Chapter: Business Science : Strategic Management : Strategies

Diversification

CONCENTRIC DIVERSIFICATION

Concentric diversification occurs when a

firm adds related products or markets. The goal of such diversification is to

achieve strategic fit. Strategic fit allows an organization to achieve synergy.

In essence, synergy is the ability of two or more parts of an organization to achieve greater total

effectiveness together than would be experienced if the efforts of the

independent parts were summed. Synergy may be achieved by combining firms with

complementary marketing, financial, operating, or management efforts. Breweries

have been able to achieve marketing synergy through national advertising and

distribution. By combining a number of regional breweries into a national

network, beer producers have been able to produce and sell more beer than had

independent regional breweries.

Financial synergy may be obtained by

combining a firm with strong financial resources but limited growth

opportunities with a company having great market potential but weak financial

resources. For example, debt-ridden companies may seek to acquire firms that

are relatively debt-free to increase the lever-aged firm's borrowing capacity.

Similarly, firms sometimes attempt to stabilize earnings by diversifying into

businesses with different seasonal or cyclical sales patterns.

CONGLOMERATE DIVERSIFICATION

Conglomerate diversification occurs when

a firm diversifies into areas that are unrelated to its current line of

business. Synergy may result through the application of management expertise or

financial resources, but the primary purpose of conglomerate diversification is

improved profitability of the acquiring firm. Little, if any, concern is given

to achieving marketing or production synergy with conglomerate diversification.

One of the most common reasons for

pursuing a conglomerate growth strategy is that opportunities in a firm's

current line of business are limited. Finding an attractive investment

opportunity requires the firm to consider alternatives in other types of

business. Philip Morris's acquisition of Miller Brewing was a conglomerate

move. Products, markets, and production technologies of the brewery were quite

different from those required to produce cigarettes.

Without some form of strategic fit, the

combined performance of the individual units will probably not exceed the

performance of the units operating independently. In fact, combined performance

may deteriorate because of controls placed on the individual units by the

parent conglomerate. Decision-making may become slower due to longer review periods and

complicated reporting systems.

DIVERSIFICATION:

GROW OR BUY?

Diversification efforts may be either

internal or external. Internal diversification occurs when a firm enters a

different, but usually related, line of business by developing the new line of

business itself. Internal diversification frequently involves expanding a

firm's product or market base. External diversification may achieve the same

result; however, the company enters a new area of business by purchasing another

company or business unit. Mergers and acquisitions are common forms of external

diversification.

INTERNAL

DIVERSIFICATION.

One form of internal diversification is

to market existing products in new markets. A firm may elect to broaden its

geographic base to include new customers, either within its home country or in

international markets. A business could also pursue an internal diversification

strategy by finding new users for its current product. For example, Arm &

Hammer marketed its baking soda as a refrigerator deodorizer. Finally, firms

may attempt to change markets by increasing or decreasing the price of products

to make them appeal to consumers of different income levels.

Another form of internal diversification

is to market new products in existing markets. Generally this strategy involves

using existing channels of distribution to market new products. Retailers often

change product lines to include new items that appear to have good market

potential. Johnson & Johnson added a line of baby toys to its existing line

of items for infants. Packaged-food firms have added salt-free or low-calorie

options to existing product lines.

It is also possible to have conglomerate

growth through internal diversification. This strategy would entail marketing

new and unrelated products to new markets. This strategy is the least used

among the internal diversification strategies, as it is the most risky. It

requires the company to enter a new market where it is not established. The

firm is also developing and introducing a new product. Research and development

costs, as well as advertising costs, will likely be higher than if existing

products were marketed. In effect,

the investment and the probability of failure are much greater when both the

product and market are new.

EXTERNAL

DIVERSIFICATION

External diversification occurs when a

firm looks outside of its current operations and buys access to new products or

markets. Mergers are one common form of external diversification. Mergers occur

when two or more firms combine operations to form one corporation, perhaps with

a new name. These firms are usually of similar size. One goal of a merger is to

achieve management synergy by creating a stronger management team. This can be

achieved in a merger by combining the management teams from the merged firms.

