Chapter: 12th Commerce : Chapter 8 : Financial Markets : Securities Exchange Board of India (SEBI)

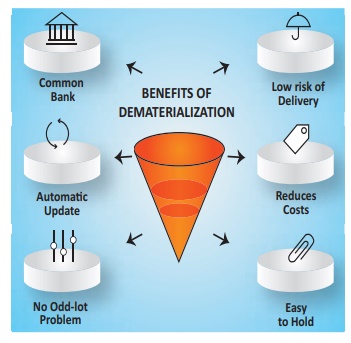

Benefits of Dematerialization (DEMAT)

Benefits of Dematerialization

i. The risks pertaining to physical certificates

like loss, theft, forgery and damage are eliminated completely with a DEMAT

account.

ii. The lack of paperwork enables quicker

transactions and higher efficiency in trading.

iii. Trading has become more convenient as one can

trade through computers at any location, without the need of visiting a broker.

iv. The shares that are created through mergers and

consolidation of companies are credited automatically in the DEMAT account.

v. As all the transactions occur through the

depository participant, a trader does not have to communicate individually with

each and every company.

vi. There is no need for stamp duty for transfer of

securities; this brings down the cost of transaction significantly.

vii. Certain banks also permit holding of both

equity and debt securities in a single account.

Banks also provide dedicated and trained customer

care officers to assist through all the procedures.

ix. A DEMAT account holder can buy or sell any amount

of shares. However, there is limit on the number of transactions done using

physical securities.

x. One can also choose to take a loan against

securities which are held in a DEMAT account by offering it as a collateral to

the lender.

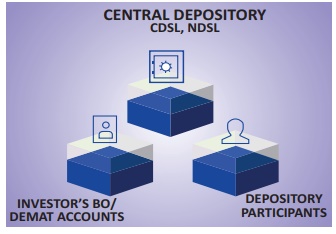

What is Demat Account?

A demat account holds all the shares that are

purchased in electronic or dematerialized form. Basically, a demat account is

to shares what a bank account is to money. Like the bank account, a demat

account holds the certificates of financial instruments like shares, bonds,

government securities, mutual funds and exchange traded funds (ETFs).

Understand

How Does Demat Account Works:

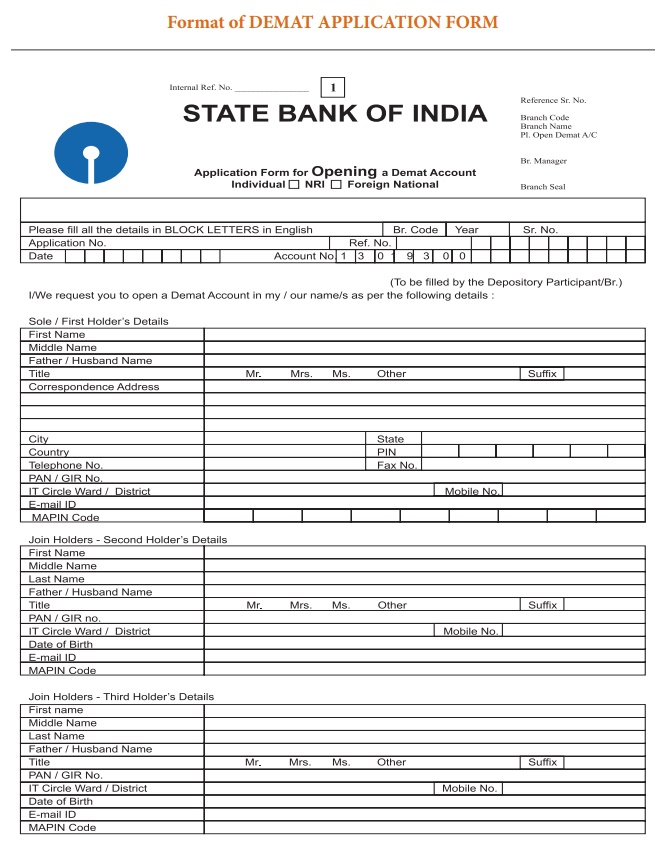

How to Open a Demat Account?

i. Fill up an account opening form and submit along

with copies of the required documents and a passport-sized photograph. You also

need to have a PAN card. Also carry the original documents for verification.

ii. You will be provided with a copy of the rules

and regulations, the terms of the agreement and the charges that you will

incur.

iii. During the process, an In-Person Verification

would be carried out. A member of the DP’s staff would contact you to check the

details provided in the account opening form.

iv. Once the application is processed, the DP will

provide you with an account number or client ID. You can use the details to

access your demat account online.

v. As a demat account holder, you would need to pay

some fees like the annual maintenance fee levied for maintenance of account and

the transaction fee levied for debiting securities to and from the account on a

monthly basis. These fees differ from every service provider (called a

Depository Participant or DP). While some DPs charge a flat fee per

transaction, others peg the fee to the transaction value, and are subject to a

minimum amount. The fee also differs based on the kind of transaction (buying

or selling). In addition to the other fees, the DP also charges a fee for

converting the shares from the physical to the electronic form or vice-versa.

vi. Minimum shares: A demat account can be opened

with no balance of shares. It also does not require that a minimum balance be

maintained.

