Chapter: 11th Commerce : Chapter 19 : Sources of Business Finance

Classification of Business Finance

Source of Business Finance

Classification of Business Finance

Business finance is classified into

three types with reference to time period i.e. Long term finance (more than 5

years), Medium term finance (above 1 year but below 5 years) and Short term

finance (within one year) for carrying on business operations. Long term

finance can be mobilized by issue of shares and debentures, term loans from

commercial banks and financial institutions, and retained earnings. Medium term

finance can be mobilized by public deposits, leasing, medium term loans from

banks

and financial institutions. Short term

fiancé can be raised through public deposits, trade credit, customer advance, ,

hypothecation, cash credit, bank overdraft, pledge, mortgage etc.

The various sources of business finance can be classified into three categories on the basis of i) period basis ii) ownership basis iii) source of generation basis

On

the basis of period

The different sources of finance can be

further grouped into three categories on the basis of period

1) Short term finance 2) Medium term

finance 3) Long term finance

Source of Short Term Finance

Short term funds are those sources which

are required by the business firms for a period of within one year. Some of the

important sources of short term finance are briefly explained below.

1.

Loans and Advances

Loan is a direct advance made in lump

sum which is credited to a separate loan account in the name of borrower. The

borrower can withdraw the entire amount in cash immediately. It can be repaid

in one or more installments. But the interest on loans and advances is

calculated on the whole of the amount borrowed right from the date of sanction.

It may be secured or unsecured. Loans and advances are usually sanctioned by

pledge of specific assets like Fixed Deposit Receipts, Document of Title to the

Goods, Shares, Debentures, etc.

2.

Bank Overdraft

Bank overdraft refers to an arrangement

whereby the bank allows the customers to overdraw the required amount from its

current deposit account within a specified limit. Interest is charged only on

the amount actually overdrawn.

3.

Discounting Bills of Exchange

When goods are sold on credit, the

suppliers generally draw bills of exchange upon customers who are required to

accept it.

The duration of such bills of exchange

may be ranging from 15 days to 180 days. Instead of holding the bills till the

date of maturity, borrowers generally prefer to get them discounted with the

bank. Discounting bills of exchange refers to an act of selling a bill to

obtain payment for it before its maturity.

4.

Trade Credit

Trade credit is the

credit extended by one

trader to another for the purpose of purchasing goods and services. Purchaser

need not pay money immediately after the purchase. Such credit appears in

balance sheet as Trade Creditors, or Accounts Payable. Trade credit is very

simple and convenient method of raising short term finance. There is no

formality involved in availing this facility. There is no need to give any

security for trade credit. It is said to be more economical than bank loans.

5.

Pledge

A customer transfers the

possession of an article with the creditor (banker) and

receives loan. Till the repayment of loan, the article is under the custody of

the borrower. If the debtor fails to refund the loan, creditor (banker) will

auction the article pawned and adjust the outstanding loan from the sale

proceeds.

6.

Hypothecation

This is loan taken by depositing

document of title to the property with the banker. Of course the physical

possession of asset property is with the borrower. If the

borrower fails to repay the loan amount, the article hypothecated will

be sold in auction by the banker concerned. Business people hypothecate goods

or equipment to get this type of loan. It is a

loan taken on the security of movable asset.

7.

Mortgage

This is a type of loan taken from the

bank by lodging with the banker title deeds of immovable assets like land and

building. Business people raise loans by depositing the title deeds of the

properties with the bank.

8.

Loans Against the Securities

Banks accept various types of securities

like fixed deposit receipt, book debts, insurance policies, supply bills,

shares debentures, bonds of company, document of title to the goods like

railway receipt, bill of lading, trust receipt, warehouse keeper’s receipt,

book debt, and so on, and provides loan on the basis of the aforesaid

securities.

9.

Clean Loan

Banks provide clean loan to certain

customer of outstanding credit worthiness on the basis of their character,

capacity and capability. It simply grants loan without any physical security.

