Chapter: Automation, Production Systems, and Computer Integrated Manufacturing : Production Planning and Control Systems

Inventory Control

INVENTORY CONTROL

Inventory

control is concerned with achieving an appropriate compromise between two

opposing objectives: (I) minimizing the cost of holding inventory and (2)

maximizing service to. customers. On the one hand, minimizing inventory cost

suggests keeping inventory to a minimum. In the extreme, zero inventory On the

other hand, maximizing customer service Implies keeping large stocks on hand

from which the customer can choose and immediately lake possession.

The types

of Inventory of greatest interest in PPC arc raw materials, purchased components,

in-process inventory (WIP), and finished products. The major costs of holding

inventory are (1)

investment costs, (2) storage

costs, and (3) cost of possible obsolescence or spoilage. The three costs arc

referred to collectively as carrying

costs or holding costs: Investment

cost is usually the largest component; for example, when a company borrows

money at a high rate or interest

to invest in materials being processed in

the factory,

but the materials arc months away from being delivered to the customer.

Companies can minimize holding costs by minimizing the amount of inventory on

hand. However, when inventories are minimized, customer service may suffer.

inducing customers to take their business elsewhere. This also has a cost,

called the stock-out cost. Most

companies want 10 minimize stock-out cost and provide good customer service.

Thus. they are caught on the horns of an inventory control dilemma: balancing

carrying costs against the cost of poor customer service.

In our

introduction to MRP (Section 26.2), we distinguished between two types of

demand, independent and dependent. Different inventory control procedures are

used for in. dependent and dependent demand items. For dependent demand items,

MRP is the most widely implemented technique. For independent demand items,

order point inventory systems are commonly used.

Order Point Inventory Systems

Order

point systems are concerned with two related problems that must be solved when

managing inventories of independent demand items: (1) how many units should be

ordered? and (2) when should the order be placed? The first problem is often

solved using economic order quantity formulas. The second problem can be solved

using reorder point methods.

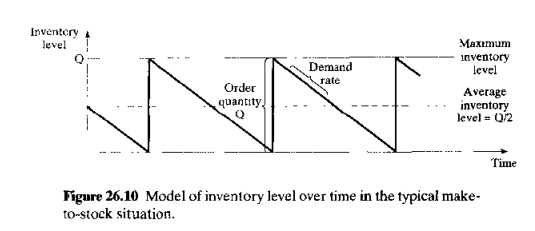

Economic

Order Quantitv Formula. The problem of deciding on the most appropriate

quantity to order or produce arises when the demand rate for the item is fairly

constant, and the rate at which the item is produced is significantly greater

than its demand rate. This is the typical make-to-stock

situation. The same basic problem occurs with dependent demand items when usage

of the item is relatively constant over time due to a steady production rate of

the final product with which the item is correlated. In this case, it may make

sense to endure some inventory holding costs so that the frequency of setups

and their associated costs can be reduced. In these situations where demand

rate remains steady, inventory is gradually depleted over time and then quickly

replenished to some maximum level determined by the order quantity. The sudden

increase and gradual reduction in inventory cause. the inventory level over

time to have a saw-tooth appearance, as depicted in Figure 26.10

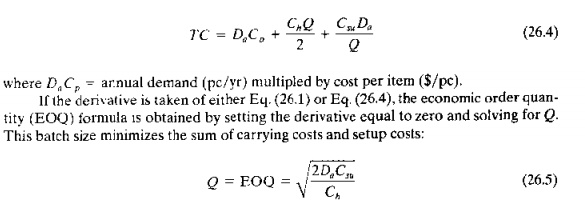

A total

cost equation can be derived for the sum of carrying cost and setup cost for

the inventory model in Figure 26.10. Because of the saw-tooth behavior of

inventory level, the average inventory level is one-half the maximum level Q in our

figure. The total annual inventory cost is therefore given by:

where TIC

== total annual inventory cost

(holding cost plus ordering cost, $/yr),Q = order

quantity (pc/order), Ch = carrying or holding cost ($/pc/yr), Csu = setup cost and/or or

during

cost for an order ($/setup or $/order), and D. = annual demand for the item

(pc/yr). In the equation, the ratio Da/Q

is the number of orders or batches produced per year. which therefore gives the

number of setups per year.

