Accountancy - Profit and loss account | 11th Accountancy : Chapter 12 : Final Accounts of Sole Proprietors - I

Chapter: 11th Accountancy : Chapter 12 : Final Accounts of Sole Proprietors - I

Profit and loss account

Profit and loss account

Profit and loss account is the

second part of income statement. It is a nominal account in nature. A business

entity is interested in knowing not only the gross profit or loss but also the

net profit earned or net loss incurred during the year. Hence, profit and loss

account is prepared to ascertain the net profit or net loss during the year.

Profit and loss account contains all the items of indirect expenses and losses

and indirect incomes and gains in addition to gross profit or gross loss

pertaining to the accounting period. The difference is net profit or net loss.

According to Prof. Carter, “A Profit and Loss Account is an account into which

all gains and losses are collected, in order to ascertain the excess of gains

over the losses or vice-versa”.

Need for preparing profit and loss account

Profit and loss account is

prepared for the following purposes:

(i) Ascertainment of net profit or net loss

The profit and loss account discloses the net profit available to the

proprietor or net loss to be borne by him. Ascertainment of profitability helps

in planning for the growth and efficiency of a business enterprise. Inter-firm

comparison and intra-firm comparison of profit and loss account items help in

assessing efficiency in comparison with other enterprises and other departments

of the same enterprise respectively.

(ii) Comparison of profit

The net profit of the current year can be compared with the profit of the previous years. It helps to know whether the business is conducted efficiently or not.

(iii) Control on expenses

Profit and loss account helps in comparing various expenses with the expenses of the previous years. The percentage of individual expenses to net sales can be calculated and compared with the similar ratios of previous years. Such a comparison will be helpful in taking effective steps for controlling unnecessary expenses.

(iv) Helpful in the preparation of balance sheet

A balance sheet can be prepared only after ascertaining the net profit

or loss through profit and loss account. Net profit or loss is shown in the

balance sheet. Thus, it facilitates preparation of balance sheet.

Preparation of profit and loss account

The amount of gross profit or gross loss brought down from the trading

account is the first item in the profit and loss account. All the indirect

expenses and losses are debited to profit and loss account. Indirect expenses

include office and administrative expenses, selling expenses, distribution

expenses, etc. As the profit and loss account is a nominal account, all the

indirect expenses and losses are shown on the debit side and all the indirect

incomes and gains are shown on the credit side.

Items shown on the debit side of profit and loss

account are as follows:

(i) Gross loss

If trading account discloses gross loss, it is shown on the debit side

of the profit and loss account.

(ii) Indirect expenses

Expenses which are not connected with purchase of goods are indirect

expenses, i.e., expenses incurred in administration, office, selling and

distribution of goods are indirect expenses.

(a) Office and administrative expenses

Expenses incurred for office and administration such as salary of office

employees, office rent, lighting, postage, printing, legal charges, audit fee,

depreciation and maintenance of office equipment, etc. are classified as office

and administrative expenses.

(b) Selling and distribution expenses

Expenses incurred for selling, promotion of sales and distribution of

goods such as advertisement charges, commission to salesmen, carriage outwards,

bad debts, godown rent, packing charges, etc., are classified as selling and

distribution expenses.

(c) Other indirect expenses and losses

The expenses such as interest on loan, repair charges, depreciation,

charity, loss on sale of fixed assets and abnormal losses such as loss due to

fire, theft, etc. not covered by insurance are shown under this category.![]()

Items shown on the credit side of profit and loss account are as follows:

(i) Gross profit

The first item on the credit side of profit and loss account is the

gross profit brought down from the trading account if there is gross profit.

(ii) Other incomes and gains

All items of indirect incomes and gains are shown on the credit side of

the profit and loss account. Income from investments, rent earned, discount

received, commission earned, interest earned and dividend received are indirect

incomes. Profit on sale of fixed assets and investments are examples of gains.

Closing of profit and loss account

After debiting indirect expenses and losses and crediting all indirect

incomes and gains, if the total of the credit side of the profit and loss

account exceeds the debit side, the difference is termed as net profit. On the other

hand, if the total in the debit side exceeds the credit side, the difference is

termed as net loss. Net profit or net loss is transferred to the capital

account.

Format of profit and loss account

Tutorial note

The expenses which are not related to the business are not shown in the

profit and loss account. Examples are personal expenses of the proprietor such

as domestic and household expenses of the proprietor, income-tax and life

insurance premium of the proprietor, etc. These expenses are classified as

drawings by the proprietor and are deducted from capital on the liabilities

side of the balance sheet if they are paid out of business funds

Only revenue receipts and revenue expenses are shown in the trading and

profit and loss account. Capital receipts, capital gains, capital expenditure

and capital losses are not shown in trading and profit and loss account. That

part of capital items that relate to that accounting period only are shown. For

example, depreciation on fixed assets. Purchase of fixed asset is a capital

expenditure. But depreciation is a revenue item which relates to the use of the

fixed asset in the current accounting period.