In other words clean loan is loan given without any security or with personal

security.

10.

Commercial Paper (CP)

Commercial paper (CP) is an unsecured

money market instrument in the form of

a promissory note. Corporates, Primary Dealers (PD), and All India

Financial Institutions are eligible to issue Commercial Paper. It was introduced

in India in 1990 under Section 45W of the Reserve Bank of India Act. It is issued by a firm to

raise funds for a short period. It can be issued for maturities between a

minimum of 7 days and a maximum of up to one year from the date of issue.

11.

Hire Purchase Finance

Small scale firms can acquire industrial

machinery, office equipments, vehicles etc., without making full payment

through hire purchase. With the help of assets acquired through hire purchase,

they can produce and sell. From the earnings, payments can easily be made in installments.

Ultimately the ownership of assets can be acquired. Now several agencies like

National Small Industries Corporation (NSIC) provide machinery and equipments

to small scale units on hire purchase basis.

12.

Factoring

Factoring is one of the methods of

raising business finance through sale or mortgage of book debts. Under this

method, business concerns sell the

accounts receivable to a

finance company called a factor at a discount.

Source of Medium Term Finance

1.

Loans from Banks

When the bank lends for a period ranging

from more than one year to less than five years, it is called medium term loan.

All aspects of bank finance have been discussed under the head long term

sources of finance.

2.

Loan from Financial Institutions

Where the financial institutions lends

for a period ranging from more than one year to less than five years, it is

called medium term loan. All aspects of institutional finance have been

discussed under the head long term sources of finance.

3.

Lease Financing

Lease financing denotes procurement of

assets through lease. For many small and medium enterprises, acquisition of

plant and equipment and other permanent assets will be difficult in the initial

stages. In such a situation Leasing is

helping them to a greater extent. Leasing here refers to the owning of an asset

by any individual or a corporate body which will be given for use to another

needy business enterprise on a rental basis.

The firm which owns the asset is called

‘Lessor’ and the business enterprise which hires the asset is called ‘Lessee’.

The contract is called ‘Lease’. The lessee pays a fixed rent on agreed basis to

the lessor for the use of the asset. The terms and conditions like lease

period, rent fixed, mode of payment and allocation of maintenance, are

mentioned in the lease contract. At the end of the lease period, the asset goes

back to the lessor. Alternatively lessee can own the asset taken on lease

by payimg the balance of price of asset concerned to lessor. Hence lease

finance is a popular method of medium term business finance.

Source of Long Term Finance

Long term sources of funds refer to

those sources which are required by the business firms for a period exceeding

five years. The various sources of long term business finance are briefly

explained below.

1.

Shares

Corporate enterprises generally obtain

capital mainly from share capital which

is divided into small units called shares. Each share has a nominal

value. The Indian Companies Act 2013

describes a share “to be a share in the share capital of a company”. The person holding a share is

called shareholder who has the interest in the assets and profit of the

company. There are two types of shares namely Equity shares and Preference

shares.

i.

Equity Shares

The fund raised by issuing equity shares

is termed as equity share capital. Equity share is the most important source of

raising long term capital by a company. These shares do not carry any special

or preferential rights in the matter of payment of annual dividend and repayment

of capital at the time of winding up . Equity shareholder enjoys more voting

rights in proportion to number of shares held by them.

Thus they take part in the management of the company.

ii.

Preference Shares

The fund raised by issue of preference

shares is called preference share capital. Preference shares are those shares

which enjoy priority regarding payment of dividend at a fixed rate out of the

net profits of the company. They will get their dividend every year before any

dividend is paid to equity shareholders. They will have a right to get their

settlement before the claims of equity shareholder are settled at the time of

liquidation of company. However they do not have voting rights.

2.

Debentures

Debentures are an important instrument

for raisinglongtermdebtcapital. Acompanycan

raisefundsthroughissueofdebentureswhich bear a fixed rate of interest. The

individual or person subscribing to debentures is called debenture holder. An

entity raising funds through debenture has to pay interest at the stipulated

date whether it earns profit or loss. Failure to pay interest leads to

liquidation of the company. Debenture holders do not have voting rights.

