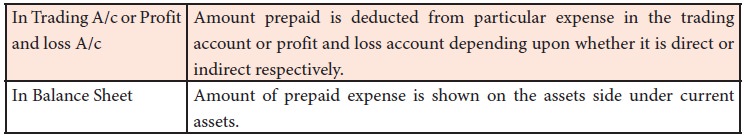

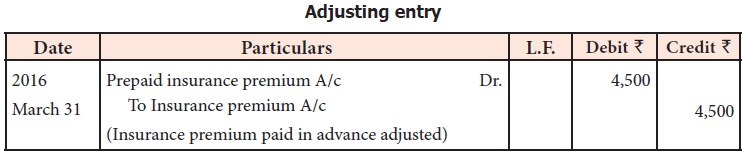

Example

Insurance premium of Rs. 6,000 for one year is paid on 1st January, 2016

and the accounting year closes on 31st March, 2016.

In this example, insurance premium has been paid in advance or prepaid

for nine months, i.e.from 1st April to 31st December amounting to Rs. 4,500 (i.e., Rs. 6000 × 9/12). The

adjusting entry is:

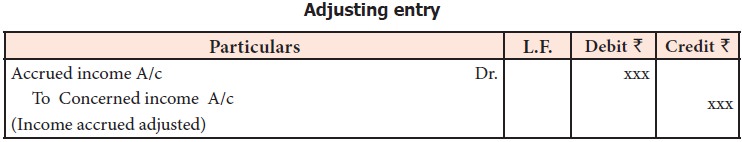

(iv) Accrued income

Accrued income is income or portion of income which has been earned

during the current accounting year but not received till the end of that

accounting year. It generally happens in case of amount to be received on

account of commission, interest, dividend, etc.

Presentation in final accounts

Tutorial note

·

If accrued income account appears in the trial

balance with debit balance, it means that journal entry has been made already

for accrued income. Hence, the accrued income account will be shown only in the

assets side of balance sheet. No adjustment is necessary in income account as

already it would have been adjusted.

·

At the beginning of the next accounting period, the

above entry is reversed to bring into account accrued income at the beginning,

so that it is reduced from amount of income in the next year.

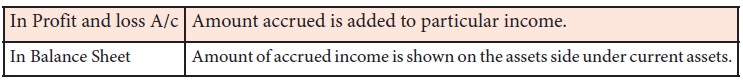

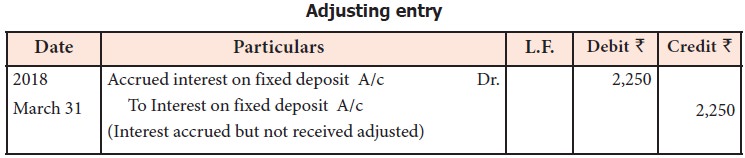

Example

A business has a fixed deposit of Rs. 1,00,000 with a bank for 12 months in the

accounting period ending 31st March, 2018 @ 9% interest p.a. Interest received

during the year was Rs. 6,750.

In this example, income earned is Rs. 9,000 (i.e., 1,00,000 × 9%). Income received is Rs. 6,750.Hence, the income

earned but not received, is the accrued interest ie., Rs. 2,250 (9,000 - 6,750).

The adjusting entry is:

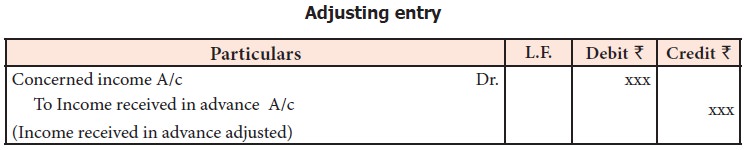

v. Income received in advance

Income received in advance refers to income or portion of income

received in an accounting year which is not earned in the accounting period. It

is also known as unearned income or unexpired income. Though the amount is

received in the current accounting year, the benefit is yet to be offered to

the concerned person in the next accounting year.

Tutorial note

·

If income received in advance account appears in

the trial balance with credit balance, it means that journal entry has been

made already for income received in advance. Hence, the income received in

advance account will be shown only in the liabilities side of balance sheet. No

adjustment is necessary in income account as already it would have been

adjusted.

·

At the beginning of the next accounting period, the

above entry is reversed to bring into account income received in advance at the

beginning, so that it is added to the amount of income in the next year.![]()

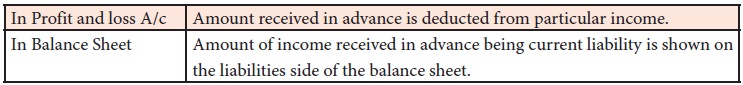

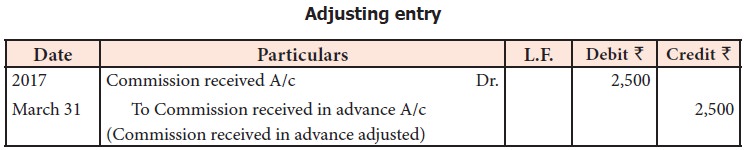

Example

The trial balance as on 31st March, 2017 shows commission received as Rs. 7,500.

