Chapter: Business Science : Merchant Banking and Financial Services : Leasing

Hire Purchase

HIRE PURCHASE

According to the Hire Purchase Act of

1972, the term hire purchase is defined as, an agreement under which goods are

let on hire and under which the hirer has an option to purchase them in

accordance with the terms of the agreement, and includes an agreement under

which a. Possession of goods is delivered by the owner thereof to a person on

the condition that such person pays the agreed amount in periodic payments b.

The property of the goods is to pass to such a person on the payment of the

last of such installment c. Such a person has a right to terminate the

agreement any time before the companies are controlled by the Hire Purchase

Act, 1972. A Hire purchase transaction has two elements, Bailment which is

governed by the Indian Contract Act, 1872 and Sale under the Sale of Goods Act,

1930.

1 Hire Purchase Agreement

A Hire Purchase

Agreement is an agreement between the seller and the buyer, where the ownership

of goods does not pass to the buyer until he pays the last installment. There

are two parties to the hire purchase agreement. The hire vendor, who is the

seller and other, is the hire purchaser, the buyer. The purchaser has to make a

down payment of 20 to 25% of the cost and the remaining amount has to be paid

in equal monthly installments. In the case of a Deposit linked plan, the hire

purchaser has to invest a fixed amount as fixed deposits in the finance company

which is returned together with interest after the payment of the last

installment.

Parties to the Hire Purchase Contract:

There

are two parties in a hire purchase contract 1. The intending seller 2.

The intending

purchaser or the hirer.

Tripartite agreement 1.

Seller 2. Financier 3. Hirer/Purchaser

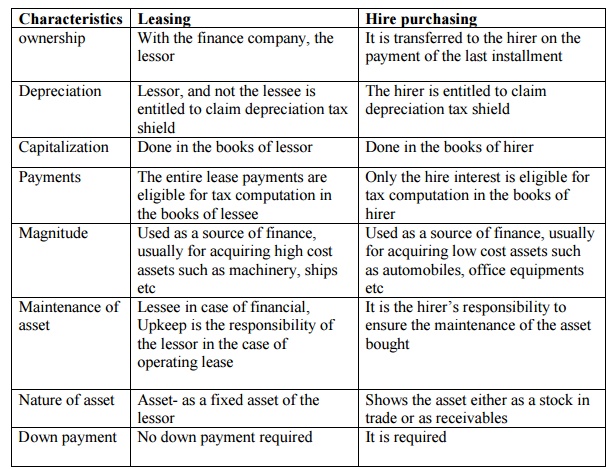

Difference between Hire Purchase and

Leasing:

Characteristics

Ownership:

Leasing: With the finance company, the lessor

Hire purchasing: It is transferred to the hirer on

the payment of the last installment

Depreciation:

Leasing: Lessor, and not the lessee is entitled to claim depreciation tax shield

Hire purchasing: The hirer is entitled to claim

depreciation tax shield

Capitalization

Leasing: Done in the books of lessor

Hire purchasing: Done in the books of hirer

Payments

Leasing: The entire lease payments are eligible for

tax computation in the books of lessee

Hire purchasing: Only the hire interest is eligible

for tax computation in the books of hirer

Magnitude

Leasing: Used as a source of finance, usually for

acquiring high cost assets such as machinery, ships etc

Hire purchasing: Used as a source of finance,

usually for acquiring low cost assets such as automobiles, office equipments

etc

Maintenance

of asset

Leasing: Lessee in case of financial, Upkeep is the

responsibility of the lessor in the case of operating lease

Hire purchasing: It is the hirer‘s responsibility to

ensure the maintenance of the asset bought

Nature

of asset

Leasing: Asset- as a fixed asset of the lessor

Hire purchasing:

Shows the asset either as a stock in trade or as receivables

Down

payment

Leasing: No down payment required

Hire purchasing: It is required

Financial Evaluation:

It is an evaluation by

the hirer of the desirability for lease and hire purchase. The hirer makes

decision based on the Present Value of Net Cash Outflow. The decision is

considered favorable when the PV of Net Cash Outflow under Hire Purchase is

less than the PV of Net cash Outflow under leasing. Following are the steps

involved.

Step 1 Calculate

annual interest amount

Step 2 Find

the principal amount outstanding at the beginning of the each year = Total outstanding

principal –principal paid in the previous year.

Step 3 Find

principal paid in the previous year = Annual installment amount –Annual

Interest

Step 4 Find

Annual ITS = Annual Interest x Tax rate

Step 5 Find

Annual Depreciation

Step 6 Find

Annual DTS = Annual depreciation x Tax rate

Step 7 Find

Total TS = Step 4 + Step 6

Step 8 Find

Annual installment amount = Total HP amount + (HP amount x flat rate of

interest) / No. of HP years

Step 9 Find

PV of salvage value of assets = SV x PVF

Step 10 Find

Net Cash Outflow of HP = Step 8 –Step 7

HIRE PURCHASE LEASING

1. It

is a tripartite agreement, involving the seller, finance company and the

purchaser/hirer

2. Depreciation

is claimed by the purchaser/hirer

3.

The agreement is entered for the

transfer of ownership after a fixed period. 1. It is a bipartite agreement

involving lessor and lessee. 2. Depreciation is claimed by the lessor in the

lease agreement. 3. In finance lease the ownership will get transferred. While

in operating lease, the ownership is not transferred.

Step 11 Find

PV of net cash outflow of HP at the appropriate discount rate.

Step 12 Find

Total PV net cash outflow of HP = Step 11 –Step 9.

Step 13 Find

Tax shield on annual ease rentals = Annual Lease rental x Tax rate.

Step 14 Find

Net cash outflow of Leasing = Annual lease rental –Step 13.

Step 15 Find

Total PV of net cash outflow of Leasing at the approp. Discount rate = Net cash

outflow of Leasing x PVAF.

Step 16 Make

a decision: HP is desirable if total PV of net cash flow of HP is Less than

that of leasing.

Related Topics