The

holding cost en consists of two main components, investment cost and storage

cost. Both are related to the time that the inventory spends in the warehouse

or factory. As previously indicated, the investment eo~1results from the money

the company must invest in the inventory before it is sold to customers. This

inventory investment cost can be calculated as the interest rate paid by the

company i (%/100), multiplied by the value

(cost) of the inventory.

Storage

cost occurs because the inventory takes up space that must be paid for. The

amount of the cost is generally related to the size of the part and how much

space it occupies. As an approximation, it can be related to the value or cost

of the item stored. For our purposes, this is the most convenient method of

valuating the storage cost of an item. By this method, the storage cost equals

the cost of the inventory multiplied by the storage rate, ,I'. The term s is the storage cost as a fraction (%/100)

of the

value of the item in inventory.

Combining

interest rate and storage rate into one factor, we have h = i + s. The term h is called the holding cost rate.

Like i and s, it is a fraction (%/100) that is multiplied by the cost

of the part to evaluate the holding cost of investing in and storing WIP. Accordingly, holding cost can be

expressed as follows

where Ch = holding (carrying) cost

($/pc/yr), Co = unit

cost of the item ($/pc). and h = holding cost rate (rate/yr).

Setup

cost includes the cost of idle production equipment during the changeover time

between batches. The costs of labor performing the setup changes might also be

added in. Thus,

where Csu = setup cost ($/setup or

$/order), Tsu = setup or changeover

time between batches, (hr /setup or hr/order),

and c(dt) = cost rate of machine downtime

during the changeover ($/hr). In cases where parts are ordered from an outside

vendor, the price quoted by the vendor usually includes a setup cost, either

directly or in the form of quantity discounts. Csu should also include the internal costs of placing the order to

the vendor.

Eq.

(26.1) excludes the actual annual cost of part production. If this cost is

included then annual total cost is given by the

following equation:

DaDp= arnual demand (pc/yr) multipled by cosst

per item (S/pc),

If the

derivative is taken of either Eq. (26.1) or Eq. (26.4), the economic order

quantity (EOQ) formula IS obtained by setting the derivative equal to zero and

solving for Q. This batch size minimizes the sum of carrying costs and setup

costs'

where EOQ

= economic order quantity (number of parts to be produced per batch,

pc/batch or pc/order]. and the other terms have been defined previously.

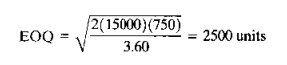

EXAMPLE 26.3 Economic Order Quantity Formula

The

annual demand for a certain item made-to-stock = 15,000

pc/yr. One unit of the item costs $20.00. and the holding cost rate = 18%/yr. Setup time to produce a

batch = 5 hr. The cost of equipment

downtime plus labor = $150/hr,

Determine the economic order quantity and the total inventory cost for this

case.

Solution: Setup

cost C,u = 5 x $150

= $750. Holding cost per unit = 0.18 x $20.00 = $3.60. Using these values and the annual demand rate in the EOQ

formula, we have

Total

inventory cost is given by the TIC equation:

TIC = 0,5(3.60)(2500) + 750(15,000/2500) = $9000

Including

the actual production costs in the annual

total, by Eq (26.4) we have:

TC = 15J)[)0(20) +

9000 = $309,000

The

economic order quantity formula has been widely used for determining so-called

optimum batch sizes in production. More sophisticated forms of Eqs, (40.1) and

(40.4) have appeared in the literature; for example, models that take

production rate into account to yield alternative EOQ equations [S]. Eq. 26.5

is the most general form and, in the author's opinion. quite adequate for most

real-life situations. The difficulty in applying the EOQ formula is in

obtaining accurate values of the parameters in the equation, namely(l) setup

cost and (2) inventory carrying costs. These cost factors are usually difficult

to evaluate; yet they have an important impact on the calculated economic batch

size.

