Chapter: 11th 12th std standard Indian Economy Economic status Higher secondary school College

Cost function, concepts and classifications

Cost

The term 'cost of production' means expenses incurred in the production of a commodity. This refers to the total amount of money spent on the production of a commodity. The determinants of cost of production are: the size of plant, the level of production, the nature of technology used, the quantity of inputs used, managerial and labour efficiency. Thus the cost of production of a commodity is the aggregate of prices paid for the factors of production used in producing a commodity.

Cost function

The cost function expresses a functional relationship between costs and output that determine it. Symbolically, the cost function is

C = f (Q)

where

C = Cost

Q = Output

Cost concepts and classifications

Money cost and Real cost

Money cost or nominal cost is the total money expenses incurred by a firm in producing a commodity.

It includes

1. Cost of raw materials

2. Wages and salaries of labour

4. Depreciation on machines, buildings and such other capital goods

5. Interest on capital

6. Other expenses like advertisement, insurance premium and taxes

7. Normal profit of the entrepreneur.

Real cost is a subjective concept. It expresses the pains and sacrifices involved in producing a commodity. The money paid for securing the factors of productions is money cost whereas the efforts and sacrifice made by the capitalists to save and invest, by the workers in foregoing leisure and by the landlords constitute real costs.

Opportunity Cost

The opportunity cost of any good is the next best alternative good that is sacrificed. For example a farmer who is producing wheat can produce potatoes with the same factors. Therefore the opportunity cost of a quintal of wheat is the amount of output of potatoes given up.

Accounting Cost and Economic cost

Accounting cost or explicit cost

Accounting costs or explicit costs are the payments made by the entrepreneur to the suppliers of various productive factors. The accounting costs are only those costs, which are directly paid out or accounted for by the producer i.e. wages to the labourers employed, prices for the raw materials purchased, fuel and power used, rent for the building hired for the production work, the rate of interest on the borrowed capital and the taxes paid.

Economic cost

The economic cost includes not only the explicit cost but also the implicit cost. The money rewards for the own services of the entrepreneur and the factors owned by himself and employed in production are known as implicit costs or imputed costs. The normal return on money capital invested by the entrepreneur, the wages or salary for his own services and rent of the land and buildings belonging to him and used in production constitute implicit cost. Thus Economic cost = Explicit cost + Implicit cost.

It may be pointed out that the firm will earn economic profits only if it is making revenue in excess of economic cost.

Economic profit = Total Revenue - Economic Costs.

Private cost and social cost

Private cost is the cost incurred by a firm for production. It includes both implicit costs and explicit costs.

Social costs are those costs, which are not borne by the producing firm but are incurred by others in society. For example, when an oil refinery discharges its waste in the river causing water pollution, such a pollution results in tremendous health hazards which involve costs to the society as a whole

Fixed cost and variable cost

Fixed cost and variable cost are helpful in understanding the behaviour of costs over different levels of output.

Meaning of Fixed and Variable factors and costs

Fixed and variable factors are with reference to short run production function.

Short run is a period of time over which certain factors of production cannot be changed, and such factors are called fixed factors. The costs incurred on fixed factors are called fixed costs. The factors whose quantity can be changed in the short run are variable factors, and the costs incurred on variable factors are called variable costs.

Fixed costs are those which are independent of output, that is, they do not change with changes in output. These costs are a 'fixed' amount, which must be incurred by a firm in the short run whether the output is small or large. E.g. contractual rent, interest on capital invested, salaries to the permanent staff, insurance premia and certain taxes.

Variable costs are those costs, which are incurred on the employment of variable factors of production whose amount can be altered in the short run. Thus the total variable costs change with the level of output. It rises when output expands and falls when output contracts. When output is nil, variable cost becomes zero. These costs include payments such as wages of labour employed, prices of raw materials, fuel and power used and the transport costs.

Total cost

Total cost is the sum of total fixed cost and total variable cost. TC = TFC + TVC where

TC = Total cost

TC = Total Fixed cost TVC = Total variable cost

It should be noted that total fixed cost is the same irrespective of the level of output. Therefore a change in total cost is influenced by the change in variable cost only.