Acquisitions, a second form of external

growth, occur when the purchased corporation loses its identity. The acquiring

company absorbs it. The acquired company and its assets may be absorbed into an

existing business unit or remain intact as an independent subsidiary within the

parent company. Acquisitions usually occur when a larger firm purchases a

smaller company. Acquisitions are called friendly if the firm being purchased

is receptive to the acquisition. (Mergers are usually "friendly.")

Unfriendly mergers or hostile takeovers occur when the management of the firm

targeted for acquisition resists being purchased.

DIVERSIFICATION:

VERTICAL OR HORIZONTAL?

Diversification strategies can also be

classified by the direction of the diversification. Vertical integration occurs

when firms undertake operations at different stages of production. Involvement

in the different stages of production can be developed inside the company

(internal diversification) or by acquiring another firm (external

diversification). Horizontal integration or diversification involves the firm

moving into operations at the same stage of production. Vertical integration is

usually related to existing operations and would be considered concentric

diversification. Horizontal integration can be either a concentric or a

conglomerate form of diversification.

VERTICAL

INTEGRATION.

The steps that a product goes through in

being transformed from raw materials to a finished product in the possession of

the customer constitute the various stages of production. When a firm diversifies closer to the sources

of raw materials in the stages of production, it is following a backward

vertical integration strategy. Avon's

primary line of business has been the selling of cosmetics door-to-door. Avon pursued a backward form of vertical

integration by entering into the production of some of its cosmetics. Forward

diversification occurs when firms move closer to the consumer in terms of the

production stages. Levi Strauss & Co., traditionally a manufacturer of

clothing, has diversified forward by opening retail stores to market its

textile products rather than producing them and selling them to another firm to

retail.

Backward

integration allows the diversifying firm to exercise more control over the quality of the supplies being

purchased. Backward integration also may be undertaken to provide a more

dependable source of needed raw materials. Forward integration allows a

manufacturing company to assure itself of an outlet for its products. Forward

integration also allows a firm more control over how its products are sold and

serviced. Furthermore, a company may be better able to differentiate its

products from those of its competitors by forward integration. By opening its

own retail outlets, a firm is often better able to control and train the

personnel selling and servicing its equipment.

Since servicing is an important part of

many products, having an excellent service department may provide an integrated

firm a competitive advantage over firms that are strictly manufacturers.

Some

firms employ vertical integration strategies to eliminate the "profits of

the middleman." Firms

are sometimes able to efficiently execute the tasks being performed by the

middleman (wholesalers, retailers) and receive additional profits. However,

middlemen receive their income by being competent at providing a service.

Unless a firm is equally efficient in providing that service, the firm will

have a smaller profit margin than the middleman. If a firm is too inefficient,

customers may refuse to work with the firm, resulting in lost sales.

Vertical integration strategies have one

major disadvantage. A vertically integrated firm places "all of its eggs

in one basket." If demand for the product falls, essential supplies are

not available, or a substitute product displaces the product in the

marketplace, the earnings of the entire organization may suffer.

HORIZONTAL

DIVERSIFICATION.

Horizontal integration occurs when a firm

enters a new business (either related or unrelated) at the same stage of

production as its current operations. For example, Avon's move to market

jewelry through its door-to-door sales force involved marketing new products

through existing channels of distribution. An alternative form of horizontal

integration that Avon has also undertaken is selling its products by mail order

(e.g., clothing, plastic products) and through retail stores (e.g., Tiffany's).

In both cases, Avon is still at the retail stage of the production process.

DIVERSIFICATION

STRATEGY AND MANAGEMENT TEAMS

As documented in a study by Marlin,

Lamont, and Geiger, ensuring a firm's diversification strategy is well matched

to the strengths of its top management team members factored into the success

of that strategy. For example, the success of a merger may depend not only on

how integrated the joining firms become, but also on how well suited top

executives are to manage that effort. The study also suggests that different

diversification strategies (concentric vs. conglomerate) require different

skills on the part of a company's top managers, and that the factors should be

taken into consideration before firms are joined.

