Chapter: Business Science : Financial Management : Working Capital Management

Factoring - Working Capital Management

FACTORING

1History

2Modus of Operations

3Mechanics of Factoring

4 Types Of Factoring

5 Difference between Factoring And Forfeiting

Factoring

Factoring is a service of financial nature involving the

conversion of credit bills into cash. Accounts receivables, bills recoverables

and other credit dues resulting from credit sales appear, in the books of

accounts as book credits. Here the risk of credit, risk of credit worthiness of

the debtor and as number of incidental and consequential risks are involved.

These risks are taken by the factor which purchase these credit receivables

without recourse and collects the m when due. These balance-sheet items are

replaced by cash received from the factoring agent.

1History

Roman

Factoring

has not been documented as having been used by the Romans. However, the word

‗factoring‘ has a Roman root. It is derived from the Latin verb ‘facio‘ which

can be translated as ―he who does things‖. In Roman times this referred to

agent of a property owner, i.e., his business manager. Though the root word has

nothing to do with the industry, as they attempt to help their clients thro ugh

their financial problem.

Factoring in United States

Factoring

arose in the United States during 19th century, as direct result of the

inability of manufacturers to ma intain consta nt and timely communications

with their sales forces in the field. At that time, as the case today, the

sales force was paid by communications. If all sales were at the risk of the

manufacturer, the salesman had no incentive to exercise prudence in connection

with whom to sell to on credit.

On the

other hand, the distant manufacturer was not in the position to make the credit

risk on sales. The risk of defective or non-conforming merchandise remained

with the manufacturer. The credit risk was now separated from disputes as to quality,

work mans hip and conformity of goods. Soon after, the salesman began to act as

independent sales agencies. It was common for them to act for more than one

manufacturer. Still later the sales function was separated from the credit

function and ―Traditional Factoring‖ as the people know, it had, at that point,

developed in the United States.

History Factoring in India

Banks

provide generally bill collection and bill discounting and with recourse. They

provide working capital finance based on these bills classified by a mounts

maturity wise. Such bills if accumulated in large quantities will burden the

liquidity and solvency position of the company and reduces the credit limits

from the banks. It is therefore felt necessary that the company assigns these

book debts to a factor for taking them off from the balance sheet. This reduces

the workload, increases the solvency and improves the liquidity position of the

company.

Vaghul

Committee report on money market reforms has confirmed the need for factoring

services to be developed in India as part of the money market instruments. Many

new instruments were already introduced like Participation certificates,

Commercial papers, Certificate of deposits etc., but the factoring service has

not developed to any significant extent in India.

The

Reserve Bank allowed some banks to set up subsidiaries on a zonal basis to take

care of the require me nts of companies in need of such service. Thus Canara

Bank, State Bank of India, Punjab National Bank and a few other banks have been

permitted to set up jointly some factor, for Eastern, Western, Northern, and

Southern Zones. The progress of the activity did not show any worth while dime

ns ion, so far.

2Modus of Operations

If a

company wants to factor its receivables it submits a list of customers, their

credit rating, a mount involved in maturity and other terms. If the factor

scrutinizes the list of buyers and they are in the approved list, the factor

gives its decision of the clients and the a mounts they may take all

receivables on wholesale discounting basis. The factor the n takes all the

documents in respect of approved list and pays up to 80% to 90% of the a mount

due less commission to the company which in turn removes these instruments,

from base of accounts and shows cash flow as against bills receivables written

off.

Factoring services

re nde re d the following services:

Purchase of book debts and receivables.

Ad ministration of sales ledger of the

clients.

Prepayments of debts

partially or fully.

Collection of book

debts or receivables

or with or

without documents.

Covering the credit risk of the

suppliers.

Dealing in book

debts of customers without recourse.

Why Factoring?

Factoring is one of the most important and

unavoidable part of the business concern which meets the short-term financial

requirement of the concern. Factoring is favorable to the industrial concern

for the following reasons.

1

.Quickest response–Customer oriented timely decisions and decision on sanction

within a week.

2. Low

cost.

3. Low

service charges (0.1% to 0.3%).

4. Low

margin (20% onwards).

5.

Instant finance–against each invoice.

6.

Generous grace period.

7.

Improves cashflow.

8.

Substitutes sundry creditors.

9.

Increases sales through better terms on sales.

10. More

operating cycles and more profits.

11. No

upfront recovery of charges.

12.

Interest on daily products.

13. Very

easy to operate.

14.

Flexible credit periods.

15. No

penal interest up to grace period.

16.

Empowers cash purchase.

17.

Improves credit reputation.

