Financial Statement Analysis | Accountancy - Preparation of comparative statements | 12th Accountancy : Chapter 8 : Financial Statement Analysis

Chapter: 12th Accountancy : Chapter 8 : Financial Statement Analysis

Preparation of comparative statements

Preparation

of comparative statements

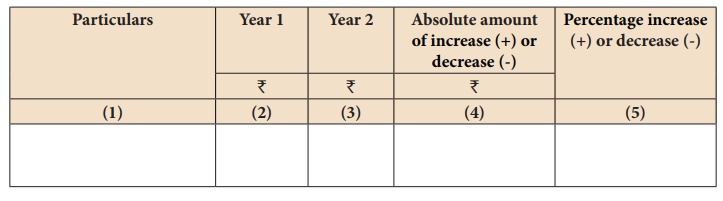

A comparative statement

has five columns. Following are the steps to be followed in preparation of the

comparative statement:

i.

Column 1: In this column, particulars of items of income statement

or balance sheet are written.

ii.

Column 2: Enter absolute amount of year 1.

iii.

Column 3: Enter absolute amount of year 2.

iv.

Column 4: Show the difference in amounts between year 1 and year

2. If there is an increase in year 2, put plus sign and if there is decrease

put minus sign.

v.

Column 5: Show percentage increase or decrease of the difference

amount shown in column 4 by dividing the amount shown in column 4 (absolute

amount of increase or decrease) by column 2 (year 1 amount). That is,

Percentage increase or

decrease = [ Absolute amount of increase or decrease / Year 1 amount ] x 100

Format of comparative statement

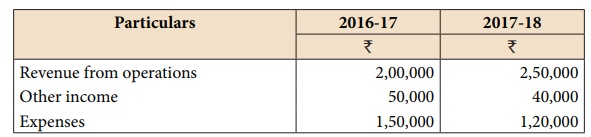

Illustration 1

From the following

particulars, prepare comparative income statement of Tharun Co. Ltd.

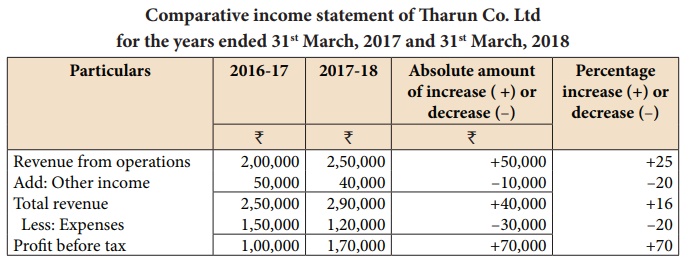

Solution

Comparative income statement of Tharun Co. Ltd for the years ended

31st March, 2017 and 31st March, 2018

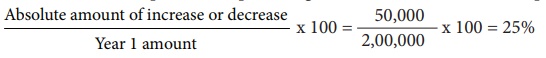

Tutorial

note:

Computation of percentage increase for revenue from operations

Illustration 2

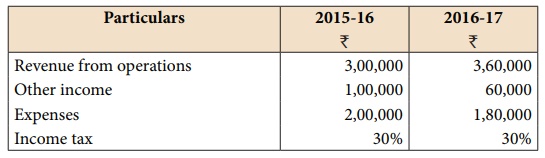

From the following

particulars, prepare comparative income statement of Abdul Co. Ltd.

Solution

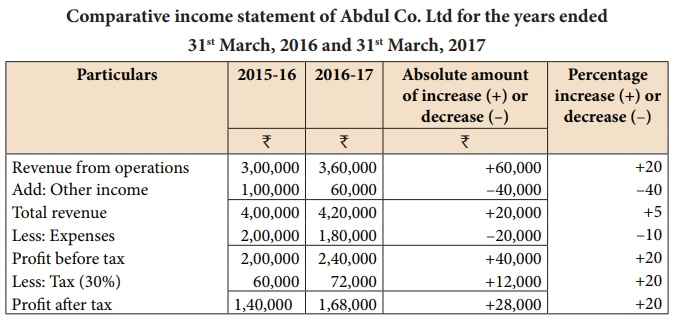

Comparative income statement of Abdul Co. Ltd for the years ended

31st March, 2016 and 31st March, 2017

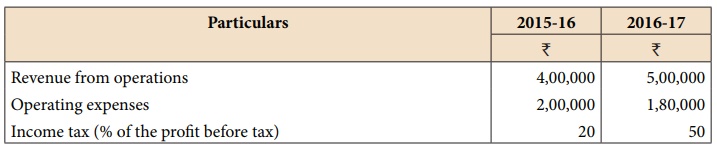

Illustration 3

From the following

particulars, prepare comparative income statement of Mary Co. Ltd.