There are many reasons for pursuing a

diversification strategy, but most pertain to management's desire for the

organization to grow. Companies must decide whether they want to diversify by

going into related or unrelated businesses. They must then decide whether they

want to expand by developing the new business or by buying an ongoing business.

Finally, management must decide at what stage in the production process they

wish to diversify.

Conglomerate diversification

Type of

diversification whereby a firm enters (through acquisition or merger) an

entirely different market that has little or no synergy with its core business

or technology.

Ex: Imagine you were able to maximize your opportunities,

minimize your risks and achieve performance breakthroughs.

You're probably thinking – "that would be great, how do I do it?"

Well it's simple but this simplicity demands critical thinking and diligent effort. So if you're

interested, let's find out how. Achieving this level of performance requires a

deliberate strategy with a performance management and measurement system that

enables you to scan the business horizon, focus your time, energy, knowledge,

relationships and resources and execute courses of action that possess the

highest pay-off, lowest costs and easiest implementation trajectory. You may

wonder whether such a strategy formulation is worth your time and effort,

especially if you're in a quickly changing business environment. This issue

came up in a discussion with leading business writer and consultant Seth Godin. We concluded that business

strategy drives growth and prosperity for businesses, both large and small. Godin said that for example Howard Shultz, founder and head of Starbucks Coffee, could have decided to open and run only a few stores, but

you better believe that to grow Starbucks like he has he had to have a

business strategy.

So with

that as introduction let's go through a step-by-step process for developing a

business strategy with a performance management and measurement system for your

business. Let's call it a "Grand Strategy" because it equates to a

necessary precursor for all subordinate strategies and systems whether they be

marketing, innovation or otherwise. There are 12 steps to this Grand Strategy

process. The first 11 steps of this process are best developed as a living document with your top management

team and a facilitator at an off-site meeting to avoid distractions. And step

twelve, "Execute, Adjust, and Execute" requires strong top management

commitment, support and involvement.

Step One. Ask "what's your 'Theory of

Business'?" As philosophers tell us, there is nothing as practical as good theory. Briefly answer these four

questions to uncover yours.

What business are you in and where are

you now?

•

Where are you

going?

•

How will you

get there?

•

How will you

know you've arrived?

Step Two. Create a clear expression of your

intangible business resources. These intangibles

form an intellectual and emotional grounding for your Grand Strategy. They drive your business and business

relationships. Without them, you won't be able to commit the time, energy and

tangible resources that move your business forward. These intangibles are:

Values – high level concepts that you pour

your life into regardless of financial

return because they define you and your business. Some examples are family well

being, charity and goodwill toward others, honesty and integri ty, and making a

difference in the world.

![]()

·

Beliefs - key

principles that state your assumptions about the cause and effect relationships

that drive you and your business. For example, if we provide excellent products

and services that please our customers at a competitive price, we will be a

profitable business.

·

Attitudes – emotional orientations exhibited by you

and your business toward others that affects how you view them and treat them,

and in turn how they react to you and your business. Attitudes result in either

positive or negative expressions such as "most people tend to be fair if

treated fairly" or "most people will take advantage of you if you let

them."

·

Capabilities

– inherent knowledge and relationships that support getting work done for you and your business.

For example, such things as patents, suppliers and customer data bases,

production processes, sales force knowledge, knowledge about competitors,

technological expertise and customer relationships fit here.

What are your Values, Beliefs, Attitudes

and Capabilities? List them.

Step Three. Write a "Mission Statement."

This statement provides you with the articulation

of your business purpose or reason for being. Answering the following four

questions in a satisfying amount of detail provides compelling background

information from which you can extract a hard hitting mission statement to move

your business and Grand Strategy forward.