There is

no disputing the mathematical accuracy of the EOQ equation. Given specific

values of annual demand (Da),setup cost (Csu).and

carrying Cost (e,,), Eq. (26.5) computes the lowest cost batch size to whatever level

of precision the user desires. The trouble is that the user may be lulled into

the false belief that no matter how much it CUS1~ to change the setup. the EOO

formula always calculates, the optimum batch size. For many years in U.S.

industry, this belief tended to encourage lung production runs by manufacturing

manager". The thought process went something like this: "If the setup

cost increases, we just increase the batch size. because the EOO formula always

tells us the optimum production quantity."

The user

of the EOQ equation must not lose sight of the total inventory cost ITIC)

equation. Eq. (26.1). from which EOQ is derived. Examining the TIC equation. a

cost conscious production manager would quickly conclude that both costs and

batch sizes can be reduced by decreasing the values of holding cost (ch) and

setup cost (Cus). The production manager may not be able to exert

much influence on holding cost because it is determined largely by prevailing

interest rates. However. methods can be developed to reduce setup cost by

reducing the time required to accomplish the changeover of a machine. Reducing setup times

is an important focus in just-in-time review the approaches for reducing setup

time in Section 26.7.2

Reorder

Point Systems. Determining the economic order quantity is nut the

only

problem

that must be solved in controlling inventories in make-to-stock situations, The

other

problem is deciding when to reorder. One of the most widely used methods is the

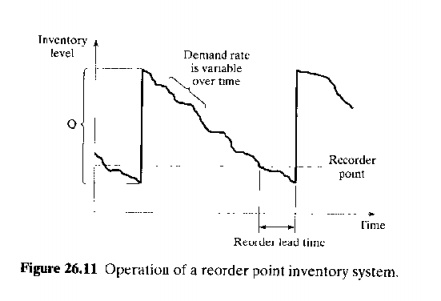

reorder point system. Although we have drawn the inventory level in Figure

26.10 as a very deterministic saw-tooth diagram, the reality is Ihat there are

usually variations in demand rate during the inventory order cycle. as

illustrated in Figure 26.11. Accordingly, the timing of when to reorder cannot

be predicted with the precision that would exist if demand rate were a known

constant value. In a reorder point

system. when the inventory level for a given stock item falls to some point

specified as the reorder point, then an order is placed to restock the item.

The reorder point is specified at a sufficient quantity level 10 minimize the

probability of a stock-out between when the reorder point is reached and the

new order is received. Reorder point triggers can be implemented using

computerized inventory control systems that continuously monitor the inventory

level as demand occurs and automatically generate an order for a new batch when

the level declines below the reorder point

Work-in-Process Inventory Costs

Work-in-process

(WIP) represents a significant inventory cost for many manufacturing firms. In

effect, the company is continually investing in raw materials, processing those

materials, and then delivering them to customers when processing has been

completed The problem is that processing takes time, and the company pays a

holding cost between start of production and receipt of payment from the

customer for goods delivered. In Chapter 2, we showed that WIP and

manufacturing lead time (MLT) are closely related. The longer the manufacturing

lead time, the greater the WIP. In this section, a method for evaluating the

cost of WIP and MLT is presented. The method is based on concepts suggested by

Meyer.

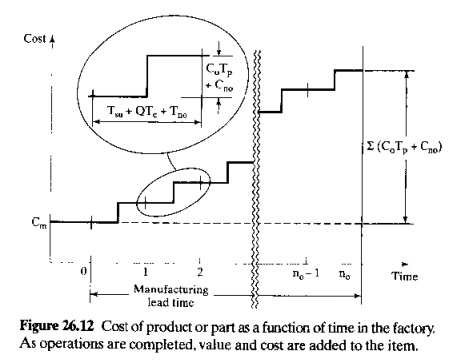

In

Chapter 2, we indicated that production typically consists of a series of

separate manufacturing steps or operations. Time is consumed in each operation,

and that time has an associated cost. There is also a time between each

operation (at least for most manufacturing situations) that we have referred to

as the non-operation time. The non-operation lime includes material handling,

inspection. and storage. There is also a cost associated with the non-operation

time. These times and costs for a given part can be graphically illustrated as

shown in Figure 26.12.At time t == 0, the cost of the part is simply its material cost em' The cost of each processing step

on the part is the production time multiplied by the rate for the machine and

labor. Production time Tp is

determined from Eq. (2.10) and accounts for both setup time and operation time.

