Goodwill in Partnership Accounts | Accountancy - Methods of valuation of goodwill | 12th Accountancy : Chapter 4 : Goodwill in Partnership Accounts

Chapter: 12th Accountancy : Chapter 4 : Goodwill in Partnership Accounts

Methods of valuation of goodwill

Methods

of valuation of goodwill

Following are the

methods generally followed to value goodwill:

1. Average profit method

Under this method,

goodwill is calculated as certain years of purchase of average profits of the

past few years. The number of years of purchase is generally determined on the

basis of the average period a new business will take in order to bring it to

the current state of the existing business. It may also be determined on the

basis of the number of years for which the past average profit will be earned

in future.

While computing the

average profit, in addition to rectification of errors, the following

adjustments are to be made:

Adjusted profit = Actual profit + Past expenses not required in

the future – Past revenues not likely to be earned in the future + Additional

income expected in the future – Additional expenses expected to be paid in the

future

The average profit may

be either simple average profit or weighted average profit.

(a) Simple average profit method

Under this method,

goodwill is calculated by multiplying the average profits by a certain number

of years of purchase. Simple average profit is calculated by adding the

adjusted profits of certain number of years by dividing the total number of

such years.

Goodwill = Average

profit × Number of years of

purchase

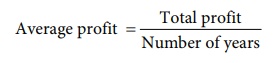

Average profit = Total

profit / Number of years

Illustration 1

The following are the

profits of a firm in the last five years:

2014: ₹ 4,000; 2015: ₹ 3,000; 2016: ₹ 5,000; 2017: ₹ 4,500 and 2018: ₹ 3,500 Calculate the

value of goodwill at 3 years purchase of average profits of five years.

Solution

Goodwill = Average

profit × Number of years of purchase

Goodwill = Average profit × Number

of years of purchase

= 4,000 × 3 = ₹ 12,000

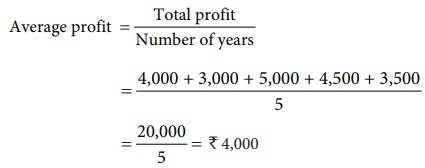

Illustration 2

The profits and losses

of a firm for the last four years were as follows:

2015: ₹ 15,000; 2016: ₹ 17,000; 2017: ₹ 6,000 (Loss); 2018: ₹ 14,000

You are required to

calculate the amount of goodwill on the basis of 5 years purchase of average

profits of the last 4 years.

Solution

Goodwill = Average

profit × Number of years of purchase

Average profit = Total

profit / Number of years

Goodwill = Average

profit × Number of years of purchase

= 10,000 × 5 = ₹ 50,000

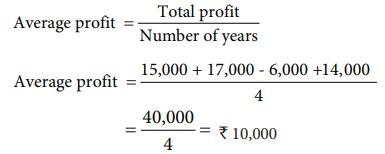

Illustration 3

A partnership firm has

decided to value its goodwill for the purpose of settling a retiring partner.

The profits of that firm for the last four years were as follows:

2015: ₹ 40,000; 2016: ₹ 50,000; 2017: ₹ 48,000 and 2018: ₹ 46,000

The business was looked

after by a partner. No remuneration was paid to him. The fair remuneration of

the partner valued at comes to ₹

6,000 per annum.

Find out the value of

goodwill, if it is valued on the basis of three years purchase of the average

profits of the last four years.

Solution

Goodwill = Average profit × Number

of years of purchase

= 40,000 × 3 = ₹ 1,20,000

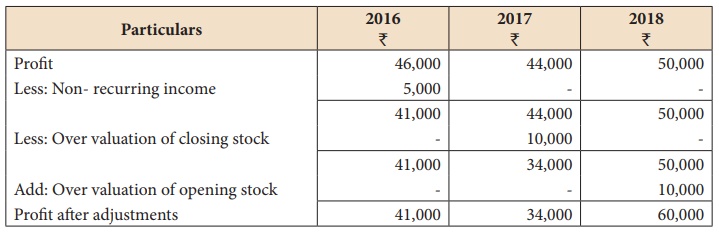

Illustration 4

From the following

information relating to Arul enterprises, calculate the value of goodwill on

the basis of 2 years purchase of the average profits of 3 years.

a) Profits for the years

ending 31st December 2016, 2017 and 2018 were ₹ 46,000, ₹

44,000 and ₹ 50,000 respectively.

b) A non-recurring income

of ₹ 5,000 is included in

the profits of the year 2016.

c) The closing stock of the

year 2017 was overvalued by ₹

10,000.