Adjustment: One-third of the commission received is in respect of work

to be done in the next accounting year.

Commission received includes one-third of the commission for the next

accounting period.Rs. 7,500 × 1/3,

that is Rs. 2,500 is

received in advance. The adjusting entry is:

In final accounts, it is presented as follows:

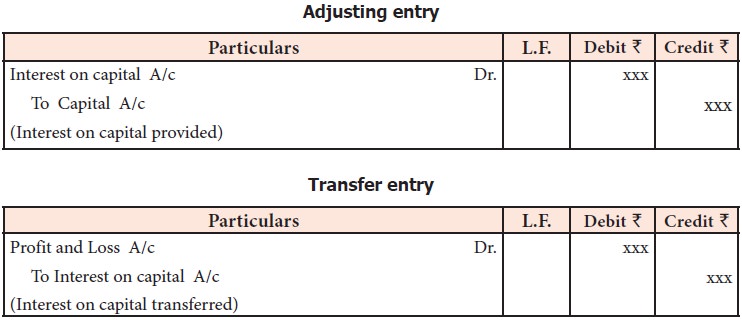

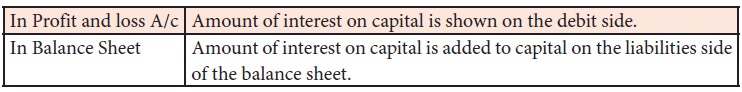

(vi) Interest on capital

According to separate entity

concept business and proprietor are two separate entities. Capital contributed

by proprietor is a liability to the business. Hence, interest may be provided

on capital contributed by proprietor. It is treated as a business expense. The

purpose is to know the true profit of the business.

Presentation in final accounts

Tutorial note

Interest on capital is calculated

on the opening balance of capital if there is no change in the capital account

during the accounting year. If there is any additional capital introduced or

capital withdrawn, then interest on capital is to be calculated proportionately

on the balance outstanding.

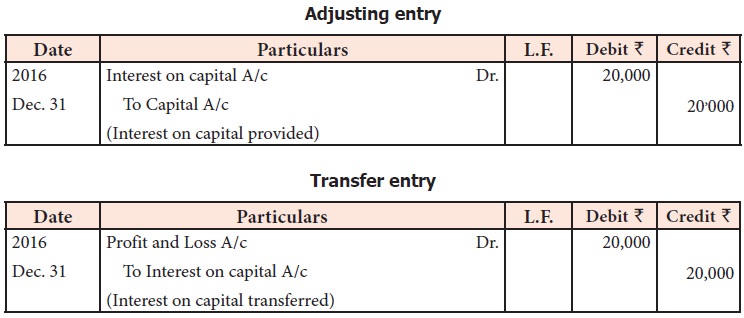

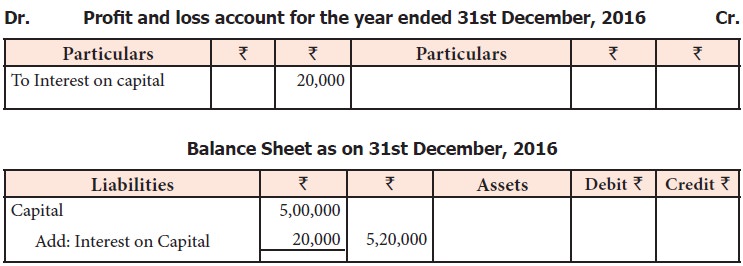

Example

The trial balance prepared on

31st December, 2016 shows Capital of Rs. 5,00,000.

Adjustment: Provide interest on

capital @ 4% p.a.

Interest on capital = Rs. 5,00,000 × 4/100 = Rs. 20,000.

The adjusting entry is:

In final accounts, it is presented as follows:

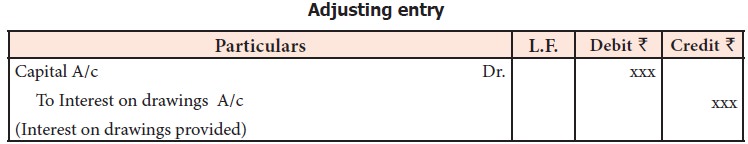

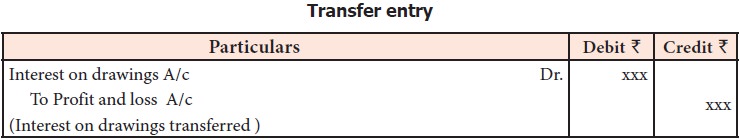

(vii) Interest on drawings

Drawings represent the amount or goods withdrawn by the proprietor from

the business for his personal use. As business is separate from owner, interest

charged on drawings, if any, is to be treated as business income.