What are the documents required for a Demat Account?

You need to submit proof of identity and address

along with a passport size photograph and the account opening form. Only

photocopies of the documents are required for submission, but originals are

also required for verification.

Proof of identity: PAN card, voter's ID, passport, driver's

license, bank attestation, IT returns, electricity bill, telephone bill, ID

cards with applicant's photo issued by the central or state government and its

departments, statutory or regulatory authorities, public sector undertakings

(PSUs), scheduled commercial banks, public financial institutions, colleges

affiliated to universities, or professional bodies such as ICAI, ICWAI, ICSI,

bar council etc.

Proof of address: Ration card,

passport, voter ID card, driving license, bank passbook

or bank statement, verified copies of electricity bills, residence telephone

bills, leave and license agreement or agreement for sale, self-declaration by

High Court or Supreme Court judges, identity card or a document with address issued

by the central or state government and its departments, statutory or regulatory

authorities, public sector undertakings (PSUs), scheduled commercial banks,

public financial institutions, colleges affiliated to universities and

professional bodies such as ICAI, ICWAI, Bar Council etc.

Key Terms

Quasi-Legislative

Quasi-Judicial

Quasi-executive

Dematerialization

Demat-account

Depository

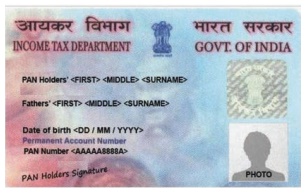

PAN, or permanent account number, is a unique 10-digit alphanumeric

identity allotted to each taxpayer by the Income Tax Department under the

supervision of the Central Board of Direct Taxes. It also serves as an identity

proof.

Case Study

a. Koushikaa’s father has gifted her the

shares of a large cement company with which he had been working. The securities

were in physical form. She already has a bank account and does not possess any

other forms of securities.

She wishes to sell the shares and

approached a registered broker for the purpose. Mention one mandatory detail

which she will have to provide with the broker.

b. Dr.Kulandaivel was the Chairman of

Thangam Bank. The bank was earning good profits. Shareholders were happy as the

bank was paying regular dividends. The market price of their share was also

steadily rising. The bank was about to announce taking over the ‘Trinity Bank’.

Mr.Kulandaivel knew that the share price of Thangam Bank would rise on this

announcement. Being a part of the bank, he was not allowed to buy shares of the

bank. He called one of the his rich friends Mr.Chandrasekaran and asked him to

invest ₹5 crores in shares of his bank promising him the capital gains.

As expected, the share prices went up by

40% and the market price of Chandrasekaran’s shares was now ₹7 crores. He

earned a profit of ₹2 crores. He gave ₹1 crore to Mr.Kulandaivel and kept ₹1

crore with himself. On regular inspection and by conducting enquires of the

brokers involved, the Securities and Exchange Board of India (SEBI) was able to

detect this irregularity. The SEBI imposed a heavy penality on Mr.Kulandaivel.

By quoting the lines from the above

paragraph, identify and state any two functions

that were performed by SEBI in the above case.

For Own Thinking

1. Collect the information on various

measures taken by SEBI to protect the interests of investors since its

inception.

2. Send a group of students to a trading

terminal in your city to gain first hand information on securities trading and

prepare a report.

3. Collect information about SEBI action

for Investor Protection taken duringlast two years.

For Own Thinking

1. Prepare a report on the role of SEBI

in regulating the Indian stock market.

You can get this information on its

website namely www.sebi.gov.in. Do you think something else should be done to

increase the number of investors in the stock market?

2. Investors’ Grievances Redressal

i. SEBI and Stock Exchanges have set up

investor grievance redressal cells for fast redressal of investor complaints

relating to securities markets

ii. SEBI has directed all the stock

exchanges, registered brokers, sub-brokers, depositories and listed companies

to make a provision for a special email ID of the grievance redressal division/

compliance officer for the purpose of registering complaints by the investors

iii. SEBI has set up a mechanism for

redressal of investor grievances arising from the issue process

iv. SEBI provides “walk-in” service at

its head office at Mumbai and its regional offices at New Delhi, Chennai,

Kolkatta and Ahmedabad on all working days. Investors can meet the officials

and get guidance relating to the grievances that they may have against issuers.

Investors can also meet the higher officials of SEBI on specified working days

v. Investors can lodge their complaints

with SEBI at: investorcomplaints@sebi.gov.in

vi. Investors can approach SEBI for any

assistance at: asksebi@sebi.gov.in

Related Topics