Solution

Calculation of adjusted profit

Tutorial note: Over valuation of

closing stock in 2017 will result in over valuation of opening stock in 2018

Goodwill = Average profit × Number

of years of purchase = 45,000 × 2 = ₹ 90,000

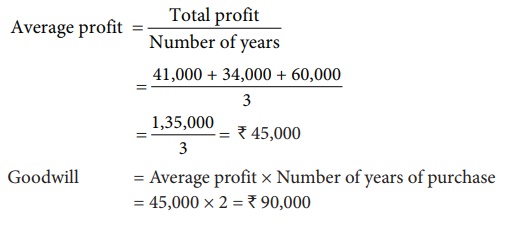

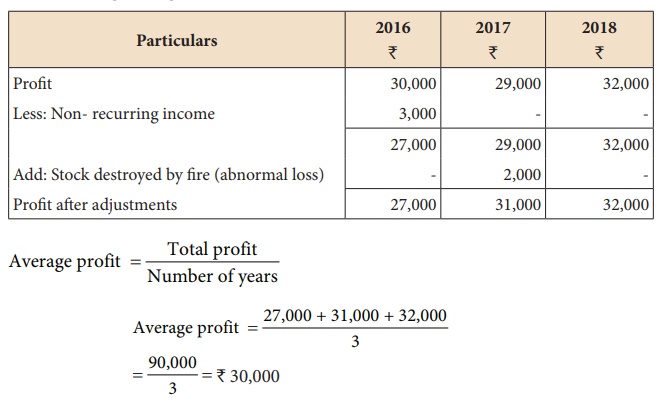

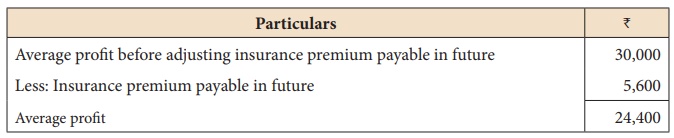

Illustration 5

The following

particulars are available in respect of a business carried on by a partnership

firm:

a) Profits earned: 2016: ₹ 30,000; 2017: ₹ 29,000 and 2018: ₹ 32,000.

b) Profit of 2016 includes

a non-recurring income of ₹

3,000.

c) Profit of 2017 is

reduced by ₹ 2,000 due to stock

destroyed by fire.

d) The stock is not

insured. But, it is decided to insure the stock in future. The insurance

premium is estimated at ₹

5,600 per annum.

You are required to

calculate the value of goodwill on the basis of 2 years purchase of average

profits of the last three years.

Solution

(a) Calculation of adjusted profit

Goodwill = Average profit × Number

of years of purchase

= 24,400 × 2

= ₹ 48,800

(b) Weighted average profit method

Under this method,

goodwill is calculated by multiplying the weighted average profit by a certain

number of years of purchase.

Goodwill = Weighted

average profit × Number of years of purchase

In this method, weights

are assigned to each year’s profit. Weighted profit is ascertained by

multiplying the weights assigned with the respective year’s profit. The sum of

the weighted profits is divided by the sum of weights assigned to determine the

weighted average profit.

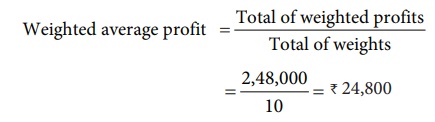

Weighted average profit = Total of weighted profits / Total of weights

This method is used when

the profits show an increasing or decreasing trend. More weight is generally

given to the profits of the recent years.

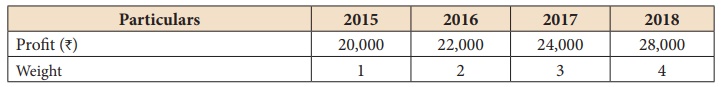

Illustration 6

For the purpose of

admitting a new partner, a firm has decided to value its goodwill at 3 years

purchase of the average profit of the last 4 years using weighted average

method. Profits of the past 4 years and the respective weights are as follows:

Compute the value of goodwill.

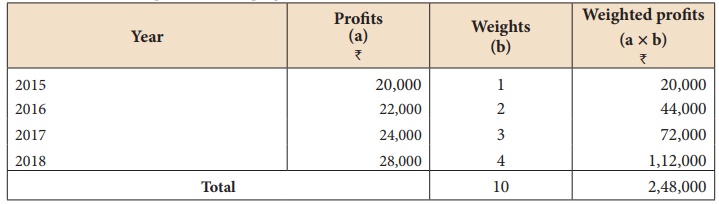

Solution

Calculation of weighted

average profit

Goodwill = Weighted average profit × Number of years of purchase

= 24,800 × 3 = ₹ 74,400

2. Super profit methods

Under these methods,

super profit is the base for calculation of the value of goodwill. Super profit

is the excess of average profit over the normal profit of a business.

Super profit = Average

profit – Normal profit

Average profit is

calculated by dividing the total of adjusted actual profits of certain number

of years by the total number of such years. Normal profit is the profit earned

by the similar business firms under normal conditions.

Normal profit = Capital employed × Normal rate of

return

Capital employed = Fixed assets + Current assets – Current

liabilities

Normal rate of return

= It is the rate at which profit is earned by similar business entities

in the industry under normal circumstances.

(a) Purchase of super profit method

Under this method,

goodwill is calculated by multiplying the super profit by a certain number of

years of purchase.

Goodwill = Super profit

× Number of years of purchase

Illustration 7

From the following

information, calculate the value of goodwill based on 3 years purchase of super

profit

i.