•

Why are you in

business?

•

What does your business do and how does it do it?

•

Who does your business, who supports it, who

benefits from it and who, if

anyone, suffers from it?

•

How many different kinds of resources are involved in your business, how

much do they costs and how much profit do you expect to make from them?

Answer

these questions and notice the power of their focusing affect on your business. From your answers,

develop a condensed and hard hitting Mission

Statement.

Step Four. Perform an "Environmental Scan"

by asking and answering the following

questions:

1. What industry are you in (retail,

wholesale, finance, manufacturing, durable or non-durable goods and so on) and

what are its trends?

2. Potential competitors? What

relevant advantages and disadvantages do they possess?

3. Who are your suppliers and

potential suppliers? What mutual interests do you share with them? What

natural conflicts exist?

4. Who are your customers and potential

customers and who are their customers? What segments do they fall in?

5. What are the demographics that impact your

business – age groups, ethnics, economic status? What are

their differences in terms of needs and preferences?

6. What is

the regulatory environment and how does it affect your business?

7. What are the emerging

technologies and how might they affect your business?

8. Who are your stakeholders (employees, suppliers, customers, investors and community) and what are their expectations?Answer these Environmental Scan questions in order to possess the necessary business intelligence and insight to proceed to the next step.

Step Five. After you complete your scan, then

perform a SWOT Analysis. SWOT stands

for "Strengths," "Weaknesses," "Opportunities"

and "Threats."

Your

Strengths and Weaknesses are internal. Your Opportunities and Threats are

external.

The areas for you to explore under

each SWOT Analysis category are:

Strengths or Weaknesses

1. Customer Service

2. Products

3. Systems and Processes

4. R&D

5. Cash Flow

6. Employee Training

7. Employee Loyalty

8. Others?

Opportunities or Threats

1. Emerging Products and Services

3. Technological

Change New Markets

4. Competitive

Pressures

5. Supplier

Relationships

6. Economic

Conditions

7. Others?

Now, brainstorm to generate ideas under

each category/area. Generate as many as ideas as possible. Using your best

judgment, select the top six ideas in terms of relevance and importance for

improving the performance and competitiveness of your business. Next, translate

the top six selected ideas into goal statements. For this translation process,

use the following format: action verb + (restated idea) in order to (object).

For example, a goal statement would look like this: "Increase customer

satisfaction in order to reduce customer losses and defections."

Step Six. Determine your "Strategic

Focus." Business is becoming more and more competitive. Let's call this phenomenon

"Hyper-Competition." From it we see the time lapse between finding a

competitive edge and having it copied shrinking. Hyper-Competition demands that you differentiate. This

differentiation starts with you selecting a Strategic Focus for your business.

Otherwise your products and services become commoditized.

Strategic Focus breaks down into the

following three disciplines:

Customer Intimacy - emphasizes paying close attention to

customers desires and providing them with total, not to be beaten

service and solutions. Ritz Carlton

Hotels and Nordstroms lead with this discipline.

1. Product Leadership – emphasizes R&D

and providing the best technology and quality available in products. Intel and

Starbucks lead with this discipline.

2. Operational Excellence – emphasizes

efficient operations and costs controls to provide the lowest costs. Wal-Mart and Southwest Airlines lead with this discipline.

Picking one of these as your lead focus

represents a smart thing to do. This imperative does not mean that you don't

try to do well in the other two. It means that you don't try to do all three

equally well. Trying to be all things for all customers puts you on a path to

failure because customers will not behave in a way that profits your business.

Business is just too hyper-competitive for you to succeed doing all three

better than anyone else.

So now

look at your: Theory of Business; Values, Beliefs, Attitudes and Capabilities; Mission Statement,

Environmental Scan and SWOT Analysis, and then make a judgment call. Pick your

Strategic Focus and lead with it.

Step Seven. Seek performance breakthroughs. You begin

this process by selecting your Strategic Focus and limiting your goal

statements to the top six. These top six goals represent your "Strategic

Goals" for achieving performance breakthroughs.

