Term 3 Unit 2 | Civics | 7th Social Science - Market and Consumer Protection | 7th Social Science : Civics : Term 3 Unit 2 : Market and Consumer Protection

Chapter: 7th Social Science : Civics : Term 3 Unit 2 : Market and Consumer Protection

Market and Consumer Protection

Unit ŌĆō 2

Market and

Consumer Protection

Learning

Objectives

ŌĆó

To identify four different types of market structures.

ŌĆó

To know the differences between each type of market structure.

ŌĆó

To understand why consumers need protection.

ŌĆó

To understand the rights of consumers.

Introduction

When

we talk about a market we generally visualise a crowded place with a lot of

shops and consumers. People are buying different types of goods like groceries,

clothing, electronics, etc in the market.

And

the shops are also selling a variety of products and services as well. So in a

traditional sense, a market is where buyers and sellers meet to exchange their

goods and services.

But

what is a market in economics? In economics, we do not refer to a market as a

physical place. Economists described a market as coming together of the buyers

and sellers, i.e. an arrangement where buyers and sellers come in direct or

indirect contact to sell/buy goods and services. For example, the market for

books will constitute all the sellers and buyers of books in an economy. It

does not necessarily refer to a geographic location.

A

set up where two or more parties engaged in exchange of goods, services and

information is called a market. Ideally a market is a place where two or more

parties are involved in

buying and selling. The two parties involved in a transaction are called seller

and buyer. The seller sells goods and services to the buyer in exchange of

money. There has to be more than one buyer and seller for the market to be

competitive.

Features of a Market

In economics, the term market refers

to the shops for one commodity or a set of commodities. For example a market

for rice, a market for cloth, a market for electronics goods, etc.

1.

A market is also not restricted to one physical or geographical location. It

covers

a

general wide area and the demand and supply forces of the region.

2.

There must be a group of buyers and sellers of the commodity to constitute a

market. And the relations between these sellers and buyers must be business

relations.

3.

Both the sellers and buyers must have access to knowledge about the market.

There should be an awareness of the demand for products, consumer choices, and

preferences, fashion trends, etc.

4.

At any given time only one price can be prevalent in the market for the goods

and services. This is only possible in the existence of perfect competition.

Classification

of Markets

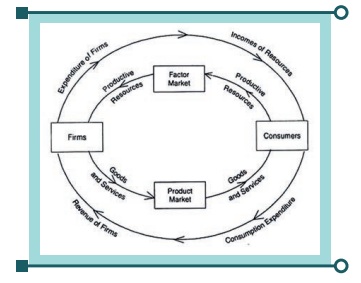

Broadly

there are two classifications of markets ŌĆō the product market and the factor

market. The factor market refers to the market for the buying and selling of

factors of production like land, capital, labour, etc. The other classification

of markets are as follows,

1. On the

Basis of Geographic Location

Local Markets:

In such a market the buyers and sellers are limited to the local region or

area. They usually sell perishable goods of daily use since the transportation

of such goods can be expensive.

Regional Markets:

These markets cover a wider are than local markets like a district, or a

cluster of few smaller states

National Market:

This is when the demand for the goods is limited to one specific country. Or the

government may not allow the trade of such goods outside national boundaries.

International Market:

When the demand for the product is international and the goods are also traded

internationally in bulk quantities, we call it as an international market.

II. On

the Basis of Time

Very Short Period

Market: This is when the supply of the goods is fixed, and

so it cannot be changed instantaneously. Say for example the market for

flowers, vegetables. Fruits etc. The price of goods will depend on demand.

Short Period Market:

The market is slightly longer than the previous one. Here the supply can be

slightly adjusted. Example:

Long Period Market:

Here the supply can be changed easily by scaling production. So it can change

according to the demand of the market. So the market will determine its

equilibrium price in time. Example:

III. On

the Basis of Nature of Transaction

Spot Market: This is where spot transactions occur,

that is the money is paid immediately. There is no system of credit.

Future Market: This is where the transactions are

credit transactions. There is a promise to pay the consideration sometime in

the future.

IV. On the Basis of

Regulation

Regulated Market: In such a market there is

some oversight by appropriate government authorities. This is to ensure there

are no unfair trade practices in the market. Such markets may refer to a

product or even a group of products. For example, the stock market is a highly

regulated market.

