Chapter: Engineering Economics and Financial Accounting : Financial Accounting (Elementary Treatment)

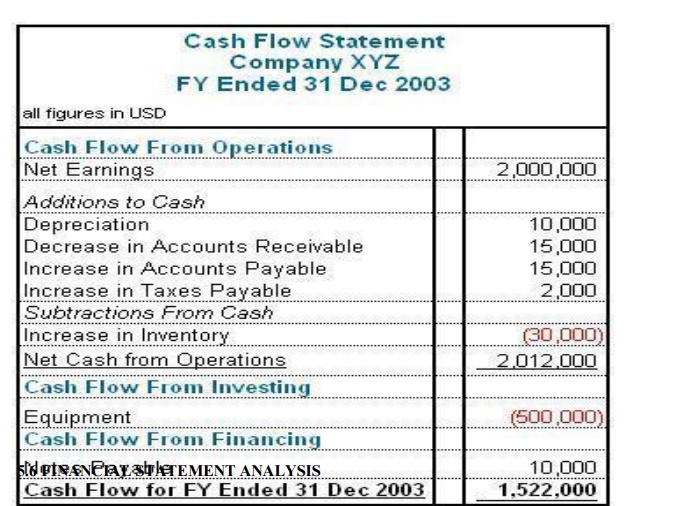

Cash Flow Statement(CFS)

CASH FLOW

STATEMENT

Complementing

the balance sheet and income statement, the cash flow statement (CFS), a

mandatory part of a company's financial reports since 1987, records the amounts

of cash and cash equivalents entering and leaving a company. The CFS allows

investors to understand how a company's operations are running, where its money

is coming from, and how it is being spent. Here you will learn how the CFS is

structured and how to use it as part of your analysis of a company.

A cash fl

ow statement is one of the most important fi nancial statements for a project

or business. The statement can be as simple as a one page analysis or may

involve several schedules that feed information into a central statement.

A cash fl

ow statement is a listing of the fl ows of cash into and out of the business or

project. Think of it as your checking account at the bank. Deposits are the

cash infl ow and withdrawals (checks) are the cash outfl ows. The balance in

your checking account is your net cash fl ow at a specifi c point in time.

The Structure of the CFS

The cash

flow statement is distinct from the income statement and balance sheet because

it does not include the amount of future incoming and outgoing cash that has

been recorded on credit. Therefore, cash is not the same as net income, which,

on the income statement and balance sheet, includes cash sales and sales made

on credit. (To learn more about the credit crisis, read Liquidity And Toxicity:

Will TARP Fix The Financial System?)

Cash flow

is determined by looking at three components by which cash enters and leaves a

company: core operations, investing and financing,

Operations

Measuring

the cash inflows and outflows caused by core business operations, the

operations component of cash flow reflects how much cash is generated from a

company's products or services. Generally, changes made in cash, accounts

receivable, depreciation, inventory and accounts payableare reflected in cash

from operations.

Cash flow

is calculated by making certain adjustments to net income by adding or

subtracting differences in revenue, expenses and credit transactions (appearing

on the balance sheet and income statement) resulting from transactions that

occur from one period to the next. These adjustments are made because non-cash

items are calculated into net income (income statement) and total assets and

liabilities (balance sheet). So, because not all transactions involve actual

cash items, many items have to be re-evaluated when calculating cash flow from

operations.

For

example, depreciation is not really a cash expense; it is an amount that is

deducted from the total value of an asset that has previously been accounted

for. That is why it is added back into net sales for calculating cash flow. The

only time income from an asset is accounted for in CFS calculations is when the

asset is sold.

Changes

in accounts receivable on the balance sheet from one accounting period to the

next must also be reflected in cash flow. If accounts receivable decreases,

this implies that more cash has entered the company from customers paying off

their credit accounts - the amount by which AR has decreased is then added to

net sales. If accounts receivable increase from one accounting period to the

next, the amount of the increase must be deducted from net sales because,

although the amounts represented in AR are revenue, they are not cash.

An

increase in inventory, on the other hand, signals that a company has spent more

money to purchase more raw materials. If the inventory was paid with cash, the

increase in the value of inventory is deducted from net sales. A decrease in

inventory would be added to net sales. If inventory was purchased on credit, an

increase in accounts payable would occur on the balance sheet, and the amount

of the increase from one year to the other would be added to net sales.

The same

logic holds true for taxes payable, salaries payable and prepaid insurance. If

something has been paid off, then the difference in the value owed from one

year to the next has to be subtracted from net income. If there is an amount

that is still owed, then any differences will have to be added to net earnings.

Investing

Changes

in equipment, assets or investments relate to cash from investing. Usually cash

changes from investing are a "cash out" item, because cash is used to

buy new equipment, buildings or short-term assets such as marketable

securities. However, when a company divests of an asset, the transaction is

considered "cash in" for calculating cash from investing.

Financing

Changes

in debt, loans or dividends are accounted for in cash from financing. Changes

in cash from financing are "cash in" when capital is raised, and

they're "cash out" when dividends are paid. Thus, if a company issues

a bond to the public, the company receives cash financing; however, when

interest is paid to bondholders, the company is reducing its cash.

Analyzing

an Example of a CFS

Related Topics