If you

look at the time you spend on your business, you find it can be broken down into three categories. These are:

•

Administrative and Operations – the time you spend keeping the routine day to day business running

• Breakthrough – the deliberate time you spend on creative efforts to improve performance

What

happens is that the first two time categories grow to occupy all your time and they push out your breakthrough

time. Maintaining a Strategic Focus combined with developing Strategic Goals to

execute amounts to the only workable solution to this challenge. Now,

incorporate this thinking into the succeeding steps of your Grand Strategy

process.

Step Eight. Understand and apply "Cause and

Effect Relationships." Let's discuss the dynamics of Cause and Effect Relationships among your Strategic

Goals. There are four basic "Perspectives" that provide the framework

for linking your goals in to

your Grand Strategy. These Perspectives

are:

•

Human Capital

– the people talent in your organization and the systems and process that

directly enable them to be productive. A good way to look at the people part is

that it's what goes home at night.

• Structural Capital – the systems, structures and strategies that the organization owns and produces value with. It stays in the organization when you turn off the lights.

•

Customer Capital –

the relationship, level of

satisfaction, reputation, potential for referrals and loyalty which your organization enjoys

with its customers.

•

Financial Performance –

the level of economic return

provided to you and your

owners relative to investment. Performance under this perspective is also

compared to alternative investments like

T-Bills.

Step Nine. Develop a "Strategy Map." Let's

start by looking at an example.

A Harvard Business Review article, The

Employee – Customer Profit Chain at Sears, Jan-Feb 1998, chronicled a

transformation of Sears.

Step Ten. Translate your Strategy Map goals into

"Key Performance Measures" (KPMs)

and perform a "Gap Analysis." First, translate your goals into

measurable terms. In some cases, a goal may already be stated in measurable

terms. But you often have to break goals down and restate them in measurable

terms. For example, the Structural Capital Goal of "Create and Maintain

Well Stocked and Attractive Shelves" may be broken down and restated as

the KPM "Mystery Shoppers Rating for Store Product Display and Appeal."

Step Eleven: Financial Performance Goals are usually

stated in measurable terms so use

these terms for your Financial Performance KPMs as appropriate. On Customer,

Structural and Human Capital Goals, you usually have to restate them in KPM

terms with a number, percentage or

ranking. Some examples of KPMs follow:

Step Twelve. Execute, Adjust, Execute. A Fortune

Magazine study in June 1999 found that many CEOs were fired

because they failed to execute their strategy. Things really have not changed

much since then. As a friend, Mike Kipp, a consultant from Nashville,

Tennessee, says "All organizations are perfectly designed to achieve the

results they are getting." Don't confuse creating your Grand Strategy with taking action. Now

the Grand Strategy process demands

real work and organizational change. Otherwise improvement won't occur and

things might even get worse. Execution and appropriate adjustments are

imperative or you've only done an academic exercise.

Grand

Strategy Steps

Summary

•

Step One. Answer "what's your Theory of Business?"

•

Step Two.

Identify

your Values, Beliefs, Attitudes and Capabilities.

•

Step Three.

Write your Mission Statement.

Step Four. Perform

an

Environmental Scan.

•

Step

Five. Perform a SWOT Analysis.

•

Step Six.

Determine

your Strategic Focus.

•

Step

Seven. Seek Performance Breakthroughs.

•

Step

Eight. Understand and Apply Cause and Effect Relationships.

•

Step

Nine. Develop a Strategy Map.

•

Step Ten.

Translate goals into KPMs

and Perform Gap Analysis.

•

Step

Eleven. Prepare a Scorecard to track and drive Your Grand Strategy.

•

Step Twelve. Execute, Adjust, Execute.

