Chapter: 11th 12th std standard Indian Economy Economic status Higher secondary school College

Monetary Transmission

Monetary Transmission

The transmission mechanism tells that monetary policy affects income through the interest rate and investment. It is the process by which money supply affects income. Let us suppose that the government follows cheap money. The central bank, for example, may reduce the bank rate. This will result in a fall in the market rate of interest. Then the investment will go up. This, in turn, will increase employment and income. The increase in money supply can also be caused by variation of cash reserve ratios and open market operations.

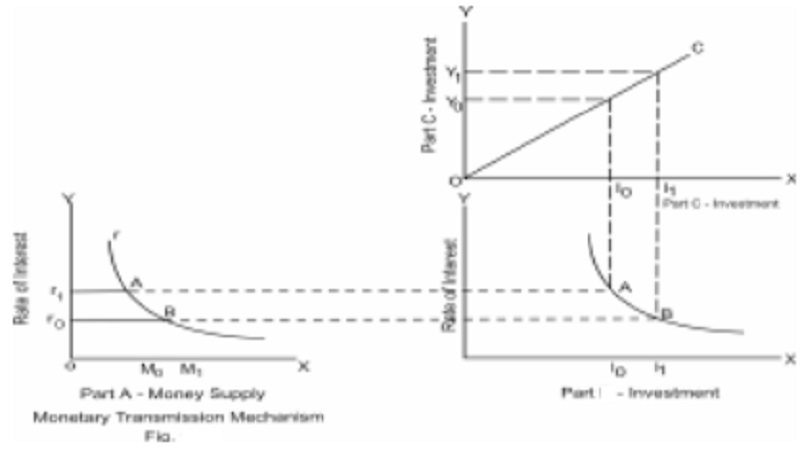

Diagrammatic representation of Transmission Mechanism Fig. illustrates how transmission mechanism works. Part A of the diagram tells that when there is a fall in the rate of interest from r1 to ro, money supply increases from Mo to M1. As a result of the fall in the rate of interest and increase in the supply of money, investment increases from Io to I1 as shown in Fig. (b). The increase in investment results in increase in income from Yo to Y1. as shown in fig.

Many modern economists argue that this view of transmission mechanism is rather narrow. They say that like investment, consumption may vary with the interest rate. The classical economists assumed that consumption is inversely related to the rate of interest. If we accept that view, a fall in the interest rate will cause an increase in consumption. Since consumption is a component of aggregate demand, aggregate demand increases. This in turn, will increase the equilibrium level of income. If both consumption and investment increase, income will increase by a greater amount than if only investment increases.

The monetary economists further argue that monetary policy may also affect income by altering net private wealth.

Net Private wealth may be defined as society's capital stock, money supply, and government debt (government debt includes treasury bills, notes and bonds). And consumption is positively related to net private wealth. If the nominal money supply increases and price level is constant, the real money supply increases. Since it is a component of net private wealth, wealth increases, and in turn consumption increases. When consumption increases, aggregate demand increases and the equilibrium level of income increases. It may be noted that wealth and consumption increase without regard to changes in the rate of interest. It follows that monetary policy is effective even in the liquidity trap. According to Keynes, liquidity trap refers to a situation in which an increase in the money supply does not result in a fall in the interest rate but merely in an addition to idle balances.

Dear Money

When there is inflation in a country, the central bank tries to control it by following dear money policy. The term 'Dear Money' refers to a phase or policy when interest rates are high.

Cheap Money

'Cheap Money' denotes a phase in which loans are available at low rates of interest or a policy which creates this situation. Cheap money policy is followed by a central bank during a period of depression to increase the supply of money so as to stimulate investment.

Value of money

By 'Value of Money' we mean the purchasing power of money. The purchasing power of money depends upon the price level. A general rise in the price level indicates a fall in the value of money and a general fall in prices indicates a rise in the value of money.

The Quantity Theory of Money and the Equation of Exchange

The Quantity Theory of Money was formulated by Irving Fisher. In its original form, the quantity theory states, 'prices always change in exact proportion to changes in the quantity of money. If the amount of money is doubled, prices double. If the amount of money is halved, prices fall to half their original level'. The main point about the quantity theory is that price level changes because of changes in the quantity of money.

Equation of Exchange : The quantity theory of money has been put forward in the form of an equation known as the 'Equation of Exchange'. It is also known as Fisher's equation. The equation of exchange states that if 'M' is the amount of money, 'V' is the velocity of circulation of money, 'P' is the price level and 'T' is the volume of trade, then MV = PT (or P = MV/T)

This is known as the equation of exchange. Velocity of circulation

(V) refers to the number of times that each unit of money is used during a given period. The equation tells when the supply of money increases, other things being equal, there will be a rise in the price level. That means a fall in the value of money. For example, when 'M' is doubled,'P' will be doubled.

Now a days, a large proportion of money consists of cheques, bills and other forms of credit instruments. So some economists are of the opinion that the above types of money should be taken into account while considering the quantity of money. So the Equation of Exchange has been modified as follows :-

PT = MV + M1V1 where M1 is the total amount of all forms of cheques, bills and other instruments of credit in circulation and V1is the velocity of circulation of M1 (credit instruments) The main criticism against the quantity theory of money is that it is based on the assumption of full employment. But if full employment is not there and if there are unemployed resources, an increase in the quantity of money will not generally increase prices. Again, during depression, all prices fall. Even if the quantity of money is increased at that time, prices will not rise. In spite of the above criticism, we may note that the quantity theory of money is a statement of tendency and it indicates in a crude way the relationship between prices and the quantity of money.

Changes in price level may be influenced by many things other than the quantity of money such as Government's monetary policy and fiscal policy, the supply of goods in the given period, the volume of trade, changes in the incomes of the people and effective demand for goods. One way of studying about changes in prices is to study about inflation and deflation.

Related Topics