Chapter: 11th 12th std standard Indian Economy Economic status Higher secondary school College

Consumer's surplus : Definition, Explanation, Importance, Criticism

Consumer's surplus

The concept of consumer's surplus was first mentioned by J.A.Dupuit, a French engineer - economist in 1844. Marshall developed the concept in his work 'Principles of Economics' (1890).

Consumer's surplus is experienced in commodities which are highly useful but relatively cheap. For example, newspaper, salt, match box, postage stamp etc. For these commodities, we are ready to pay more than what we actually pay, if the alternative is to go without them. The extra satisfaction a consumer derives is called consumer's surplus.

Suppose a consumer wants to buys a shirt. He is willing to pay Rs 250 for it. But the actual price is only Rs 200. Thus he enjoys a surplus of Rs 50. This is called consumer's surplus.

Definition

Marshall defines Consumer's surplus as follows:

'The excess of price which a person would be willing to pay rather than go without the thing, over that which he actually does pay, is the economic measure of this surplus of satisfaction. It may be called consumer's surplus.'

Assumptions

1. Cardinal utility, that is, utility of a commodity is measured in money terms.

2. Marshall assumes that there is definite relationship between expected satisfaction (utility) and realized satisfaction (actual).

3. Marginal utility of money is constant.

4. Absence of differences in income, tastes, fashion etc.

5. Independent goods and independent utilities.

6. Demand for a commodity depends on its price alone; it excludes other determinants of demand.

Measurement

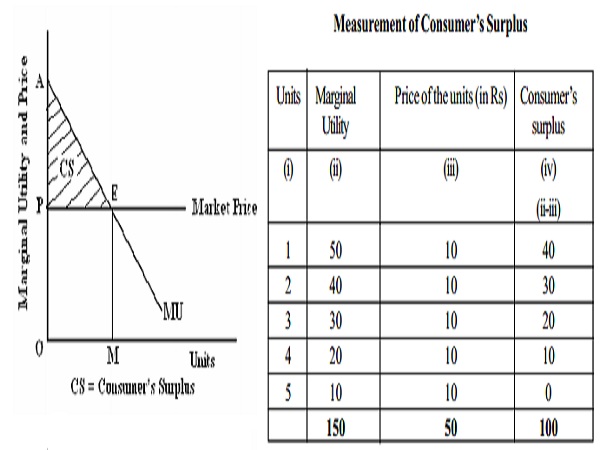

Consumer's Surplus for a single commodity is measured as follows:

Consumer's surplus = Potential price - Actual price

Potential price is the price which a consumer is willing to pay for a commodity and actual price is the price which the consumer actually pays for that commodity.

Units Marginal Price of the units (in Rs) Consumer's

Utility surplus

(i) (ii) (iii) (iv)

(ii-iii)

1 50 10 40

2 40 10 30

3 30 10 20

4 20 10 10

5 10 10 0

150 50 100

Consumer's surplus is determined by the potential price of the commodity purchased and the actual price in the market price. Thus the consumer's surplus is the difference between the sum of marginal utilities (i.e. the total utility) minus the total money spent (price multiplied by quantity purchased) on the commodity. This can be illustrated by a table.

In the above table, we have assumed that the market price of the commodity is Rs10/- (column 3). Column 2 gives the marginal utility. Marginal utility explains the price which a consumer is willing to pay for the unit of the commodity. As more and more units of a commodity is purchased, the marginal utility declines. Therefore the price, which the consumer is willing to pay, also decreases. The difference between marginal utility (potential price) and the market price (actual price) gives the consumer's surplus. Thus from the table consumer's surplus for each unit is the difference between Marginal Utility (column 2) minus market price (column 3). The consumer's surplus for all the units can be calculated as total utility minus the total amount spent on the commodity i.e. consumer's surplus = Rs 150 - 50 = Rs 100. Consumer's surplus can be illustrated with a diagram by taking units of the commodity on the x-axis and the utility and price on the y-axis.

MU is the marginal utility curve. OP is the price and OM is the quantity purchased. For OM units, the consumer is willing to pay OAEM. The actual amount he pays is OPEM. Thus consumer's surplus is OAEM - OPEM = PAE (the shaded area).

A rise in the market price reduces consumer's surplus. A fall in the market price increases the consumer's surplus.

Criticism

Two major criticisms against the Marshallian concept of Consumer's Surplus are

1. Marshall assumed that utility is measurable, but utility is immeasurable, because it is psychological in nature;

2. The Marshallian assumption of marginal utility of money remaining constant is unrealistic.

This contribution of the great economist Marshall, has perhaps provoked the most caustic of criticisms from various economists.

Marshall assumed that utility is measurable. But J.R.Hicks says that utility is not measurable, because it is a psychological phenomenon.

1. Marshall assumed that there's no interpersonal differences. But it will change with regard to tastes, preferences, status etc.

2. Marshall assumed that there is constancy of marginal utility of money. But it is unrealistic. Marginal utility of money increases with the fall in the stock of money.

Importance of Consumer's Surplus

Consumer's Surplus is useful to the Finance Minister in formulating taxation policies. It is also helpful in fixing a higher price by a monopolist in the market, based on the extent of consumer's surplus enjoyed by consumers.

Consumer's Surplus enables comparison of the standard of living of people of different regions or countries. This comparison helps to distinguish consumption levels between the people, who are living in rich countries and poor countries. For example, a middleclass person in New York enjoys more consumers' surplus than a similar person in Chennai. Alfred Marshall has stated that a middle class person in a modern city enjoys more consumer's surplus than a king of the Medieval Ages.

Related Topics