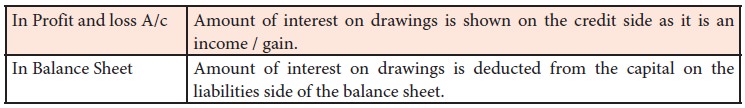

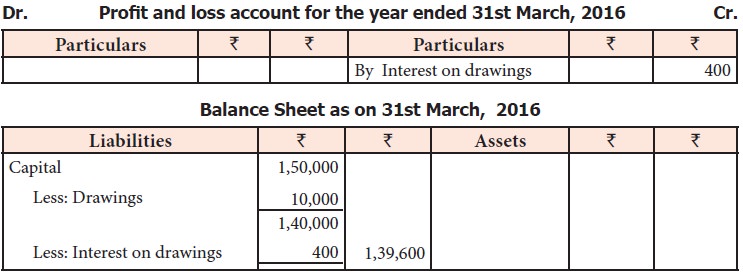

Presentation in final accounts

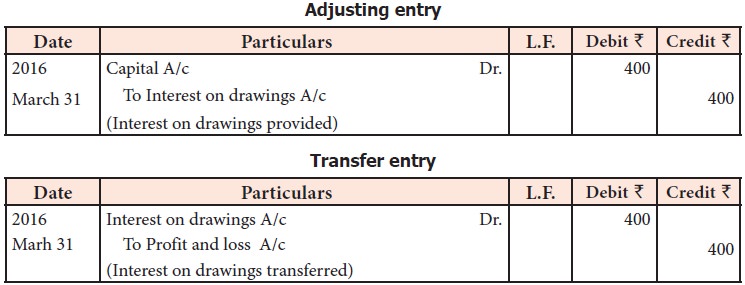

Example

The trial balance on 31st March,

2016 shows capital as Rs. 1,50,000

and drawings as Rs. 10,000.

Adjustment: Charge interest on

drawings at 4%.

Interest on drawings = Rs. 10,000 × 4/100 = Rs. 400. The

adjusting entry is:

In final accounts, it is presented as follows:

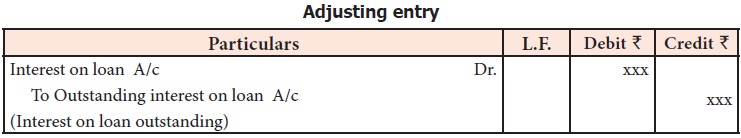

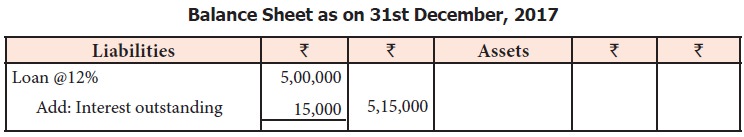

(viii) Interest on loan

Business entities may have loans

borrowed from banks and other financial institutions, private money lenders,

etc. If any interest is payable on loan and not yet provided at the time of

preparation of trial balance, it is necessary to provide for outstanding

interest on loan. It is an outstanding expense.

Presentation in final accounts

Tutorial note

·

If the trial balance contains loan account

specifying the percentage of interest and date of borrowing and interest paid

appears in the trial balance, it is to be checked whether interest for the

whole year is paid. If it is not paid, outstanding interest must be adjusted.

·

Similar to any other expenses outstanding, this

entry also will be reversed at the beginning of the next accounting period.

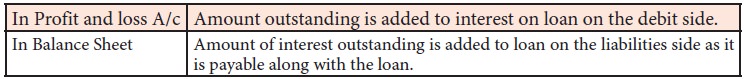

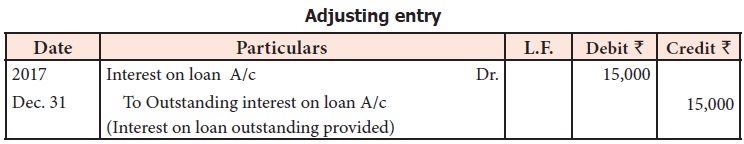

Example

Extracts from the trial balance

as on 31st December, 2017 is given below:

Adjustment: Interest on loan is unpaid for three months.

Interest unpaid = Rs. 5,00,000 × 12/100 × 3/12 = Rs. 15,000. The adjusting entry is:

In final accounts, it is presented as follows:

