Vouching of Cash Transactions | Auditing - Wages | 11th Auditing : Chapter 6 and 7 : Vouching of Cash Transactions

Chapter: 11th Auditing : Chapter 6 and 7 : Vouching of Cash Transactions

Wages

Wages

Vouching of payment of wages is an important duty

of an auditor as there are many chances of misappropriation of cash. The

following are some of the duties of an auditor in vouching wage payments.

1.

The auditor should verify the effectiveness of the

system of Internal check in operation with regard to the preparation of wage

sheet, maintenance of records and payment of wages.

2.

He should verify the arithmetical accuracy in

calculation of wages.

3.

He should verify the attendance register of the

employees and vouch it with the wage sheet to ensure that the wages has been

correctly calculated only for the days worked by the employee.

4. Auditor

should carefully scrutinize the wage sheet to identify that no dummy workers or

ex-employees are included in the wage sheet.

5.

Auditor should vouch the entries in the cash book

with the wage sheet. He should also vouch the entries in the cash book with the

bank statement to ensure that correct amount is withdrawn for payment of wages.

6. The

auditor should compare the signature or thumb impression of the workers with

previous months to check the genuineness of the person receiving the payment.

7. He should

ensure that unclaimed or unpaid wages has been deposited in the bank. He should

vouch the unpaid amount in the wage sheet with the entry in the bank statement.

Payment for unpaid wages should be made only against authorization signed by a

responsible official.

8. Auditor

should verify that there is a proper system of wage payment to casual

labourers.

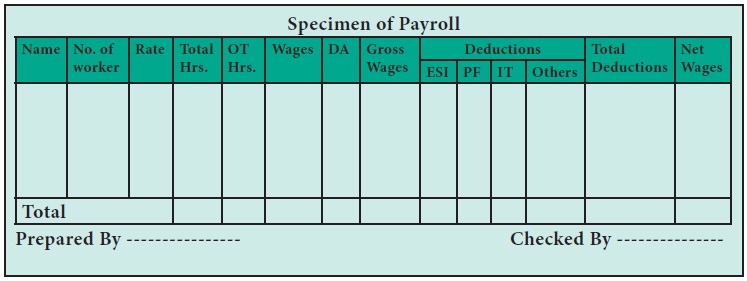

Documents to be Vouched: Attendance register, Time or piece records, Leave

register, Overtime register, Wage sheet, Bank statement, Register of casual

labourers.

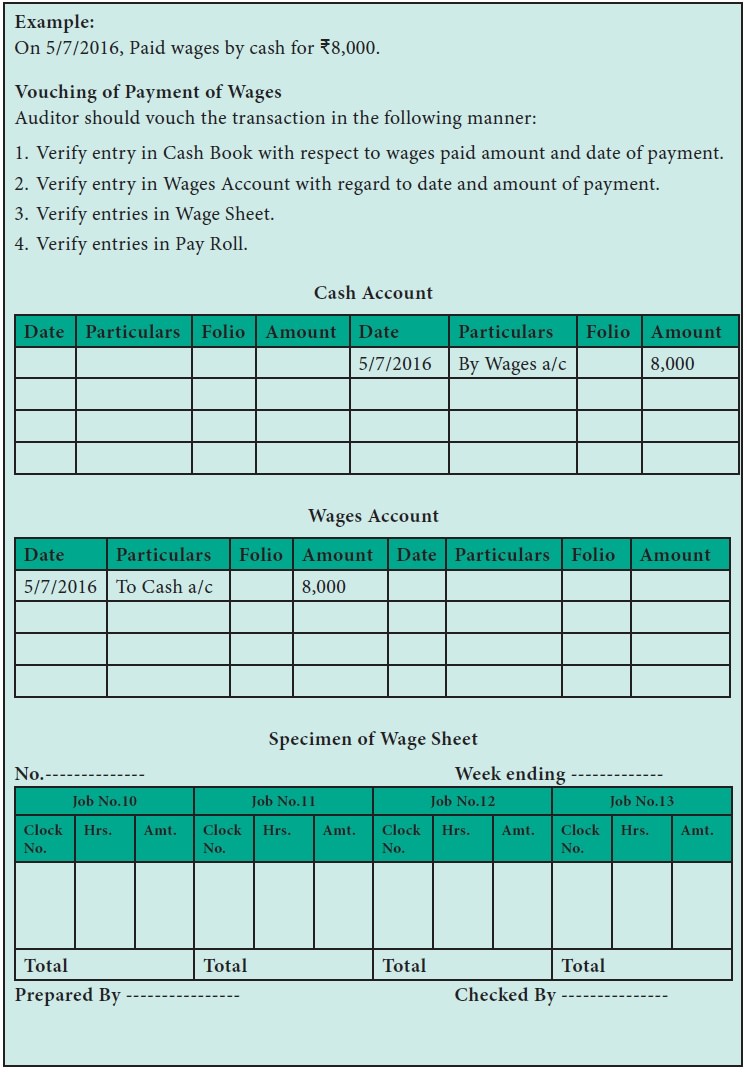

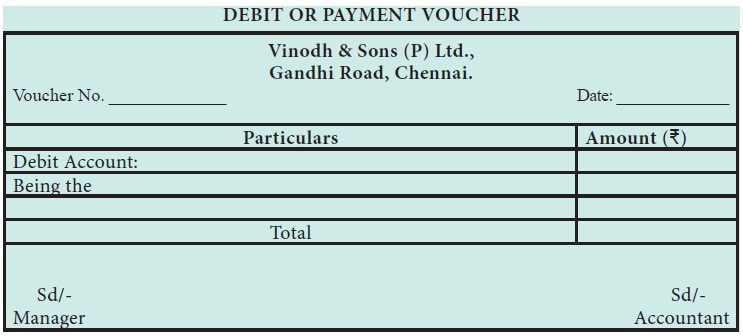

Example:

On 5/7/2016, Paid wages by cash for Rs. 8,000.

Vouching of Payment of Wages

Auditor should vouch the transaction

in the following manner:

1. Verify entry in Cash Book with

respect to wages paid amount and date of payment.

2. Verify entry in Wages Account with

regard to date and amount of payment.

3. Verify entries in Wage Sheet.

4. Verify entries in Pay Roll

Related Topics