Accountancy - Classification of expenditure | 11th Accountancy : Chapter 11 : Capital and Revenue Transactions

Chapter: 11th Accountancy : Chapter 11 : Capital and Revenue Transactions

Classification of expenditure

Classification of expenditure

Expenditures may be classified into the following three categories:

i.

Capital

expenditure

ii.

Revenue

expenditure

iii.

Deferred

revenue expenditure.

1. Capital expenditure

It is an expenditure incurred during an accounting period, the benefits

of which will be available for more than one accounting period. It includes any

expenditure resulting in the acquisition of any fixed asset or contributes to

the revenue earning capacity of the business. It is non- recurring in nature.

Features of capital expenditure

Following are the features of

capital expenditure:

·

It gives

benefit for more than one accounting period.

·

It

includes acquisition of fixed assets and all expenditure incurred upto the

point an asset is ready for use.

·

It

contributes to the revenue earning capacity of the business.

·

It is

non-recurring in nature.

·

It is

shown on the assets side of the balance sheet.

Examples

·

Cost of

acquisition of land and building.

·

Cost of

acquisition of office equipment, computer and air-conditioner.

· Cost of acquisition of plant and machinery including installation charges and trial run.

2. Revenue expenditure

The expenditure incurred for day to day running of the business or for

maintaining the earning capacity of the business is known as revenue

expenditure. It is recurring in nature. It is incurred to generate revenue for

a particular accounting period. The revenue expenditure may be incurred in

relation with revenue or in relation with a particular accounting period. For

example, cost of purchases is a revenue expenditure related to sales revenue.

Rent and salaries are related to a particular accounting period.

Features of revenue expenditure

Following are the features of

revenue expenditure:

·

It is

recurring in nature.

·

It is

incurred for maintaining the earning capacity of the business.

·

Its

benefit expires in the same accounting period.

·

It is

shown on the debit side of the trading and profit and loss account.

Examples

·

Purchase

of goods for resale.

·

Administrative,

selling and distribution expenses.

·

Manufacturing

expenses.

3. Deferred revenue expenditure

An expenditure, which is revenue expenditure in nature, the benefit of

which is to be derived over a subsequent period or periods is known as deferred

revenue expenditure. The benefit usually accrues for a period of two or more

years. It is for the time being, deferred from being charged against income. It

is charged against income over a period of certain years.

Features of deferred revenue expenditure

Following are the features of

deferred revenue expenditure:

·

It is a

revenue expenditure, the benefit of which is to be derived over a subsequent

period or periods.

·

It is not

fully written off in the year of actual expenditure. It is written off over a

period of certain years.

·

The

balance available after writing off (i.e., Actual expenditure - Amount written

off) is shown on the assets side balance sheet.

Examples

·

Considerable

amount spent on advertising

·

Major

repairs to plant and machinery

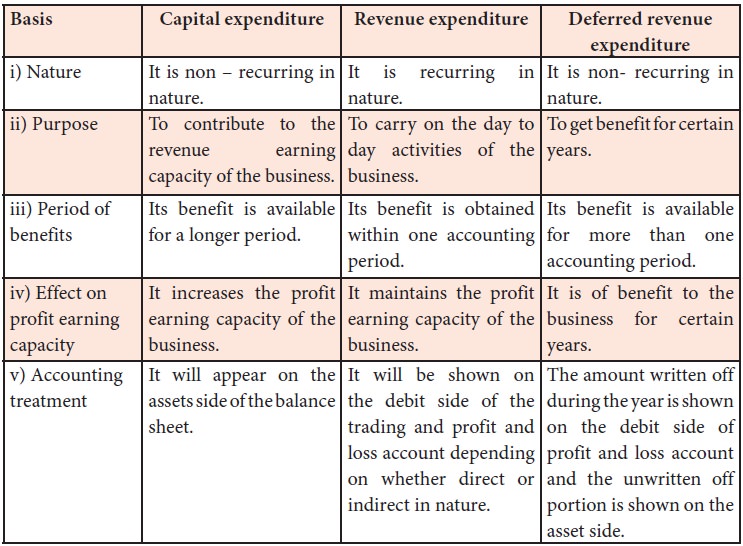

Comparison of capital, revenue and deferred revenue expenditure

Following are the points of comparison among capital, revenue and

deferred revenue expenditure:

Related Topics