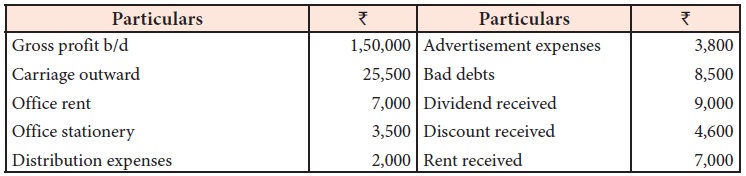

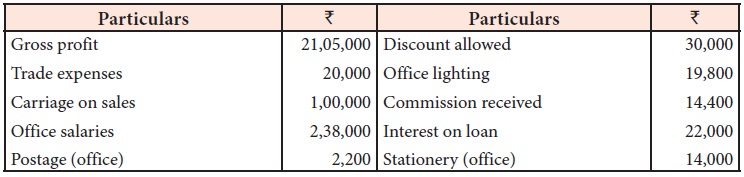

Illustration 8

From the following information, prepare profit and loss account for the

year ended 31st March, 2018.

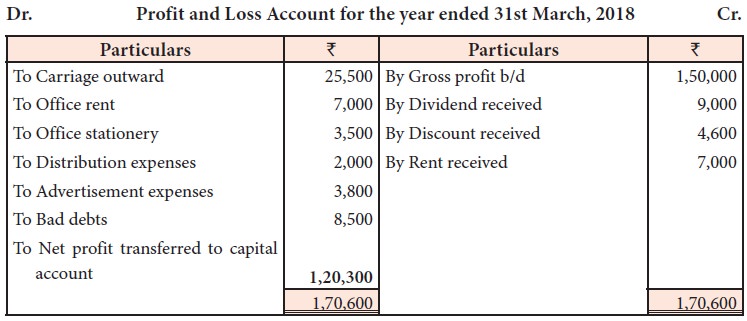

Solution

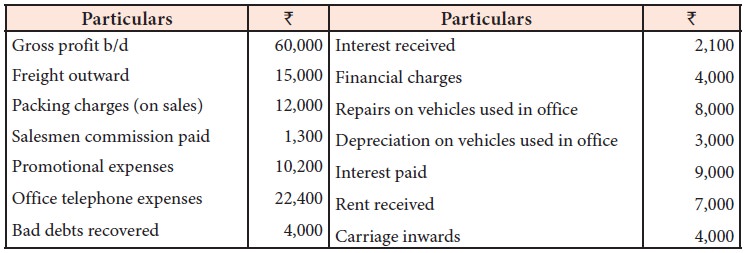

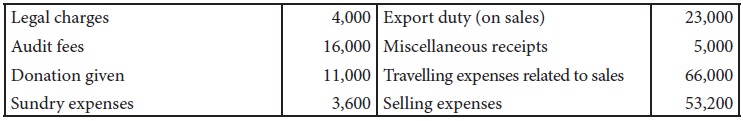

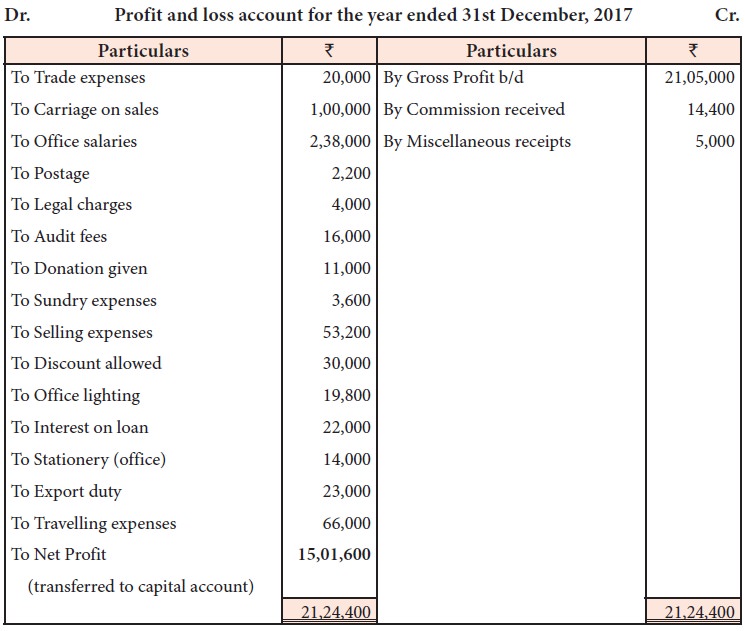

Illustration 9

From the following information,

prepare profit and loss account for the year ended 31st December, 2017.

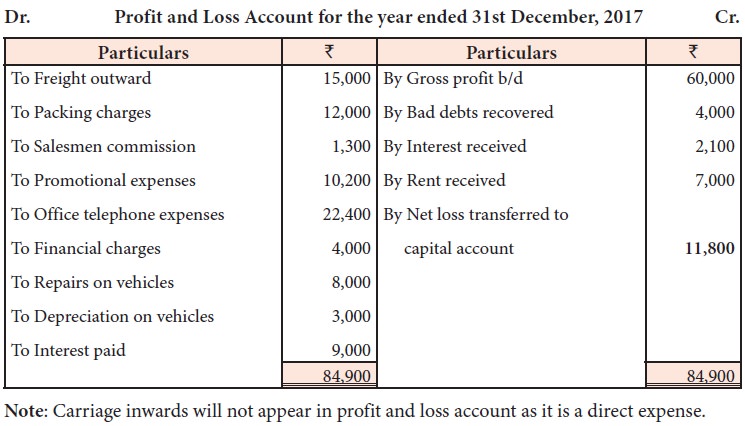

Solution

Illustration 10

From the following particulars,

prepare profit and loss account for the year ended 31st December, 2017.

Related Topics