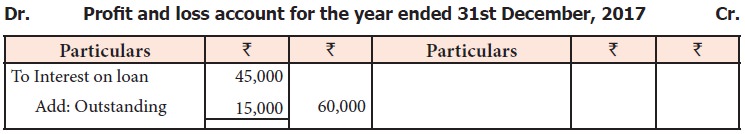

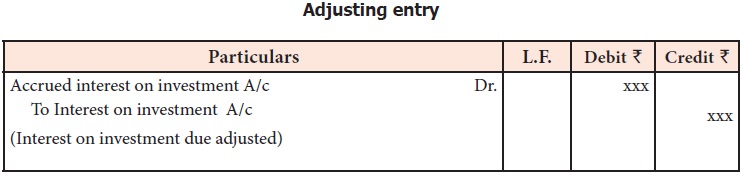

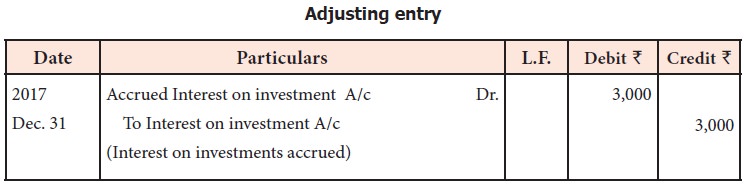

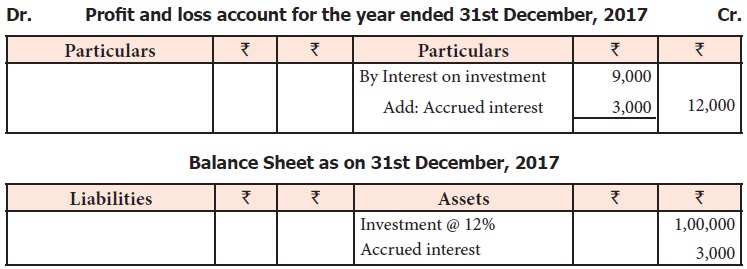

(ix) Interest on investment

Business entities may have

investments in outside securities carrying specified rate of interest. If

interest is due but not yet received, adjustment is to be made for the same in

the accounting records before preparation of final accounts. Interest

receivable on any investments in the form of shares, deposits, etc. made

outside the business is called accrued interest. It is an accrued income.

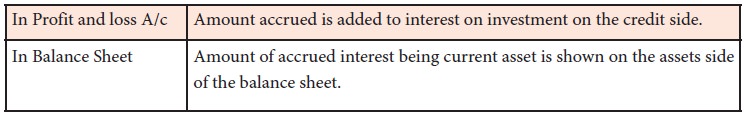

Presentation in final accounts

Example

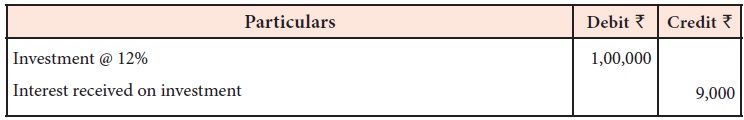

Extracts from the trial balance as on 31st December, 2017 is given below:

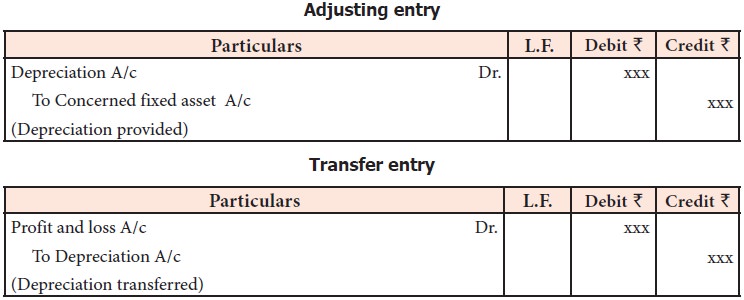

(x) Depreciation

The decrease in book value of fixed assets due to usage or passage of

time is called depreciation. It is a loss to the business. Therefore, it must

be written off from the value of asset. Generally, a certain percentage on the

value of the asset is calculated as the amount of depreciation.

Presentation in final accounts

Tutorial note

When depreciation already appears in trial balance, it means journal

entry is already made and asset account has been already reduced to the extent

of depreciation. Hence, depreciation will be shown only in profit and loss

account.

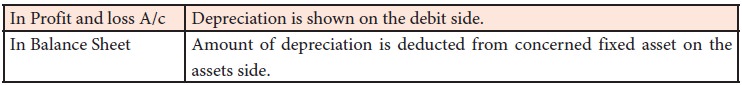

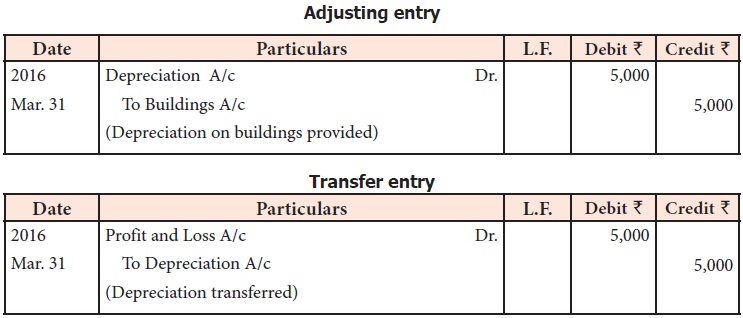

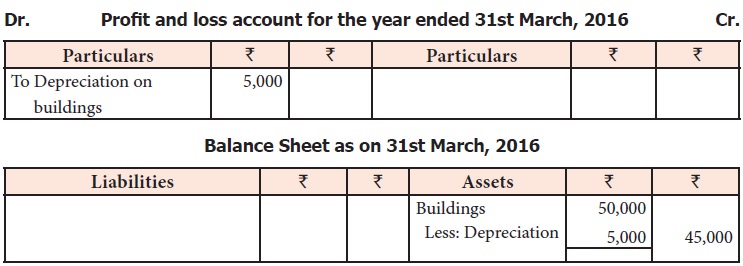

Example

The trial balance prepared on

31st March, 2016 shows the value of buildings as Rs. 50,000.

Adjustment: Depreciate buildings

@ 10% p.a.

Amount of depreciation = Rs. 50,000 x 10/100 = Rs. 5,000.