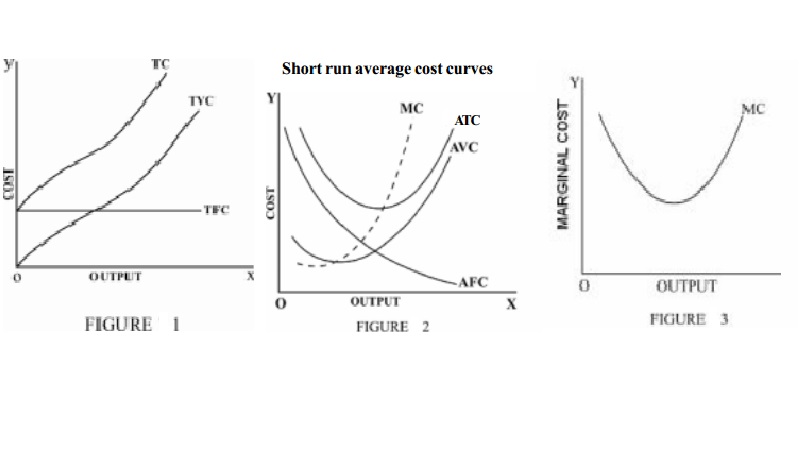

The relationship between total fixed cost, total variable cost and total cost will be clear from the Figure.

Short run average cost curves

Average Fixed Cost (AFC)

The average fixed cost is the fixed cost per unit of output. It is obtained by dividing the total fixed cost by the number of units of the commodity produced.

Symbolically AFC = TFC / Q

Where AFC = Average fixed Cost TFC = Total Fixed cost

Q = number of units of output produced

Suppose for a firm the total fixed cost is Rs 2000 when output is 100 units, AFC will be Rs 2000/100 = Rs 20 and when output is 200 units, AFC will be Rs 2000/200 = Rs10/- Since total fixed cost is a constant quantity, average fixed cost will steadily fall as output increases; when output becomes very large, average fixed cost approaches zero.

Average Variable cost (AVC): Average variable cost is the variable cost per unit of output. It is the total variable cost divided by the number of units of output produced.

AVC = TVC / Q

Where AVC = Average Variable Cost

TVC = Total Variable Cost

Q = number of units of output produced

Average variable cost curve is 'U' Shaped. As the output increases, the AVC will fall upto normal capacity output due to the operation of increasing returns. But beyond the normal capacity output, the AVC will rise due to the operation of diminishing returns.

Average Total Cost or Average Cost : Average total cost is simply called average cost which is the total cost divided by the number of units of output produced.

AC = TC / Q where AC = Average Cost TC = Total Cost

Q = number of units of output produced

Average cost is the sum of average fixed cost and average variable cost. i.e. AC = AFC+AVC

Table Calculation of Average Fixed, Average variable and Average Total Cost

Units of TFC TVC TC AFC AVC AC

output 2 � 1 3 � 1 5 + 6

1 2 3 4 5 6 7

0 120 0 120 - 0 -

1 120 100 220 120 100 220

2 120 160 280 60 80 140

3 120 210 330 40 70 110

4 120 240 360 30 60 90

5 120 400 520 24 80 104

6 120 540 660 20 90 110

7 120 700 820 17.14 100 117.14

8 120 880 1000 15 110 125

The average cost is also known as the unit cost since it is the cost per unit of output produced. The following figure shows the shape of AFC, AVC and ATC in the short period.

From the figure , it can be understood that the behaviour of the average total cost curve depends on the behaviour of AFC and AVC curves. In the beginning, both AFC and AVC fall. So ATC curve falls. When AVC curve begins rising, AFC curve falls steeply ie fall in AFC is more than the rise in AVC. So ATC curve continues to fall. But as output increases further, there is a sharp increase in AVC, which is more than the fall in AFC. Hence ATC curve rises after a point. The ATC curve like AVC curve falls first, reaches the minimum value and then rises. Hence it has taken a U shape.

Marginal Cost

Marginal cost is defined as the addition made to the total cost by the production of one additional unit of output.

Table Computation of marginal cost

Output (units) Total cost (Rs) Marginal Cost (Rs)

0 200 -

1 300 100

2 390 90

3 470 80

4 570 100

5 690 120

6 820 130

7 955 135

8 1100 145

For example, when a firm produces 100 units of output, the marginal cost would be equal to the total cost of producing 100 units minus the total cost of producing 99 units. Suppose the total cost of producing 99 units is Rs 9000 and the total cost of producing 100 units is Rs 10,000 then the marginal cost will be Rs10, 000 - Rs 9,000 = Rs 1,000. The firm has incurred a sum of Rs 1,000 in the production of one more unit of the commodity. Symbolically

MCn = TCn - TCn-1 where

MCn = Marginal cost

TC n = Total cost of producing n units

TC n-1 = Total cost of producing n-1 units

The marginal cost curve is given below

The marginal cost curve is 'U' shaped. The shape of the cost curve is determined by the law of variable proportions. If increasing returns (economies of scale)is in operation, the marginal cost curve will be declining, as the cost will be decreasing with the increase in output. When the diminishing returns (diseconomies of scale) are in operation, the MC curve will be increasing as it is the situation of increasing cost.

Related Topics