Unregulated Market: This is an absolutely free market.

There is no oversight or regulation, the market forces decide everything.

Example:

V. On the basis of

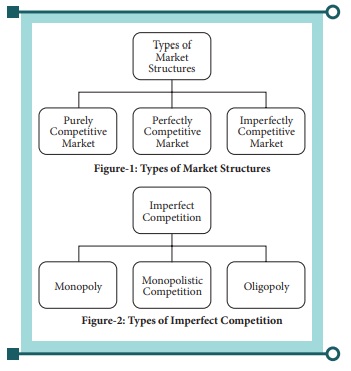

nature of competition

Monopoly:

Monopoly refers to a market

structure in which there is a single producer or seller that has a control on

the entire market. This single seller deals in the products that have no close

substitutes.

Monopolistic

Competition:

The term monopolistic competition

was given by Prof Edward H. Chamberlin of Harvard University in 1933 in his

book Theory of Monopolistic Competition. The term monopolistic competition

represents the combination of monopoly and perfect competition. Monopolistic

competition refers to a market situation in which there are a large number of

buyers and sellers of products. However, the product of each seller is

different in one aspect or the other.

Oligopoly:

The

term oligopoly has been derived from two Greek words, Oligoi means few and poly

means control. Therefore, oligopoly refers to a market form in which there are

few sellers dealing either in homogenous or differentiated products.

1. Who is

a Consumer?

A

Consumer is a person w ho purchases a product or avails a service for a

consideration, either for his personal use or to earn his livelihood by means

of self employment.

The

consideration may be:

Ō£ō Paid

Ō£ō Promised

Ō£ō Partly paid and partly

promised.

It

also includes a beneficiary of such goods/services when such use is made with

the approval of such person.

2. Who is

not a Consumer ?

A

person is not a consumer if he/she:

Ō£ō Purchases any goods or

avails any service free of charge;

Ō£ō Purchases a good or

hires a service for commercial purpose;

Ō£ō Avails any service

under contract of service.

What is Unfair Trade

Practice?

An

ŌĆ£unfair trade practiceŌĆØ means a trade practice, which, for the purpose of

promoting any sale, use or supply of any goods or services, adopts unfair

method, or unfair or deceptive practice. Some of these practices include:

*

False representation

*

When goods and services are not of stated standard, quality or grade;

*

When second hand, renovated goods are sold as new ones;

*

When goods and services do not have the claimed use, usefulness or benefit;

*

When products / services do not have the claimed warranty / guarantee;

*

When the price of product or service is misleading.

*

False and misleading advertisement of selling at bargain price.

*

Offering gifts, prizes, etc. to lure customers with no intention of providing

them.

*

Selling goods which do not fall within the safety standards set up by competent

authority.

*

Hoardings or destroying goods with the intention of raising the cost of these

or similar goods

manufactured

in greater number so as to manipulate higher prices.

*

Manufacturing or offering spurious goods or adopting deceptive practices in the

provision of services.

ŌĆ£Goods once sold will not be taken backŌĆØorŌĆ£No exchangeŌĆØ,or ŌĆ£No

refund under anycircumstancesŌĆØIt amounts to Unfair Trade Practice and does not

carry any legal weight.

Consumer protection

Consumer protection is a group of

laws enacted to protect the rights of consumers, fair trade, competition and

accurate information in the market place. The laws are designed to prevent the

businesses that engage in unfair practices from gaining an advantage over

competitors. They may also provide additional protection for those most

vulnerable in society. Consumer protection laws are a form of government

regulations that aim to protect the rights of consumers. For example, a

government may require businesses to disclose detailed informationaboutproductsŌĆöparticularlyinareas

where safety or public health is an issue, such as food.

Consumer protection is linked to the ideas of consumer rights and

to the formation of consumer organisations, which helps consumers make better

choices in themarketplace and get help with consumer complaints. Other

organisations that promote consumer protection include government organisations

and self-regulating business organisations.

Example:

Telecom Regulatory Authority of

India ŌĆō TRAI. Insurance Regulatory and Development Authority of India ŌĆō IRDAI.