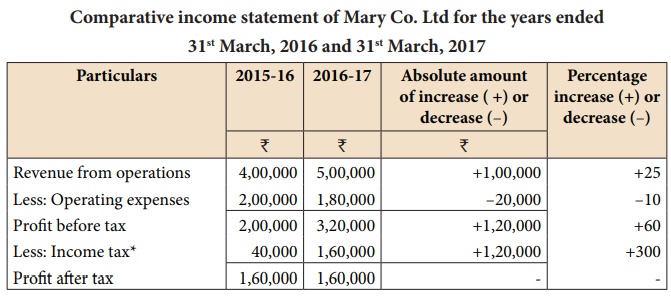

Solution

Comparative income statement of Mary Co. Ltd for the years ended 31st March, 2016 and 31st March, 2017

* Note: Calculation of income tax:

For 2015-16: 2,00,000 x 20% = ₹

40,000

For 2016-17: 3,20,000 x 50% = ₹

1,60,000

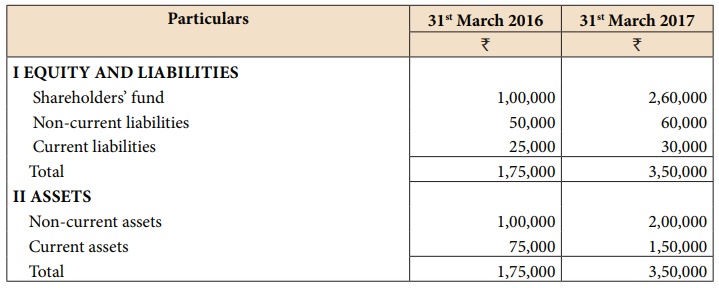

Illustration 4

From the following

balance sheet of Chandra Ltd, prepare comparative balance sheet as on 31st

March 2016 and 31st March 2017.

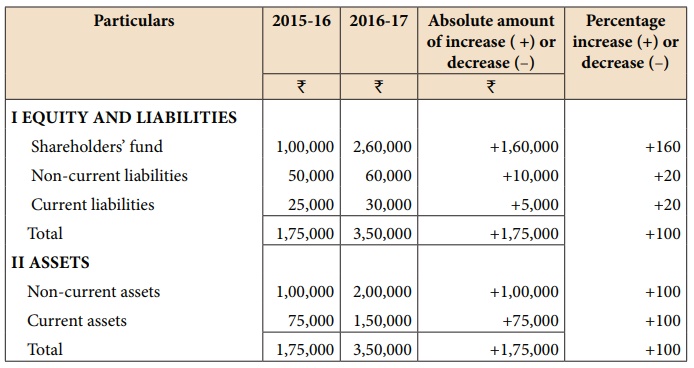

Solution

Comparative balance sheet of Chandra Ltd as on 31st March 2016 and

31st March 2017

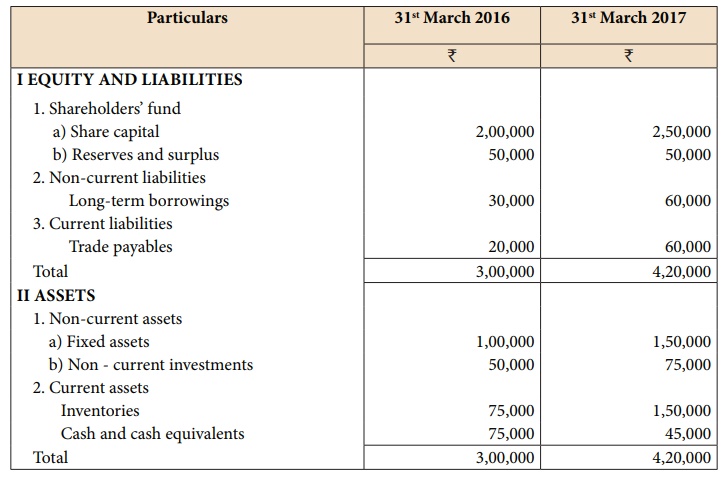

Illustration 5

From the following

particulars, prepare comparative balance sheet of Malar Ltd as on 31st March

2016 and 31st March 2017.

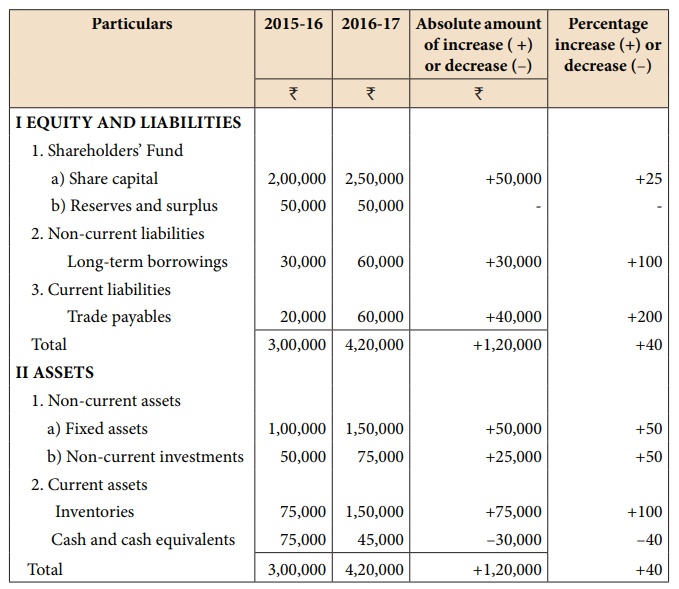

Solution

Comparative balance sheet of Malar Ltd as on 31st March 2016, and

31st March 2017

Related Topics