Chapter: 11th 12th std standard Indian Economy Economic status Higher secondary school College

Rate of interest: Liquidity Preference Theory

Rate of interest: Liquidity Preference Theory

Any business move has to take into consideration a vital factor which influences the current supply of money, namely interest. The rate of interest is another major determinant that influences aggregate investment. In fact, the Keynesian theory of employment begins with the rate of interest. Interest affects investment and employment. Keynes propounded his famous liquidity preference theory of interest to explain the necessity, justification and importance of interest. The concept of liquidity preference is a remarkable contribution of Keynes. According to Keynes, the rate of interest is 'the reward for parting with liquidity for a specified period'.

Liquidity preference refers to the cash holdings of the people. Liquidity means cash. Why do people hold cash? It is because money is the most liquid asset and people prefer to keep their wealth in the form of cash. Keynes gives three motives for the liquidity preference of the people. They are

1. Transaction motive

2. Precautionary motive and

3. Speculative motive

In order to carry on day-to-day transactions, people prefer to keep cash. It is governed by the transaction motive. To meet unforeseen expenditure like sudden medical expenses, people hold cash. It is determined by precautionary motive. To take advantage of market movements of prices of bonds, shares, etc. people keep cash and in this case the speculative motive determines their cash holdings. 'Speculative motive refers to the object of securing profit from knowing better than the market what the future will bring forth' (Keynes).

Liquidity preference depends on rate of interest. Higher the rate of interest, people would like to take advantage and so will part with their cash. Therefore we can say that higher the rate of interest, lower will be the liquidity preference of the people. On the other hand, lower the rate of interest, higher will be the liquidity preference.

According to Keynes, the liquidity preference is more stable as it depends on human habits which remain same. Liquidity preference relates to the demand for money. It is important to note that it influences the demand side in determining the price of capital . The other side is the supply of money which depends on government monetary policy, and credit creation by commercial banks.

Briefly stated, the Keynesian investment function gives immense importance to the rate of interest. If the rate of interest remains constant, then investment increases with an increase in the business confidence about the future.

Simple Income Determination

According to Keynes, the level of income of a country in the short run will change as a result of change in employment. The level of employment depends on aggregate demand and aggregate supply. The equilibrium level of income depends on the balance between aggregate demand and aggregate supply. Full employment prevails when there is equality between these two. Thus the model can be used to show the determination of income, output and employment.

Assumptions

Keynes made the following assumption to explain income determination in a simple way.

1. There are only two sectors viz. consumers ( C ) and firms ( I ).

Government influence on the economy is nil. In other words government expenditure ( G ) is zero. As there is no taxation, all personal income will become disposable income.

1. The economy is a closed one without any influence of foreign trade (X-M) that is, X-M is zero.

2. Wages and prices remain constant.

3. There are unemployed resources and hence less than full employment equilibrium prevails.

4. There is no variation in the rate of interest.

5. Investment is autonomous and it has no effect on price level or rate of interest.

6. The consumption expenditure is stable.

Due to the first three assumptions the basic equation Y = C + I + G + X-M

has been reduced to Y = C + I

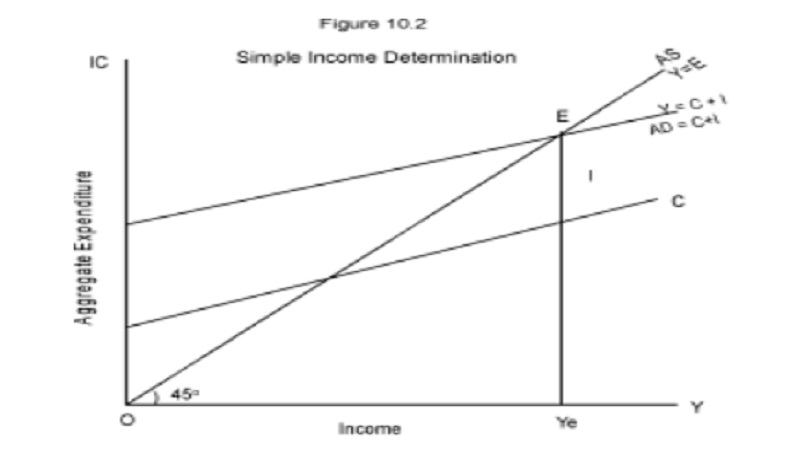

In Figure , vertical axis measures total or aggregate demand (or aggregate expenditure). Horizontal axis measures income and output. You have learnt in National Income lesson (Plus One) that in the aggregate economy, income, expenditure and output are equal. Hence they are measured in the same axis.