The Eight

Basic Consumer Rights

1. The Right to Basic Needs.

2. The Right to Safety.

3. The Right to Information.

4. The Right to Choose.

5. The Right to Representation.

6. The Right to Redress.

7. The Right to Consumer Education.

8. The Right to a Healthy Environment.

The Consumer

Protection Act, 1986 (COPRA)

This Act enacted in 1986 in the

Parliament of India to protect the interests of consumers. It makes for the

establishment of consumer councils and other authorities for the settlement of

consumer's grievances and for matters connected there with it. The act was

passed in Assembly in October 1986 and came into force on December 24, 1986.

COPRA is regarded as the 'Magna

Carta' in the field of consumer protection for checking unfair trade practices,

ŌĆśdefects in goodsŌĆÖ and ŌĆśdeficiencies in servicesŌĆÖ as far as India is concerned.

It has led to the establishment of a widespread network of consumer forums and

appellate courts all over India. It has significantly impacted how businesses

approach consumer complaints and has empowered consumers to a great extent.

Consumer Protection Councils are

established at the national, state and district level to increase consumer

awareness. To increase the awareness of consumers, there are many consumer

organisations and NGOs that have been established.

Consumer Disputes

Redressal Agencies

National Consumer Disputes Redressal

Commission (NCDRC): Established by the Central Government. It deals with

matters of more than 10 million.

State Consumer Disputes Redressal

Commission (SCDRC): Also known as the "State Commission" established

by the State Government in the State. It is a state level court that takes up

cases valuing less than Ōé╣10 million.

District Consumer Disputes Redressal

Forum (DCDRF): Also known as the "District Forum" established by the

State Government in each district of the State. The State Governments may

establish more than one District

Forum in a district. It is a district level court that deals with cases valuing

up to Ōé╣2 million.

Consumer protection

Act of 2019

Indian Parliament, in August 2019,

passed the landmark Consumer Protection Bill, 2019 which aims to provide the

timely and effective administration and settlement of consumer disputes in this

Digital Age. The New Act will come into force on such date as the Central

Government may so notify. The New Act seeks to replace more than 3 (three)

decades old Consumer Protection Act, 1986 (Act).

Highlights of the New

Act:

1.

E-Commerce Transactions: The

New Act has widened the definition of 'consumer'. The definition now

includes any person who buys any goods, whether through offline or online

transactions, electronic means, teleshopping, direct selling or multi-level

marketing.

2.

Enhancement of Pecuniary Jurisdiction: Revised pecuniary limits have been fixed under the

New Act. Accordingly, the district forum can now entertain consumer complaints

where the value of goods or services paid does not exceed INR 10,000,000 (Indian

Rupees Ten Million). The State Commission can entertain disputes where such

value exceeds INR 10,000,000 (Indian Rupees Ten Million) but does not exceed

INR 100,000,000 (Indian Rupees One Hundred Million), and the National

Commission can exercise jurisdiction where such value exceeds INR 100,000,000

(INR One Hundred Million).

3.

E-Filing of complaints: The

New Act contains enabling provisions for consumers to file complaints

electronically and for hearing and/or examining parties through

video-conferencing.

4.

Establishment of Central Consumer Protection Authority: The New Act proposes the

establishment of a regulatory authority known as the Central Consumer

Protection Authority (CCPA), with wide powers of enforcement. The CCPA will

have an investigation wing, headed by a Director-General, which may conduct

inquiry or investigation into consumer law violations.

5.

Unfair Trade Practices: The

New Act introduces a specific broad definition of Unfair Trade

Practices, which also includes sharing of personal information given by the

consumer in confidence, unless such disclosure is made in accordance with the

provisions of any other law.

6. Penalties for Misleading

Advertisement: The

CCPA may impose a penalty of up to INR 1,000,000 on a manufacturer or an endorser,

for a false or misleading advertisement. The CCPA may also sentence them to

imprisonment for up to two years for the same. In case of a subsequent offence,

the fine may extend to INR 5,000,000 and imprisonment of up to five years. The

CCPA can also prohibit the endorser of a misleading advertisement from

endorsing that particular product or service for a period of up to one year.

For every subsequent offence, the period of prohibition may extend to three

years.

Consumer courts in

India

National Consumer Disputes Redressal

Commission (NCDRC): A

national level court works for the whole country and deals compensation

claimed exceeds rupees one core. The National Commission is the Apex body of

Consumer Courts; it is also the highest appellate

court in the hierarchy. The National Consumer Disputes redressal Commission

(NCDRC), is a quasi-judicial commission in India which was set up in 1988 under

the

Consumer Protection Act of 1986. Its

head office is in New Delhi. The commission is headed by a sitting or retired

judge of the Supreme Court of India.