The adjusting entry is:

In final accounts, it is presented as follows:

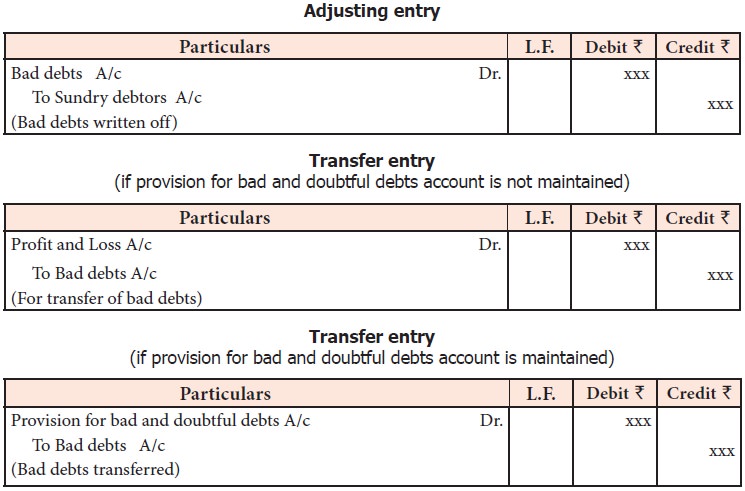

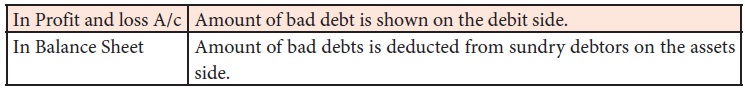

(xi) Bad debts

When it is definitely known that

amount due from a customer (debtor) to whom goods were sold on credit, cannot

be realised at all, it is treated as bad debts. In other words, debts which

cannot be recovered or irrecoverable debts are called bad debts. It is a loss

for the business and should be charged against profit.

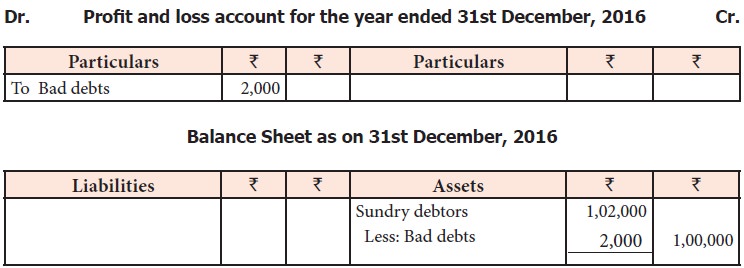

Presentation in final accounts

Tutorial note

·

When bad debts already appears in the trial balance

it means journal entry is already made, i.e., debtors is already reduced.

Hence, bad debt is taken only to debit side of profit and loss account.

·

If there is bad debt in trial balance as well as in

adjustments, total bad debt is debited in profit and loss account. Additional

bad debt only is deducted from debtors in the balance sheet.

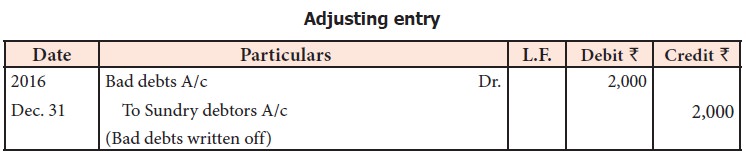

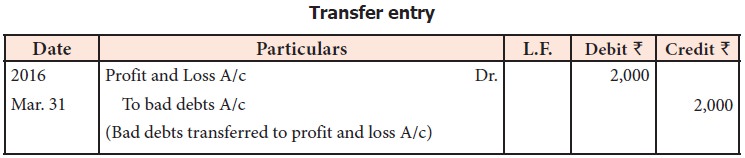

Example

The trial balance as on 31st

December, 2016 shows sundry debtors as Rs. 1,02,000.

Adjustment: Write off Rs. 2,000 as bad debts. The adjusting entry is:

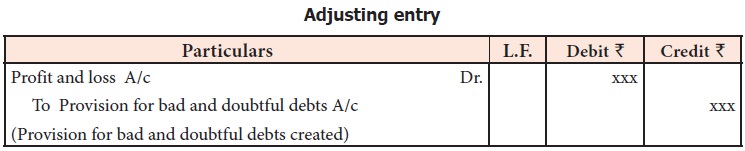

(xii) Provision for bad and doubtful debts

Provision for bad and doubtful debts refers to amount set aside as a

charge against profit to meet any loss arising due to bad debt in future. At

the end of the accounting period, there may be certain debts which are

doubtful, i.e., the amount to be received from debtors may or may not be

received. The reason may be incapacity to pay the amount or deceit.![]()

In general, based on past experience, the amount of doubtful debts is

calculated on the basis of some percentage on debtors at the end of the

accounting period after deducting further bad debts (if any). Since the amount of

loss is impossible to ascertain until it is proved bad, doubtful debts are

charged against profit and loss account in the form of provision. A provision

for doubtful debts is created and is charged to profit and loss account. When

bad debts occur, it is transferred to provision for doubtful debts account and

not to profit and loss account.

This is according to the

convention of conservatism. Moreover, according to matching principle, all

costs related to earning revenue in a period must be charged in the relevant

period itself. Hence, it is appropriate that provision is created in the

current year against debtors of current year.