3.

Retained earnings

Retained earnings refer to the process

of retaining a part of net profit year

after year and reinvesting them

in the business. It is also termed as ploughing back of profit. An individual would like to save a

portion of his/her income for meeting the contingencies and growth needs.

Similarly profit making company would retain a portion of the net profit in

order to finance its growth and expansion in near future. It is described to be

the most convenient and economical method of finance.

4.

Public Deposits

Under this method, companies invite

public deposits by giving advertisement in the media. It offers deposit schemes

for a longer tenure. Person interested in making public deposit has to undergo

a simple formality. The interest rates offered by companies on public deposits

are relatively higher than the bank. Public deposits are perceived to be

economical for the company since the interest rate on deposits is less than the

cost of borrowing from the bank.

The company need not offer any of its

assets as security on accepting public deposits. Moreover the control of the

company is not diluted as the deposit holders do not enjoy the voting rights.

5.

Long Term Loan from Commercial Banks

Commercial banks are important sources

of raising business finance for various purposes as well as for different time

periods. Banks in modern times offer long tenured loans for a period beyond 5

years also. The long term loan taken from banks can be repaid either in

installment or in one lump sum. Banks provide long term loans on the security

of assets of the business firms. Nowadays the formalities for taking long term

loans are simplified by the Reserve Bank of India.

6.

The Loans from Financial Institutions

Central and State Governments have

established various financial

institutions in India to provide

finance to business enterprises for a longer period. These institutions aim at

promoting the industrial development

of a country.

In addition to loan assistance, they conduct market

surveys, provide technical assistant and supply managerial talents to borrowing

enterprises to manage the companies. They mainly provide large funds for longer

period for financing expansion,

reorganisation and modernisation of an enterprise. They allow longer

repayment period to repay the loan. Hence the borrowing companies do not feel

the stress of repayment. Financial institutions provide term loans mostly to

highly rated corporates by the credit rating companies.

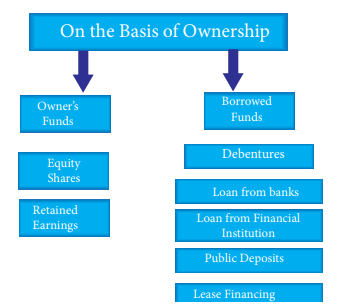

On the Basis of Ownership

Business finance can be divided into two

categories based on ownership of funds.

1.

Owner’s Funds

Owner’s funds mean funds which are

provided by the owner of the enterprises who may be an individual, or partners

or shareholders of a company. The profits reinvested in the business (ploughing

back of profit or retained earnings) come under owner’s funds. These funds are

not required to be refunded during the life time of business enterprise. It

provides the owner the right to control the management of the enterprise.

2.

Borrowed Funds

The term ‘borrowed funds’ denotes the

funds raised through loans or borrowings. For example debentures, loans from

banks and financial institutions, public deposits, trade credit, lease

financing, commercial papers, factoring, etc. represent borrowed funds.

·

These borrowed sources of funds provide

specific period before which the fund is to be returned.

·

Borrower is under legal obligation to

pay interest at given rate at regular intervals to the lender.

·

Generally borrowed funds are obtained on

the security of certain assets like bonds, land, building, stock, vehicles,

machinery, documents of title to the goods, and the like.

On the Basis of Generation of Funds

The sources of funds can be grouped into

two categories based on generation.

1.

Internal Sources

This includes all those sources

generated from within the business enterprises. For instance retained earnings,

collection from receivables (trade debtors and bills receivable), surplus from

disposal of old assets and so on. These sources can meet only limited needs of

business enterprise.

2.

External Sources

External sources of funds include all

those sources which generate funds from outside the business enterprise. For

example issue of shares and debentures, borrowings from banks and financial

institutions, public deposits, factoring, leasing, hire purchase, etc.

Related Topics