State Consumer Disputes Redressal

Commission (SCDRC): A

state level court works at the state level with cases where compensation

claimed is above 20 lakhs but up to one core. The State Commission also has the

appellate jurisdiction over the District Forum.

District Consumer Disputes Redressal

Forum (DCDRF): A

district level court works at the district level with cases where the

compensation claimed is up to 20 lakhs.

Important Acts

Ō£ō The Consumer

Protection Act, 1986

Ō£ō The Legal Metrology

Act, 2009

Ō£ō The Bureau of Indian

Standards Act, 1986

Ō£ō The Essential

Commodities Act, 1955

Ō£ō The prevention of

Black Marketing and maintenance of supplies of essential

Ō£ō Commodities Act, 1980

Website of the Department: http:// consumeraffairs.nic.in

Website of the NDRC :http://ncdrc.nic.in/

State Commission :http://ncdrc.nic.in/ statelist.html

District Forums :http://ncdrc.nic.in/ districtlist.html

Wrap up

*

This is dummy text_ dummy text_ dummy text_ dummy text_ dummy text_ dummy text_

dummy text_ dummy text.

*

This is dummy text_ dummy text_ dummy text_ dummy text_ dummy text_ dummy text_

dummy text_ dummy text.

Glossary

1. Commodities trade

goods, supplies Ó«ĄÓ«┐Ó«»Ó«ŠÓ«¬Ó«ŠÓ«░Ó«¬Ó»Ź Ó«¬Ó«ŠÓ«░Ó»üÓ«│Ó»ŹÓ«ĢÓ«│

2. Prevalent very

common, frequent Ó«ÄÓ«ÖÓ»ŹÓ«ĢÓ»üÓ««Ó«┐Ó«░Ó»üÓ«ĢÓ»ŹÓ«ĢÓ»üÓ««Ó»Ź, Ó«ĄÓ«┤Ó«ĢÓ»ŹÓ«ĢÓ««Ó«ŠÓ«®

3. Cluster a grouping

of a number of similar things, bunch Ó«żÓ»ŖÓ«ĢÓ»üÓ«¬Ó»ŹÓ«¬Ó»üÓ«ĢÓ»Ź Ó«ĢÓ»üÓ«┤Ó»ü, Ó«żÓ«┐Ó«░Ó«│

4.Instantaneously immediately,

without hesitation Ó«ēÓ«¤Ó«®Ó«¤Ó«┐Ó«»Ó«ŠÓ«ĢÓ«Ģ, Ó«ĢÓ«ŻÓ«¬Ó»ŹÓ«¬Ó«¬Ó»ŖÓ«┤Ó»üÓ«żÓ«┐Ó«▓Ó»Ź

5. Spurious invalid,

fake Ó«¬Ó«ŠÓ«▓Ó«┐Ó«»Ó«ŠÓ«®, Ó«¬Ó«ŠÓ«»Ó»ŹÓ«»Ó«®

6. Vulnerable attacked

either physically or emotionally, helpless Ó«¬Ó«ŠÓ«żÓ«┐Ó«ĢÓ»ŹÓ«ĢÓ«¬Ó»ŹÓ«¬Ó«¤Ó«ĢÓ»ŹÓ«ĢÓ»éÓ«¤Ó«┐Ó«» Ó«åÓ«¬Ó«żÓ»ŹÓ«żÓ«®

7. Redress compensate,

remedy, rectify Ó«ĢÓ»üÓ«▒Ó»ł Ó«©Ó«┐Ó«ĄÓ«░Ó»ŹÓ«żÓ«żÓ«┐ Ó«ĢÓ»üÓ«▒Ó»ł Ó«żÓ»ĆÓ«░Ó»ŹÓ«ĢÓ»ŹÓ«ĢÓ»üÓ««Ó»Ź

8. Pecuniary relating

to money, financial Ó«¬Ó«¬Ó«ŠÓ«░Ó»üÓ«│ Ó«ÜÓ«ŠÓ«░Ó»ŹÓ«©Ó»Ź Ó«¬Ó«ŻÓ«ĄÓ«ĢÓ»łÓ«ĢÓ«»Ó«ŠÓ«®

Related Topics