Meaning, Definition, Example, Contents, Benefits (or) Advantages, Disadvantages | Auditing - Audit Note Book | 11th Auditing : Chapter 5 : Documentation

Chapter: 11th Auditing : Chapter 5 : Documentation

Audit Note Book

Audit Note Book

Meaning

Audit Note Book is a register maintained by the

audit staff to record important points observed, errors, doubtful queries,

explanations and clarifications to be received from the clients. It also

contains definite information regarding the day-to-day work performed by the

audit clerks. In short, audit note book is usually a bound note book in which a

large variety of matters observed during the course of audit are recorded. The

note book should be maintained clearly, completely and systematically. It

serves as authentic evidence in support of work done to protect the auditor

against any legal charge initiated against him for negligence. It is of immense

help to the auditor in preparing audit report. It also acts as a valuable guide

for conducting audit for future years.

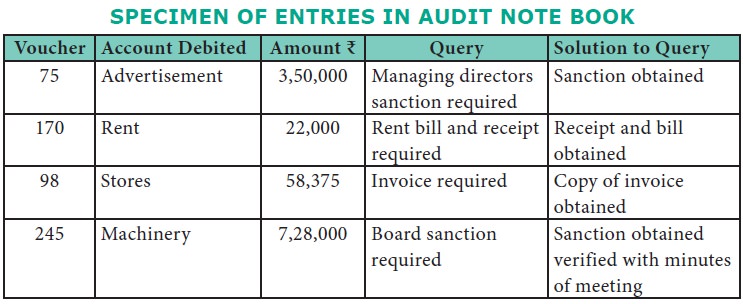

Example:

Following are the queries made in the

Audit Note Book:

1. Voucher No.75 Paid towards

advertisement expenses for Rs. 3,50,000.

2. Voucher No.170 Rent paid Rs. 22,000.

3. Voucher No.98 Material purchased

and received in Stores for Rs. 58,375

4. Voucher No.245 Machinery

purchased for Rs.

7,28,000.

Contents of Audit Note Book

The following matters should have been incorporated

in an Audit Note Book.

1. A list of the account books normally used and

maintained.

2. Names of the principal officers, their duties

and responsibilities.

3. Nature of business carried on and important

documents relating to the constitution of business like

Memorandum of Association, Articles of Association,

Partnership deed etc.,

4. Extracts of minutes and contracts affecting the

accounts.

5. Extracts of correspondence with statutory authorities.

6. Copy of audit programme.

7. Accounting methods, internal control and

internal check system in operation.

8. Routine queries like missing receipts and

vouchers etc.

9. Details of errors and frauds discovered during

the course of audit.

10. Points to be included in audit report.

11. Details of all important information to be used

as reference for future audits.

12. Date of commencement and completion of audit.

Advantages of Audit Note Book

1.

Facilitates

Audit Work: It facilitates the work of

an auditor as all important details about the audit are recorded in the note

book which the audit clerk cannot remember everything at all the time. It helps

in remembering and recalling the important matters relating to the audit work.

2.

Preparation

of Audit Report: Audit note

book helps in providing required data for preparing the audit report. An

auditor examines the audit note book before preparing and finalizing the audit

report.

3.

Serves as

Documentary Evidence: Audit

note book serves as a documentary evidence in the court of law when a suit is

filed against the auditor for his negligence.

4.

Serves as

a Guide: When a audit assistant is

changed before the completion of audit work, audit note book serves as a guide

in completion of balance work. It also acts as a guide for carrying on

subsequent audits.

5.

Evaluating

Work of Audit Staff: It helps

to assess the work performed by the audit staff and helps in evaluating their

level of efficiency.

6.

Fixation

of Responsibility: Audit note

book helps in fixing responsibility on concerned clerk who is responsible

for any undetected errors and frauds in the course of audit.

7. No Dislocation of Audit Work: An audit note book contains all important

details about audit hence any change in the audit staff will not disturb or

dislocate the audit work.

Disadvantages of Audit Note Book

1. Fault-finding Attitude: It

leads to development of a

fault-finding attitude in the minds of the staff.

2. Misunderstanding: Very often maintenance of audit note book creates misunderstanding between

the client’s staff and the audit staff.

3. Improper Preparation: Since

it serves as evidence in the court

of law, it needs to be prepared with great caution. When the note book is

prepared without due care it cannot be used as evidence against the auditor for

negligence.

4. Adverse Effects on Subsequent Audits: Since

audit note book is used in

performing subsequent audits, any mistakes in the note book may have adverse

impacts on the next audit.

Guidelines and Standards issued by The Institute of Chartered

Accountants of India (ICAI)

1. AS – Accounting Standards

2. AAS – Auditing and Assurance

Standards

3. International Standards on

Auditing (ISA) was issued by the International Auditing and Assurance Standards

Board (IAASB) which was later modified as Standard Auditing Practices (SAP) by

the Institute of Chartered Accountants of India.

Related Topics