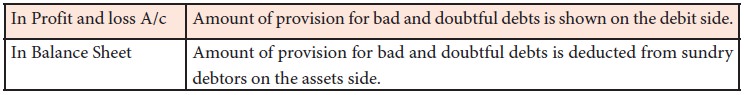

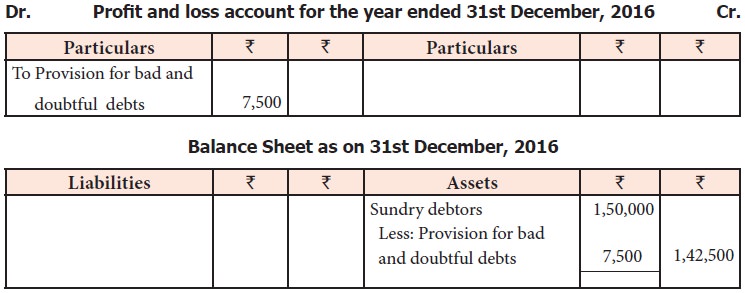

Presentation in final accounts

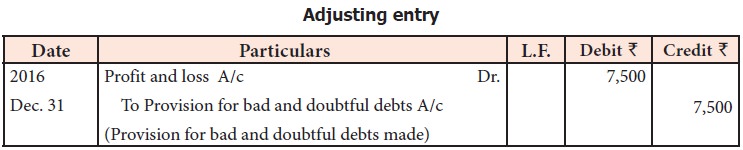

Example

The trial balance prepared on 31st

December, 2016 shows sundry debtors as Rs. 1,50,000.

Adjustment: Provide 5% for bad

and doubtful debts on sundry debtors.

Provision for bad and doubtful debts = Rs. 1,50,000 x 5/100 = Rs. 7,500. The adjusting entry is:

In final accounts, it is presented as follows:

Tutorial note

When provision already exists and

appears in trial balance, the accounting treatment is as below:

·

If the provision required at the end plus the bad

debts written off, is higher than the existing provision, the difference amount

will be created as provision in the current year and will appear on the debit

side of profit and loss account.

·

If the provision required at the end plus bad debts

written off, is lesser than the existing provision, the excess is written back

and will appear on the credit side of profit and loss account.

The journal entries are:

(a) For bad debts written off

Bad debts A/c Dr. xxx

To Debtors A/c xxx

(b) For transferring bad debts

Provision for doubtful debts A/c Dr. xxx

To Bad debts A/c xxx

(c) For creating provision to the extent of difference

Profit and Loss A/c Dr. xxx

To Provision for doubtful debts A/c xxx

(d) For writing back provision to the extent of difference

Provision for doubtful debts A/c Dr. xxx

To Profit and Loss A/c xxx

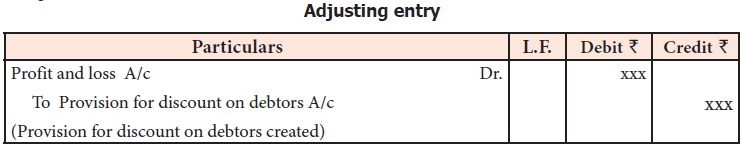

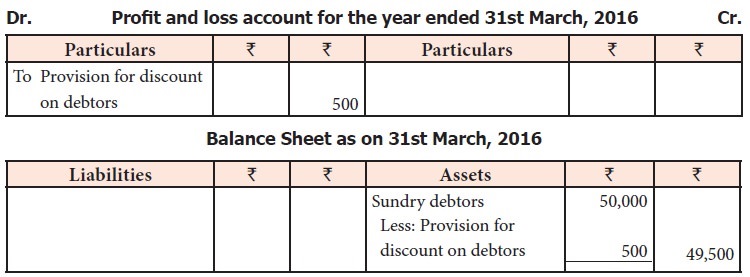

(xiii) Provision for discount on debtors

Cash discount is allowed by the suppliers to customers for prompt

payment of amount due either on or before the due date. A provision created on

sundry debtors for allowing such discount is called provision for discount on

debtors. This provision is a charge against profit and hence profit and loss

account is debited.

Provision for discount on debtors

is made on the basis of past experience at an estimated rate on sundry debtors.

Discount should be calculated on sundry debtors after deducting bad debts and

provision for bad debts.

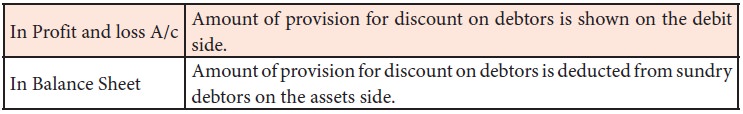

Presentation in final accounts

Tutorial note

i.

Provision for discount on debtors is calculated on

the balance of debtors after deducting bad debts and provision for doubtful

debts. This is because provision for discount is to be expected only on good

book debts. When the amount realisable itself is doubtful, provision for

discount is not to be made. Similar to bad debts and provision for doubtful

debts, here also discount allowed to debtors must be transferred to provision

for discount on debtors account if a provision exists.

ii.

