Financial Mathematics - Types of annuities | 11th Business Mathematics and Statistics(EMS) : Chapter 7 : Financial Mathematics

Chapter: 11th Business Mathematics and Statistics(EMS) : Chapter 7 : Financial Mathematics

Types of annuities

Types of annuities

a) Based on the number of periods:

(i) Certain annuity: An annuity payable

for a fixed number of years is called certain annuity.

Installments of payment for a

plot of land, Bank security deposits, purchase of domestic durables are

examples of certain annuity. Here the buyer knows the specified dates on which

installments are to be made.

(ii) Annuity contingent: An annuity payable at regular interval of time till the happening of a

specific event or the date of which cannot be accurately foretold is called

annuity contingent.

For example the endowment funds

of trust, where the interest earned is used for welfare activities only. The

principal remains the same and activity continues forever.

All the above types of annuities

are based on the number of their periods. An annuity can also be classified on

the basis of mode of payment as under.

b) Based on the mode of payment :

(i) Ordinary annuity: An annuity in which

payments of installments are made at the end of each period is called ordinary

annuity (or immediate annuity)

For

example repayment of housing loan, vehicle loan etc.,

ii) Annuity due: An annuity in which

payments of installments are made in the beginning of each period is

called annuity due.

In annuity due every payment is

an investment and earns interest. Next payment will earn interest for one

period less and so on, the last payment will earn interest of one period.

For

example saving schemes, life insurance payments,

etc.,

The derivation of

the following formulae are given for better understanding and are exempted from

examination

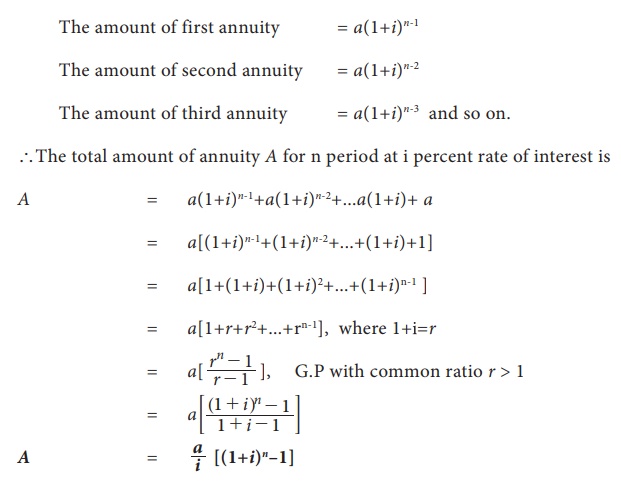

(i) Amount of immediate annuity (or) Ordinary annuity (or) Certain annuity

Let ‘a’ be the ordinary annuity and i

percent be the rate of interest per period. In ordinary annuity, the first

installment is paid after the end of first period. Therefore it earns interest

for (n – 1) period, second

installment earns interest for (n –

2) periods and so on. The last installment earns for (n – n) periods. (i.e)

earns no interest.

For (n–1) periods,

The amount of first annuity = a(1+i) n-1

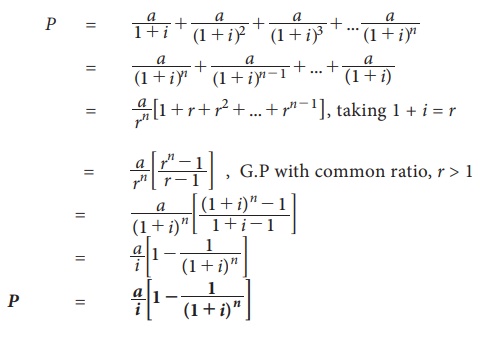

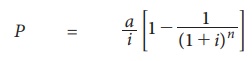

(ii) Present Value of immediate annuity (or ordinary annuity)

Let ‘a’ be the annual payment of an ordinary annuity, n be the number of years and i percent be the interest on one rupee

per year and P be the present value

of the annuity. In the case of

immediate annuity, payments are made periodically at the end of specified period. Since the first installment is paid

at the end of first year, its present value is a / 1+i , the present value of

second installment is a / (1+i)2 and so on. If the present value of

last installment is a / (1+i)n , then we have

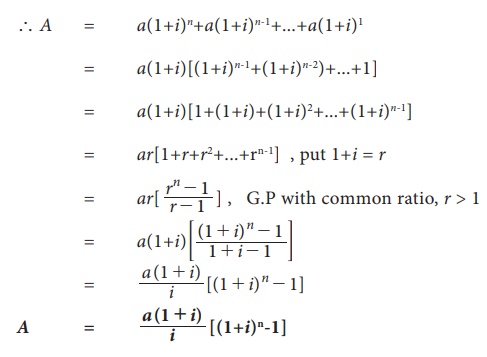

(iii) Amount of annuity due at the end of n period

Annuity due is an annuity in

which the payments are made at the beginning of each payment period. The first

installment will earn interest for n

periods at the rate of ‘i’ percent

per period. Similarly second installment will earn interest for (n – 1) periods, and so on the last

interest for on period.

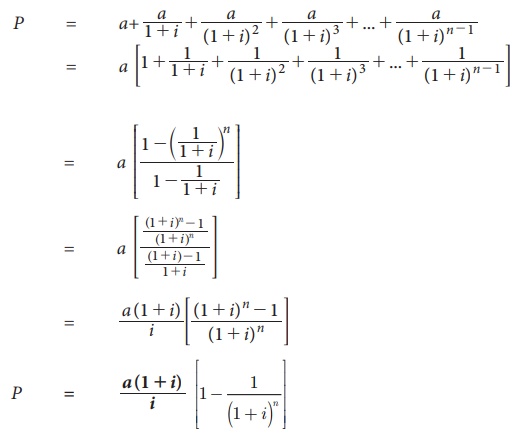

(iv) Present value of annuity due

Since the first installment is

paid at the beginning of the first period (year), its present value will be the

same as ‘a’, the annual payment of

annuity due. The second installment is paid in the beginning of the second

year, hence its present value is given a / (1+ i) and so on. The last

installment is paid in the beginning of nth year, hence its present value is

given as a / (1+ i)n-1

If P denotes the present value of annuity due, then

(v) Perpetual

Annuity

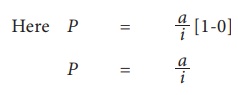

Perpetual annuity is an annuity

whose payment continuous for ever. As such the amount of perpetuity is

undefined as the amount increases without any limit as time passes on. We know

that the present value P of immediate

annuity is given by

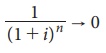

Now as per the definition of

perpetual annuity as n → ∞, we know

that  since 1+i > 1.

since 1+i > 1.

NOTE

In all the above

formulae the period is of one year. Now if the payment is made more than once

in a year then ‘i’ is replaced by i/k and n is replaced by nk,

where k is the number of payments in

a year.

Related Topics