Meaning, Definition, Contents, Objectives, Importance (or) Advantages | Auditing - Audit Working Papers | 11th Auditing : Chapter 5 : Documentation

Chapter: 11th Auditing : Chapter 5 : Documentation

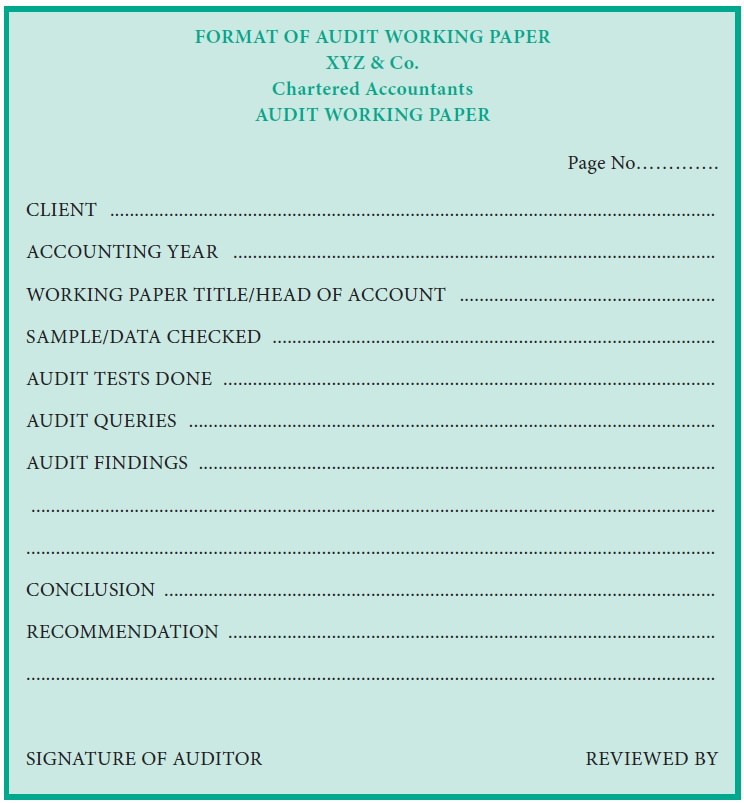

Audit Working Papers

Audit Working Papers

Meaning

Papers and documents which contain important facts

about accounts which are under audit are called as Audit Working Papers.

Working papers provide the basis of conclusions and summarizations of the

report prepared by the auditor at the end of the audit work. As per SA-230

“Audit Documentation” audit working paper refers to the documents proposed or

obtained by the auditor and retained by him in connection with the performance

of his audit.

The term ‘audit working paper’ mean the written

paper and document containing details about accounts which are under audit,

analysis, summaries and comments built up by an auditor during the course of a

particular audit engagement.

Thus, all the documents gathered or prepared by

auditors during the course of an audit constitute audit working papers, but

broadly these are two types:

·

Working papers prepared

by the auditor himself, like audit note book, audit program, details of queries

made and their explanations thereof.

· Working

papers collected by the auditor from

the client, like schedule of debtors and creditors, management representations,

confirmations etc.,

Definition

Institute

of Chartered Accountants of India defines audit working paper as, “working paper must include audit

program, queries, explanations given for the queries, schedules for the

important items like depreciation, inventories, confirmation from third

parties, certificates issued by the management, banks,etc..”.

Prof.

Meigs, “the term working paper is

a comprehensive one and includes all the evidences gathered by the auditor to

show the work he has done, the methods and procedures he has followed and the

conclusions he has developed”.

Guidelines of Audit Working Papers as specified in SA-230, Audit

Documentation

Working Papers prepared or obtained

by the auditor in connection with the performance of audit are the property of

auditor and it is the duty of the auditor to retain and preserve the working

papers for a period of 7 years.

According

to A.W. Johnson, “Audit working

papers are written, private material which the auditor prepares for each audit.

They describe the accounting information used, his conclusions (and reasons

thereof) and the financial statements.”

Contents of Audit Working Papers

The documents obtained in the conduct of audit

constitute the audit working papers. The content of audit working papers varies

depending on the type and scope of audit. Auditing and Assusrance Statndards

(AAS 3) issued by the Institute of Chartered Accountatns of India states

working papers should record the auditors plan, the nature, timing and extent

of the audit procedure performed and the conclusions obtained from the

evidence.

In general audit working papers consists of the

following:

1. Schedule of Debtors, Creditors and bank

statement.

2. Correspondences and balance confirmations from

Debtors, Creditors and bankers.

3. Correspondences from legal advisors and

statutory authorities.

4. Certificates of officials with regard to bad

debts.

5. Certificate from valuers for valuing

stock-in-trade and investments.

6. Certificate confirming cash balance.

7. Certificate from authorized person with regard

to outstanding assets and liabilities, contingent assets and liabilities etc.

8. Bank Reconciliation statement.

9. Adjusting entries.

10. Copies of the minutes of the meeting of

directors and shareholders.

Objectives of Audit Working Papers

1.

Planning

and Organizing Audit Work: Working

papers provide a means of planning, organizing and reviewing the audit work.

They are the evidence for conducting the audit work against the generally

accepted auditing standards and practices.

2.

Support

for Auditor’s Opinion: Working papers

provide support for the report of the auditor. When the auditor’s opinion on

financial statement or recommendations given by the auditor is questioned

working papers support the opinion or recommendations given by the auditor.

3.

Division

of Labour: Working papers help in

dividing the audit work among the audit staff so that each staff is responsible

for his work to the auditor.

4. Use as a Permanent Record: Working papers are the permanent record of the

auditing procedure employed and the financial records examined during the

conduct of audit.

5. Basis for Evaluation and Training of Audit Staff: Working

papers provide a means to test

whether the auditor and his staff have done their job as per the standards.

Training to the staff can be provided by reviewing the working papers of past

years.

Importance (or) Advantages Of Audit Working Papers

1. Planning the Audit Work: It acts

as the process of planning for the

auditor so that he can estimate the time that is required for conducting the

audit work.

2. Helps in Fixing Responsibility: It helps

in fixing responsibility and to

measure the work being performed by the audit assistants.

3. Helps in Drawing Conclusions: Working

papers are necessary to draw conclusion from the evidence obtained.

4. Helps in Preparing Audit Report: The

auditor prepares and finalises the audit report taking into account the

informations or extracts contained in the working papers.

5. Documentary Evidence: It is a

valuable documentary evidence in the

Court or Tribunal of law when a charge of negligence is brought against the

auditor.

6. Permanent Record: Working

papers are the permanent record of

the work done by the auditor during a particular period of time.

Related Topics