When provision already exists and appears in trial

balance, the accounting treatment is as below:

·

If the provision required at the end plus the

discount allowed, is higher than the existing provision, the difference amount

will be created as provision in the current year and will appear on the debit

side of profit and loss account.

·

If the provision required at the end plus discount

allowed, is lesser than the existing provision, the excess is written back and

will appear on the credit side of profit and loss account.

The presentation in the balance

sheet is as below:

Debtors xxx

Less Bad debts (in adjustments) xxx

Less Provision for doubtful debts (end) (adjustment) xxx/xxx

Less Provision for discount on debtors (end) (adjustment) xxx/xxx

Balance to be shown in balance sheet xxx

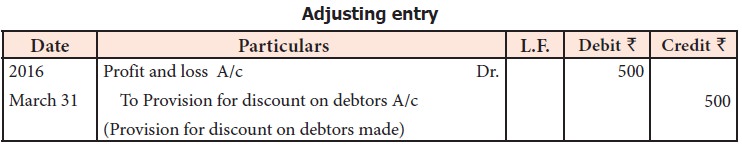

Example

The trial balance for the year

ended 31st March, 2016 shows sundry debtors as Rs. 50,000.

Adjustment: Create a provision

for discount on debtors @ 1%.

Provision for discount on debtors

= Rs. 50,000 x 1/100 = Rs. 500. The

adjusting entry is:

In final accounts, it is presented as follows:

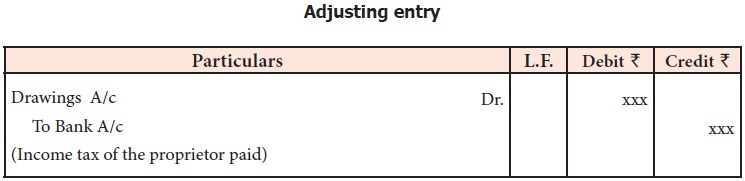

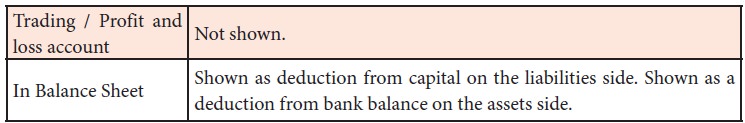

(xiv) Income tax paid

As per the Indian Income Tax Act,

1961, business income of the sole proprietor is not assessed and taxed

separately. It is the sole proprietor who is assessed to tax for his total

income including the business income. Hence, income tax paid by the business is

not a business expenditure and is treated as drawings.

Presentation in final accounts

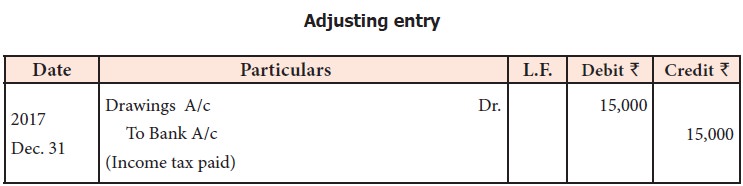

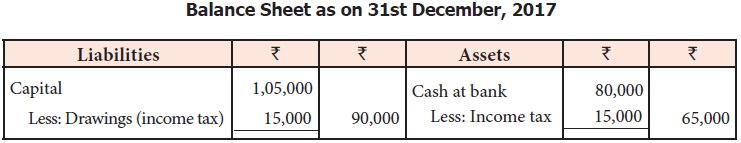

Example

Trial balance of Sibi as on 31st December, 2017 shows the capital as Rs. 1,05,000 and cash at bank as Rs. 80,000.

Adjustment: Income tax paid Rs. 15,000. The adjusting entry is:

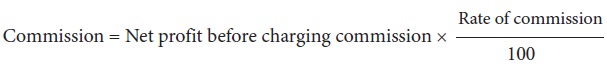

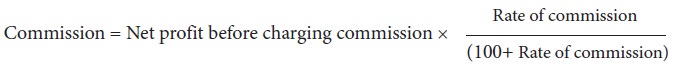

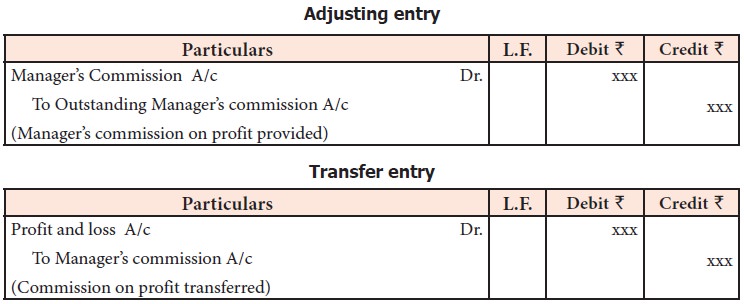

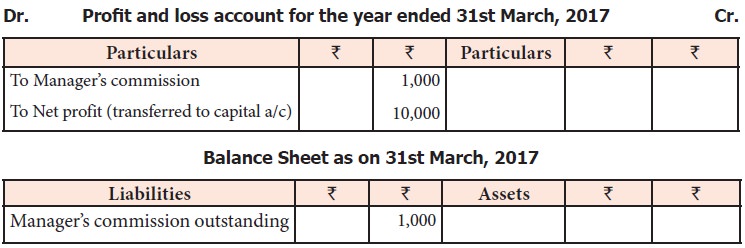

(xv) Manager’s commission

Sometimes the manager is given

commission as a percentage on profit of the business. It may be given at a

certain percentage on the net profit before charging such commission or after

charging such commission. Calculation procedure is explained below:x

The purpose of giving such

commission may be to motivate the managers to work with their full potential,

to reward the managers for their efficiency and to retain the efficient

managers by rewarding them sufficiently. Such commission can be calculated only

at the end of the accounting period after calculating net profit. Hence, it

remains outstanding at the end of the accounting period.