18.

Follow up of each invoice.

19.

Collection of receivables.

20. MIS reports

like customers overdue invoices enabling constant evaluation of customers.

21.

Outstation payments at nominal rates.

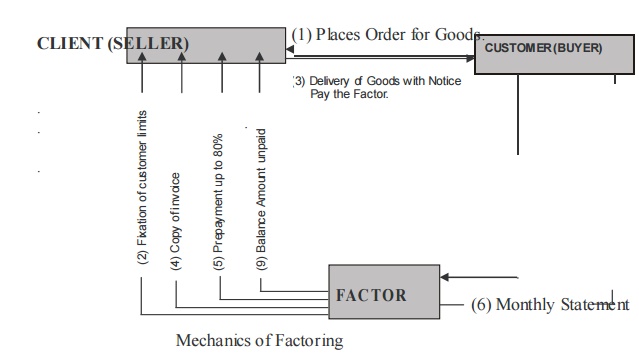

3 Mechanics of

Factoring

The

following are the steps for factoring:

The customer places an order with

the seller (client).

The factor and the seller enter into

a factoring agreement about the various terms of factoring.

Sale contract is entered into with

the buyer and the goods are delivered.

The

invoice with the notice to pay the factor is sent alongwith.

The copy of invoice covering the

above sale to

the factor, who maintains the sale ledger.

The factor prepays 80% of the

invoice value.

The monthly statement are sent by

the factor to the buyer.

Follow up action is initiated if

there are any unpaid invoices.

The buyer settles the invoices on the

expiry of the credit period allowed.

The balance 20% less the cost of

factoring is paid by the factor to the client.

4 Types Of Factoring

Notified factoring

Here, the

customer is intimated about the assignment of debt to a factor, also directed

to make payments to the factor instead of to the fir m. This is invariably done

by a legend and the invoice has been assigned to or sold to the factor.

Non-notified or confidential factoring

Under

this facility, the supplier/factor arrangement is not declared to the customer

unless or until there is a breach of the agreement on the part of the client,

or exceptionally, where the factor considers himself to be at risk.

With re course or without re course factoring

Under

recourse arrangements, the client will carry the credit risk in respect of

debts sold to the factor. In without recourse factoring, the bad debts are

borne by the factor.

Bank Participation Factoring

The

client creates a floating charge on the factoring reserves in favour of banks

and borrow against these reserves.

Ex port Facto ring

There is

usually the presence of two factors: an export factor and an import factor. The

former buys the invoices of a client exporter and assumes the risk in case of

default by the overseas customers. Because of distance, different condition or

lake of information, the export factor usually forms out to an agent, known as

the import factor, the administrative job of servicing the debts owed to its

exporting clients.

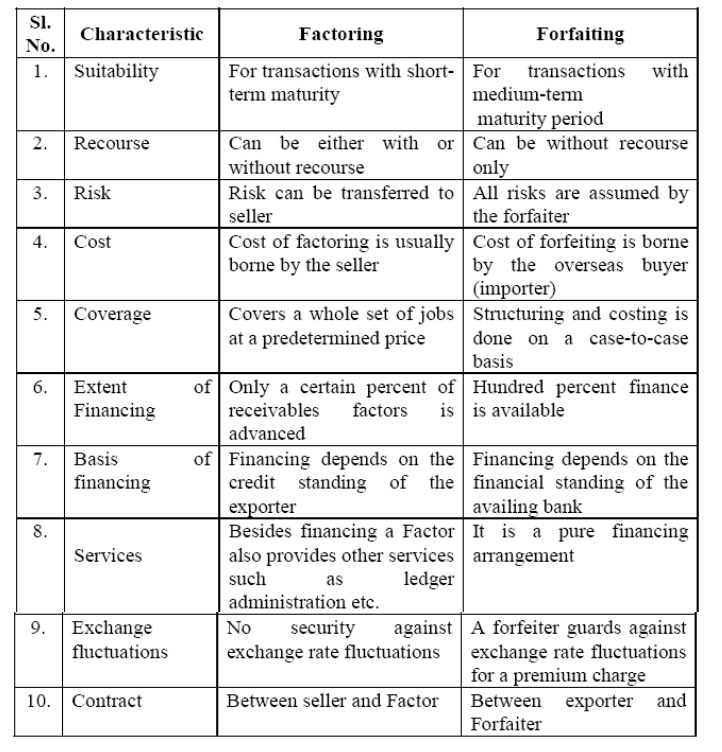

5 Difference between Factoring And Forfeiting

The

following are differences between factoring and forfeiting

Related Topics