Accountancy - Capital and revenue receipts | 11th Accountancy : Chapter 11 : Capital and Revenue Transactions

Chapter: 11th Accountancy : Chapter 11 : Capital and Revenue Transactions

Capital and revenue receipts

Capital and revenue receipts

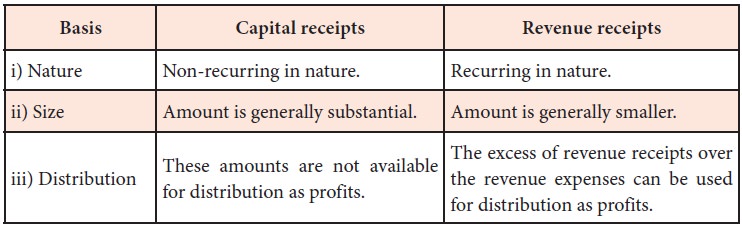

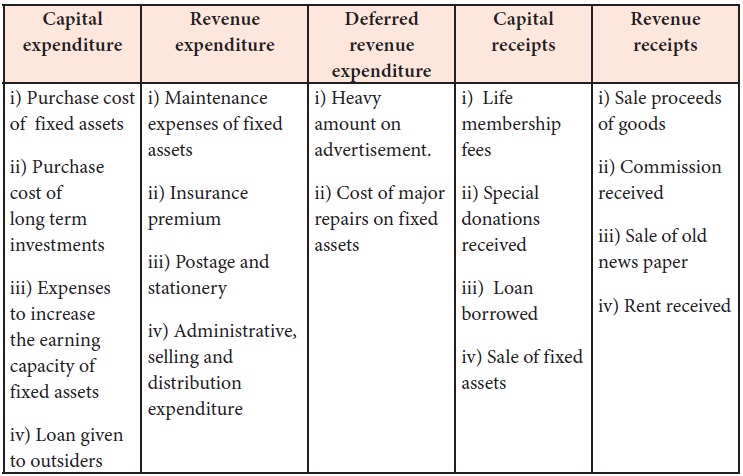

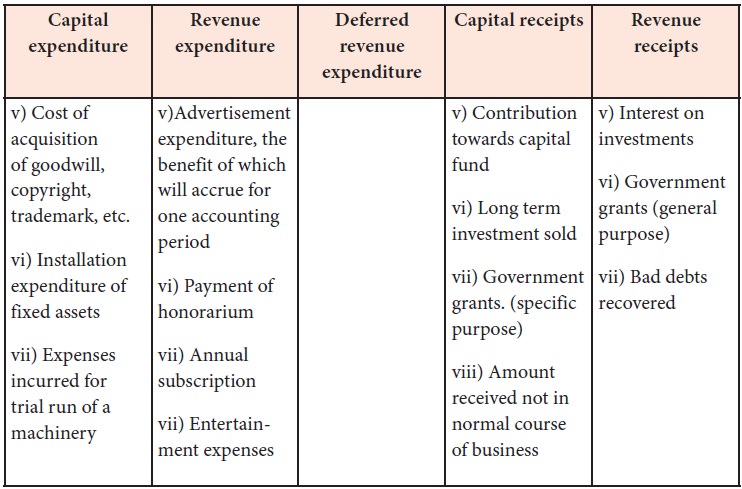

1. Capital receipt

Receipt which is not revenue in nature is called capital receipt. It is

non-recurring in nature. The amount received is normally substantial. It is

shown on the liabilities side of the balance sheet.

Examples

·

Proceeds

from issue of shares and debentures

·

Long term

loan raised from bank and other financial institutions

·

Proceeds

of sale of fixed assets

·

Proceeds

of sale of long-term investments

·

Receipt

of special donations

2. Revenue receipt

Receipts which are obtained in the normal course of business are called

revenue receipts. It is recurring in nature. The amount received is generally

small.

Examples

·

Proceeds

from sale of goods

·

Interest

on investments received

·

Rent

received

·

Dividend

from investment in shares.

Related Topics