Chapter: Pharmaceutical Biotechnology: Fundamentals and Applications : Economic Considerations in Medical Biotechnology

The Value of a New Medical Technology

THE VALUE OF A NEW MEDICAL TECHNOLOGY

The task of determining the value of a new agent should fall somewhere

within the purview of the marketing function of a firm. Although some

compa-nies have established health care economic capabil-ities within the

clinical research structure of their organizations, it is essential that the

group that addresses the value of a new product does so from the perspective of

the market and not of the company or the research team. This is important for

two reasons. First, evaluating the product candidate from the perspective of

the user, and not from the team that is developing it, can minimize the bias

that is inherent in evaluating one’s own creations. Second, and most

importantly, a market focus will move the evaluation away from the technical

and scientifically interesting aspects of the product under evaluation and

toward the real utility the product might bring to the medical care

marketplace. Although the scientific, or purely clinical, aspects of a new

product should not be discounted, when the time comes to measure the economic contribution

of a new agent, those devel-oping the new agent must move past these

considera-tions. It is the tangible effects that a new treatment will have on

the patient and the health care system that determine its value, not the

technology support-ing it. The phrase to keep in mind is “value in use.”

The importance of a marketing focus when evaluating the economic effects

of a new agent, or product candidate, cannot be overstated. Failing to consider

the product’s value in use can result in overly optimistic expectations of

sales performance and market acceptance. Marketing is often defined as the

process of identifying and filling the needs of the market. If this is the

case, then the developers of new pharmaceutical technologies must ask two

questions: “What does the market need?” and “What does the market want?”

Analysis of the pharmaceutical market in the first decade of the twenty first

century will show that the market needs and wants:

n Lower costs

n Controllable costs n Predictable cost

n Improved outcomes

Note that this list does not include new therapeutic agents. From the

perspective of many payers, authorities, clinicians, and buyers, a new agent,

in and of itself, is a problem. The effort required to evaluate a new agent and

prepare recommendations to adopt or reject it takes time away from other

efforts. For many in the health care delivery system a new drug means more

work—not that they are opposed to innovation, but newness in and of itself,

regardless of the technology behind it, has no intrinsic value. The value of

new technologies is in their efficiency, their ability to render results that

are not available through other methods or at costs significantly lower than

other interventions. Documenting and understanding the economic effects of new

technologies on the various health care systems helps the firm to allocate its

resources more appropriately, accelerate the adoption of new tech-nologies into

the health care system, and reap the financial rewards of its innovation.

There are many different aspects of the term “value,” depending upon the

perspective of the individual or group evaluating a new product and the needs

that are met by the product itself. When developing new medical technologies,

it is useful to look to the market to determine the aspects of a product that

could create and capture the greatest amount of value. Two products that have

entered the market in recent years provide good examples of the different ways

in which value is assessed.

Activase [tissue plasminogen activator (tPA)] from Genentech, one of the

first biotechnology entrants in health care, entered the market priced at

nearly ten times the price level of streptokinase, its nearest competitor. This

product, which is used solely in the hospital setting, significantly increased

the cost of medical treatment of patients suffering myocardial infarctions. But

the problems associated with strepto-kinase and the great urgency of need for

treatments for acute infarctions were such that many cardiolo-gists believed

that any product that proved useful in this area would be worth the added cost.

The hospitals, which in the United States are reimbursed on a capitated basis

for the bulk of such procedures, were essentially forced to subsidize the use

of the agent, as they were unable to pass the added cost of tPA to many of

their patients’ insurers. The pricing of the product created a significant

controversy, but the sales of Activase and its successors have been growing

consistently since its launch. The key driver of value for tPA has been, and

continues to be, the urgency of the underlying condition. The ability of the

product to reduce the rate of immediate mortality is what drives its value.

Once the product became a standard of care, incidentally, reimbursement rates

were increased to accommodate it, making its economic value positive to

hospitals.

A product that delivered a different type of value is the

colony-stimulating factor from Amgen (G-CSF, Neupogen ). Neupogen was priced

well below its economic value. The product’s primary benefit is in the

reduction of serious infections in cancer patients, who often suffer

significant decreases in white blood cells due to chemotherapy. By bolstering

the white count, Neupogen allows oncol-ogists to use more efficacious doses of

cytotoxic oncology agents while decreasing the rate of infection and subsequent

hospitalization for cancer patients. It has been estimated that the use of

Neupogen reduces the expected cost of treating infections by roughly $6,000 per

cancer patient per course of therapy. At a price of roughly $1400 per course of

therapy, Neupogen not only provides better clinical care but also offers

savings of approximately $4600 per patient. The economic benefits of the

product have helped it to gain use rapidly with significantly fewer

restrictions than products such as tPA, whose economic value is not as readily

apparent.

These two very successful products provide clear clinical benefits, but

their sources of value are quite different. The value of a new product may come

from several sources, depending on the needs of clinicians and their

perceptions of the situations in which they treat patients. Some current

treatments bring risk, either because of the uncertainty of their effects on

the patient (positive or negative) or because of the effort or cost required to

use or understand the treatments. A new product that reduces this risk will be

perceived as bringing new value to the market. In such cases, the new product

removes or reduces some negative aspects of treatment. Neupogen, by reducing

the chance of infection and reducing the average cost of treatment, brought new

value to the marketplace in this manner.

Value can come from the enhancement of the positive aspects of treatment

as well. A product that has a higher rate of efficacy than current therapies is

the most obvious example of such a case. But any product that provides benefits

in an area of critical need, where few or no current treatments are available,

will be seen as providing immediate value. This was, and remains, the case for

tPA.

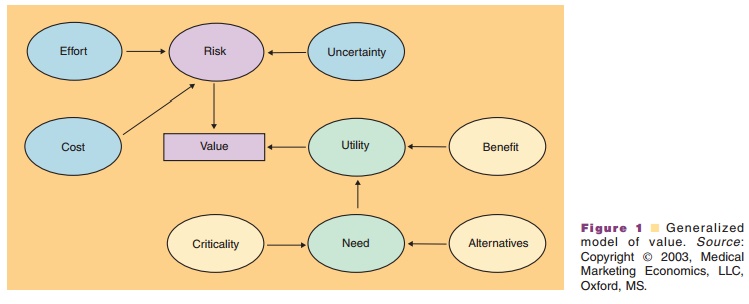

Any new product under development should be evaluated with these aspects

of value in mind. A generalized model of value, presented in Figure 1, can be

used to determine the areas of greatest need in the marketplace for a new agent

and to provide guidance in product development. By talking with clinicians,

patients, and others involved in current treatments and keeping this model in

mind, the shortcomings of those current approaches can be evaluated and the

sources of new incremental value can be determined.

Understanding the source of the value brought to the market by a new

product is crucial to the development of the eventual marketing strategy. Using

Figure 1 as a guide, the potential sources of value can be determined for a

product candidate and appropriate studies, both clinical and economic, can be

designed to measure and demonstrate that value.

Related Topics