Aggregate supply is the total value of all commodities that the firms intend to supply (produce). This purely depends on available technology, resources (material and human), efficiency of labour, etc. Most of these factors change only in the long run and remain constant in the short run. As the aggregate supply curve represents equality of total income and output, the 45-degree line is drawn from the origin representing AS curve. The 45-degree line divides the quadrant into two equal halves with equal distance from the two axes. Every point on the line indicates equal amount of income, output and expenditure ( Y = E ). The importance of this is that if any other line intersects the 45-degree line, the point of intersection will show an equal amount of income, output and expenditure.

Aggregate demand represents the total expenditure on consumption and investment (or total expenditure). The aggregate demand (expenditure) curve is the combination of consumption and investment function. In Figure , C represents consumption function. When investment is added, it becomes C+I. The value of investment is shown by the vertical distance between C and C+I curves.

Thus Aggregate Expenditure (AD) = C + I

Equilibrium occurs at the point of intersection of aggregate demand and aggregate supply. At point E the planned total spending (or aggregate demand) by consumers( C ) and investors ( I ) is equal to the total amount of national income ( Y = C + I ). The equilibrium level of output also determines the equilibrium level of employment. Hence, at point E, we get equilibrium level of income, output and employment.

The equilibrium level of employment need not correspond to full employment. If any of the components of aggregate demand rises at each level of income, for example, because government increases its expenditure, that shifts the entire AD line upward. This raises equilibrium income and output. Similarly, if any one component of AD falls, that shifts the line downward and lowers equilibrium output.

Multiplier: Ultimate determinant of Income and Employment

We have dealt with the immediate determinants of income and employment namely, consumption spending and investment spending (C+I). Among them autonomous consumption and investment are not related to income. The ultimate determinant of income and employment is the multiplier. Any increase in investment increases income manifold due to multiplier effect. Thus the concept of multiplier expresses the relationship between an initial investment and the final increment in the GNP. That is, the magnified or amplified effect of initial investment on income is called as the multiplier effect. It is measured by the ratio of change in equilibrium income to change in expenditure.

Multiplier (K) = change in equilibrium income / ∆ change in expenditure

Or K = ∆Y / I

whereas DY - change in equilibrium income; DI - change in expenditure

Thus, K is the co-efficient that shows the number of times at which income increased due to increase in investment. K can also be calculated by another way.

K = 1/ MPS

where MPS = marginal propensity to save

or

K = 1 / (1 - MPC)

where MPC = marginal propensity to consume.

Government Spending

We have discussed the simple income determination only with two kinds of expenditure. One is consumption expenditure (C) to produce consumer goods. Second is investment expenditure (I) to produce capital goods. The third component is the public expenditure (G) made by government. It is made to produce public goods like literacy, public health, child nutrition, social welfare and many more for the collective well-being of the society.

The classical economists held the view that government was unproductive. Keynes rejected their idea and argued that government activities (taxing and spending) strongly influence the level of economy. Taxation and public spending can be used to achieve macro goals like growth and economic stability. Such usage is called fiscal policy.

Keynes proved that fiscal policy is more effective in recovering economies from depression. Public expenditure can be used to increase effective demand during depression. The injection of money in the economy will generate demand and this will increase investment and employment. Thus public expenditure will put back the economy again on its growth path.

Many countries have adopted his policy suggestions and recovered from the Great Depression of 1930s. Since then the role of government and fiscal policy became important in macroeconomic management.

Principle of Acceleration

According to the theory of multiplier, the increase in investment generates manifold increase in income. Such increases in income increases consumption. The initial increase in demand automatically gathers momentum. The available productive capacities will be exhausted fully. This in turn encourages more investment to meet the expanding demand.

As the existing productive capacity would not be enough to meet the expanding demand, productive capacities will be expanded by new investments.

Thus the level of investment depends upon the rate of change in income and the resultant change in consumption. This is what called as the principle of accelerator. According to this principle, net investment is positively related to changes in income.

The theory of multiplier states the effect of investment upon the level of income. The principle of accelerator states that the effect of an increase in income upon the level of investment.

Money and Interest

Keynes represented a monetary theory of interest. It is known as the liquidity preference theory of interest. Interest, according to Keynes, is payment for the use of money. The demand for money (liquidity preference) and the supply of money, determine the rate of interest. The essence of the Keynesian theory of liquidity preference is that the quantity of money, along with the state of liquidity preference determines the rate of interest.

Related Topics