Capital employed: ₹

2,00,000

ii.

Normal rate of return: 15%

iii.

Average profit of the business: ₹ 42,000

Solution

Normal profit = Capital

employed × Normal rate of return

= 2,00,000 × 15% = ₹

30,000

Super profit = Average

profit – Normal profit

= 42,000 – 30,000

= ₹ 12,000

Goodwill = Super profit

× Number of years of purchase

= 12,000 × 3

= ₹ 36,000

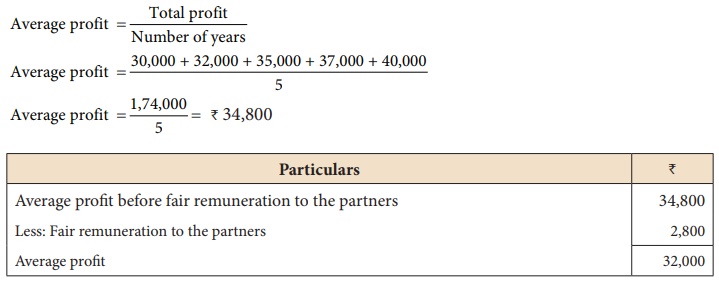

Illustration 8

Calculate the value of

goodwill at 5 years purchase of super profit from the following information:

(a) Capital employed: ₹ 1,20,000

(b) Normal rate of

profit: 20%

(c) Net profit for 5

years:

2014: ₹ 30,000; 2015: ₹ 32,000; 2016: ₹ 35,000; 2017: ₹ 37,000 and 2018: ₹ 40,000

(d) Fair remuneration to

the partners ₹ 2,800 per annum.

Solution

Normal profit = Capital

employed × Normal rate of return

= 1,20,000 × 20%

= ₹ 24,000

Super profit = Average profit – Normal profit

= 32,000 – 24,000

= ₹ 8,000

Goodwill = Super profit × Number of years of

purchase

= 8,000 × 5

= ₹ 40,000

(b) Annuity method

Under this method, value

of goodwill is calculated by multiplying the super profit with the present

value of annuity.

Goodwill = Super profit

× Present value annuity factor

Present value annuity

factor is the present value of annuity of rupee one at a given time. It can be

found out from annuity table or by using formula.

Illustration 9

From the following

information, compute the value of goodwill as per annuity method:

(a) Capital employed: ₹ 50,000

(b) Normal rate of

return: 10%

(c) Profits of the years

2016, 2017 and 2018 were ₹

13,000, ₹ 15,000 and ₹ 17,000 respectively.

The present value of

annuity of ₹ 1 for 3 years at 10% is

₹ 2. 4868.

Solution

Average profit = Total

profit / Number of years

= 13,000 + 15,000 +

17,000 / 3

= 45,000/3

= ₹ 15,000

Normal profit = Capital

employed × Normal rate of return = 50,000 × 10% = ₹ 5,000

Super profit = Average

profit – Normal profit = 15,000 – 5,000

= ₹ 10,000

Goodwill = Super profit × Value of annuity = 10,000 × 2.4868 = ₹ 24,868

c. Capitalisation of super profit method

Under this method, value

of goodwill is calculated by capitalising the super profit at normal rate of

return, that is, goodwill is the capitalised value of super profit.

Goodwill = [ Super

profit / Normal rate of return ] × 100

Illustration 10

From the following

information, compute the value of goodwill by capitalising super profit:

a) Capital employed is ₹ 4,00,000

b) Normal rate of return is

10%

c) Profit for 2016: ₹ 62,000; 2017: ₹ 61,000 and 2018: ₹ 63,000

Solution

Average profit = Total profit/Number of years

= [62,000 + 61,000 + 63,000] /3

= ₹ 62,000

Normal profit = Capital employed × Normal rate of return

= 4,00,000 × 10%

= ₹ 40,000

Super profit = Average profit – Normal profit

= 62,000 – 40,000

= ₹ 22,000

Goodwill = Super profit/Normal rate of return x 100

= 22,000/10 x 100

= ₹ 2,20,000

3. Capitalisation method

Under this method,

goodwill is the excess of capitalised value of average profit of the business

over the actual capital employed in the business.

Goodwill = Total capitalised

value of the business – Actual capital employed

The total capitalised

value of the business is calculated by capitalising the average profits on the

basis of the normal rate of return.

Capitalised value of the business = [ Average profit / Normal rate of return ] x 100

Actual capital employed

= Fixed assets (excluding goodwill) + Current assets – Current liabilities

Illustration 11

From the following

information, find out the value of goodwill by capitalisation method:

(a) Average profit = ₹ 60,000

(b) Normal rate of

return = 10%

(c) Capital employed = ₹ 4,50,000

Solution

Total capitalised value

of the average profit = [ Average profit / Normal rate of return ] x 100

= 60,000 / 10 = x 100

Goodwill = Total

capitalised value of the average profit – Capital employed

= 6,00,000 – 4,50,000

= ₹ 1,50,000

Related Topics