Entrepreneurship:

It is the

act of being an entrepreneur, which can be defined as "one who undertakes innovations, finance and

business acumen in an effort to transform innovations into economic goods". This

may result in new organizations or may be part of revitalizing mature organizations

in response to a perceived opportunity. The most obvious form of entrepreneurship is

that of starting new businesses. In recent years, the term has been

extended to include social and political forms of entrepreneurial activity. When entrepreneurship is describing

activities within a firm or large organization it is referred to as intra- preneurship and may

include corporate venturing, when large entities spin-off organizations.

According to Paul Reynolds,

entrepreneurship scholar and creator of the Global Entrepreneurship Monitor,

"by the time they reach their retirement years, half of all working men in

the United States probably have a period of self-employment of one or more

years; one in four may have engaged in self-employment for six or more years.

Participating in a new business creation is a common activity among U.S.

workers over the course of their careers." And in recent years has been

documented by scholars such as David Audretsch to be a major driver of economic

growth in both the United States and Western Europe.Entrepreneurial activities

are substantially different depending on the type of organization and

creativity involved. Entrepreneurship ranges in scale from solo projects (even

involving the entrepreneur only part-time) to major undertakings creating many

job opportunities. Many "high value" entrepreneurial ventures seek

venture capital or angel funding (seed money) in order to raise capital to

build the business.

Organizational Politics

Organizational politics have been defined

as ―actions by individuals which are directed toward the goal of furthering

their own self interests without regard for the well-being of others or their

organization‖ (Kacmar and Baron 1999, p. 4). Research suggests that perceptions

of organizational politics consistently result in negative outcomes for

individuals (Harris, Andrews, and Kacmar 2007). According to Harris and Kacmar

(2005), politics has been conceptualized as a stressor in the workplace because

it leads to increased stress and/or strain reactions. Members of organization

react physically and psychologically

to perceptions of organizational politics, physical reactions including fatigue

and somatic tension (Cropanzano et al. 1997), and psychological reactions

include reduced commitment (Vigoda 2000) and reduced job satisfaction (Bozeman

et al. 2001).

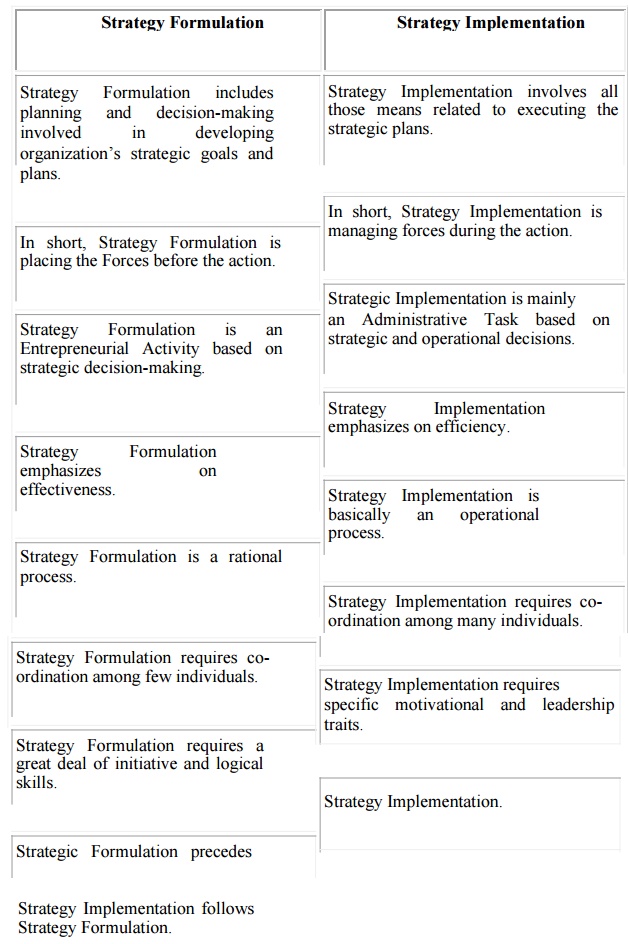

Following are the main differences between Strategy Formulation and

Strategy Implementation-

Related Topics