Let us symbolize the fate as Co' Non-operation costs (c.g., inspection and

material handling) related to the processing step are symbolized by the term Cno

Accordingly, the cost associated with each processing step in the manufacturing

sequence is the sum

The cost

for each step is shown in Figure 26.12 as a vertical line, suggesting no time

lapse. This is a simplification in the graph, justified by the fact that the

time between operations

spent

waiting and in storage is generally much greater than the tune for processing, handling

and inspection

The total

cost that has been invested In the part

at the end of all operations is the sum of the material cost and the

accumulated processing, inspection, and handling costs. Syrnbolizing this part

cost as Cp' we can evaluate it using the

following equation:

where k is used to indicate the sequence of

operations, and there are a lotal of flo operations. For convenience. if

we assume that 1~ and Cooare equal for all n.,

operations, then

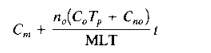

The part

cost function shown in Figure 26.12 and represented by Eq. (26.6) can be

approximated by a straight line as shown in Figure 26.13. The line starts at

lime t = 0 with a

value = em and slopes upward 10 the right so that its final value is the

same as the final part cost in Figure 26.12. The approximation becomes more

accurate as the number of processing steps increases. The equation for this

line is

where MLT = manufacturing lead

time for the part, and t =

time in Figure 26.13.

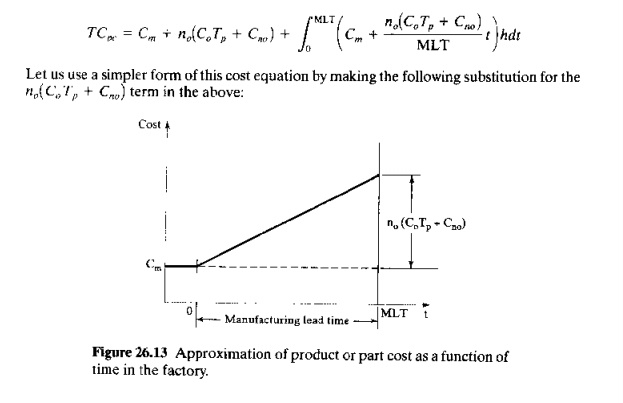

As in our

derivation of the economic order quantity formula, we apply the holding cost

rate h to the accumulated part cost

defined by Eq. (26.6), but substituting the straightline approximation in place

of the stepwise cost accumulation in Figure 26.12. In this way, we have an

equation for total cost per part that includes the WIP carrying costs:

Let us

use a simpler form of this cost equation by making the following substitution

for the no(CoTp+Cno) term in the

above:

EXAMPLE 26.4 Inventory Holding Cost for WIP During Manufacturing

The cost

of the raw material for a certain part is $100. The part is processed through

20 processing steps in the plant, and the manufacturing lead time is 15 wk. The

production time per processing step is 0.8 hr, and the machine and labor rate

is $25.00/hr. Inspection, material handling, and other related costs average to

$l1Oper processing step by the time the part is finished. The interest rate

used by the company i =20%, and the

storage rate s = 13%. Determine the cost per part

and the holding cost.

The $38.08

in our example is more than 5% of the

cost of the part; yet the holding cost is usually not included

directly in the company's evaluation

of part cost. Rather, it is considered as overhead.

Suppose that this is a typical part for the company, and 5000 similar parts are processed

through the plant each year; then

the annual inventory cost for WIP of 5000 parts = 5000

x $38.08 == $190,400. If the manufacturing lead time could be reduced to half its

current value, this would translate into a 50% savings in WIP holding

cost.

Related Topics