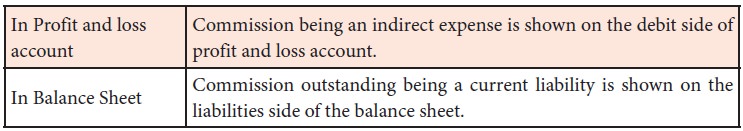

Presentation in final accounts

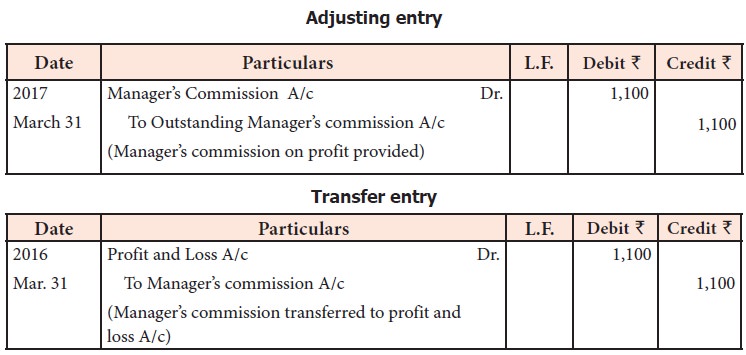

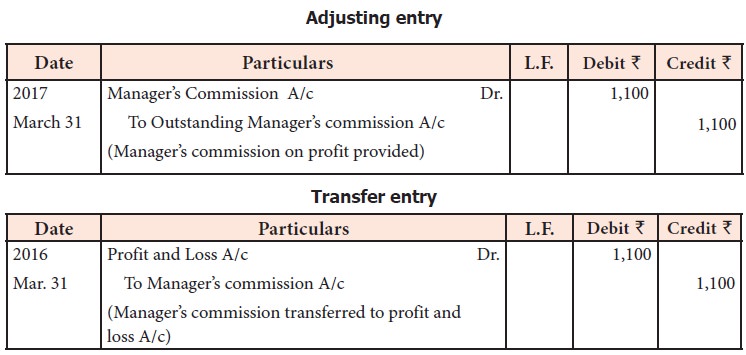

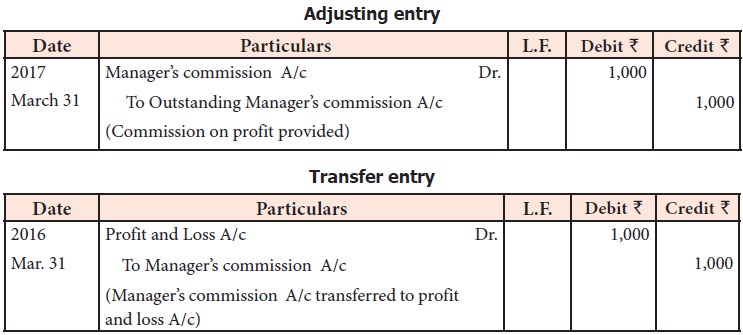

Example

On 31st March, 2017, Net profit

before charging commission is Rs. 11,000.

The manager is entitled to

receive 10% as commission on the profit before charging such a commission.

Commission = 11,000 x 10/100 = Rs. 1,100. The adjusting entry is:

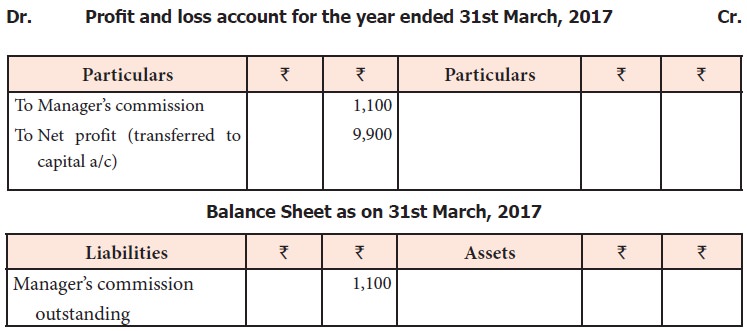

In final accounts, it is presented as follows:

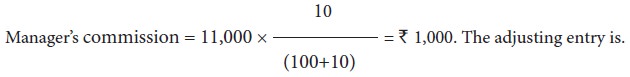

Example

On 31st March, 2017, Net profit

before charging commission is Rs. 11,000.

Adjustment: Provide manager’s

commission at 10% on the profit after charging such Manager’s commission.

Related Topics