Computation of ratios | Accountancy - Turnover ratios | 12th Accountancy : Chapter 9 : Ratio Analysis

Chapter: 12th Accountancy : Chapter 9 : Ratio Analysis

Turnover ratios

Turnover ratios

Turnover ratios show how

efficiently assets or other items have been used to generate revenue from

operations. They are also called as activity ratios or efficiency ratios. They

show the speed of movement of various items. They are expressed as number of

times in relation to the item compared.

The important turnover

ratios are:

i.

Inventory turnover ratio

ii.

Trade receivables turnover ratio

iii.

Trade payables turnover ratio

iv.

Fixed assets turnover ratio

(i) Inventory turnover ratio

It indicates the number

of times inventory is turned over to make revenue from operations (sales)

during a particular accounting period. It is a comparison of cost of revenue

from operations (cost of goods sold) with average amount of inventory during a

given period. It is calculated as under:

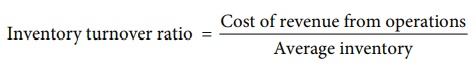

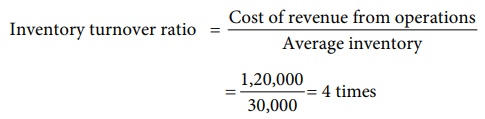

Inventory turnover ratio

= Cost of revenue from operations / Average inventory

Cost of revenue from

operations = Purchases of stock in

trade + Changes in inventories of finished goods + Direct expenses

(or)

= Revenue from

operations – Gross profit

Tutorial note

Revenue from operations

is the net sales.

Changes in inventory =

Opening inventory – Closing inventory

Direct expenses = Wages

+ Carriage inwards + Freight inwards + Dock charges + Octroi + Import duty +

Coal, gas, fuel and power + Other direct expenses

Average inventory = [

Opening inventory + Closing inventory ] / 2

Cost of revenue from

operations is taken because the inventory is always valued at cost except when

net realisable value is lower than cost, it is valued at net realisable value.

Greater the inventory turnover ratio, greater is the efficiency in the movement

of stock. However, high inventory turnover ratio may also be due to

insufficient inventory, buying in small quantities, etc. Similarly, a low

inventory turnover ratio may be due to inclusion of obsolete items in

inventory, etc. Hence, inventory turnover ratio must be analysed together with

the related items.

Tutorial note

In the absence of

opening inventory, closing inventory can be taken instead of average inventory.

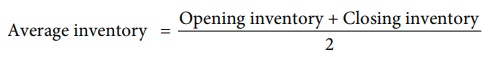

Inventory conversion period

Inventory conversion

period is the time taken to sell the inventory. A shorter inventory conversion

period indicates more efficiency in the management of inventory. It is computed

as follows:

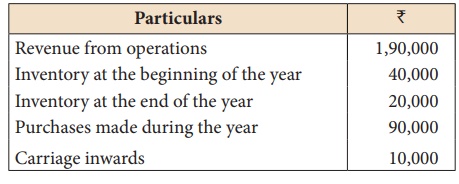

Inventory conversion period (in days) = Number of days in a year /

Inventory turnover ratio

Inventory conversion period (in months) = Number of months in a year / Inventory turnover ratio

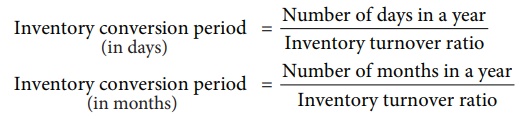

Illustration 8

From the given

information calculate the inventory turnover ratio and inventory conversion

period (in months) of Sania Ltd.

Solution

Cost of revenue from operations

= Opening inventory + Net Purchases + Direct expenses (carriage inwards) – Closing inventory

= 40,000 + 90,000 + 10,000 – 20,000

= ₹ 1,20,000

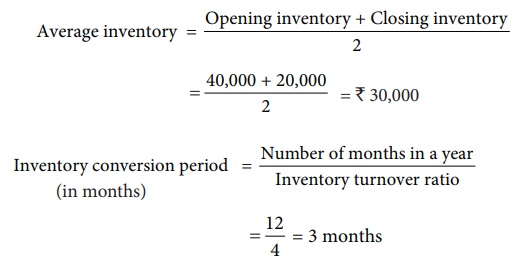

(ii) Trade receivables turnover ratio

Trade receivables

turnover ratio is the comparison of credit revenue from operations with average

trade receivables during an accounting period. It gives the velocity of collection

of cash from trade receivables. It is calculated as follows:

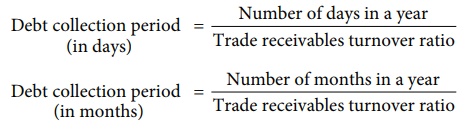

Trade receivables

turnover ratio = Credit revenue from operations / Average trade receivables

Average trade

receivables = [ Opening trade receivables + Closing trade receivables ] / 2

Trade receivables = Trade debtors + Bills receivable

Credit revenue from

operations (net credit sales) is taken for trade receivables turnover ratio as

trade receivables arise only from credit sales. Greater the trade receivables

turnover ratio, greater is the efficiency of management in collection of

receivables.

Tutorial note

In the absence of

opening trade receivables, closing trade receivables can be taken instead of

average trade receivables to calculate the ratio.

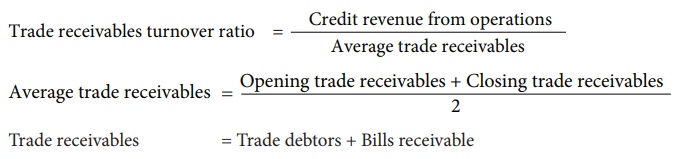

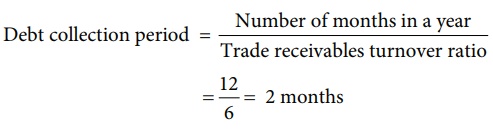

Debt collection period

Debt collection period

is the average time taken to collect the amount due from trade receivables.

Lesser the debt collection period, greater is the efficiency of management in

collection of cash from trade receivables. It is calculated as follows:

Debt collection

period (in days) = Number of days in a

year / Trade receivables turnover ratio

Debt collection

period (in months) = Number of months in

a year / Trade receivables turnover ratio

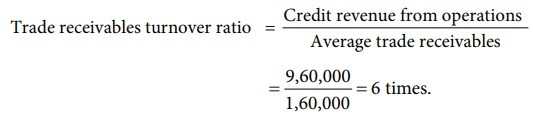

Illustration 9

The credit revenue from

operations of Harini Ltd. amounted to ₹

9,60,000. Its debtors and bills receivable at the end of the accounting period

amounted to ₹ 1,00,000 and ₹ 60,000 respectively.

Calculate trade receivable turnover ratio and also collection period in months

Solution

Trade receivables

turnover ratio = Credit revenue from operations / Average trade receivables

= 9,60,000 / 1,60,000 =

6 times.

Trade receivables = Debtors + Bills receivable = 1,00,000 + 60,000 = ₹ 1,60,000

Tutorial note

Closing trade receivables

are taken instead of average trade receivables as the opening trade receivables

are not given.

Debt collection period

= Number of months in a year / Trade receivables turnover ratio

= 12/6 = 2 months

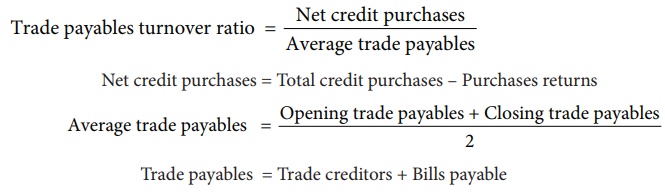

(iii) Trade payables turnover ratio

Trade payables turnover

ratio is the comparison of net credit purchases with average trade paybles

during an accounting period. It gives the velocity of payment of cash towards

trade payables. It is calculated as follows:

Trade payables

turnover ratio = Net credit purchases / Average trade payables

Net credit purchases =

Total credit purchases – Purchases returns

Average trade payables

= [ Opening trade payables + Closing trade payables ] / 2

Trade payables = Trade

creditors + Bills payable

Greater the trade

payable turnover ratio, better is the efficiency of the management in managing

trade payable as it indicates that amount due to suppliers are settled quicker.

Tutorial note

In the absence of

opening trade payables, closing trade payables can be taken instead of average

trade payables.

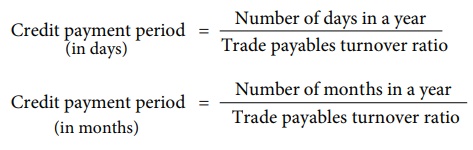

Credit payment period

It is the average time

taken by the business for payment of accounts payable. Lesser the credit

payment period, greater is the efficiency of the management in managing

accounts payable as it indicates quicker settlement of trade payables. It is

calculated as follows:

Credit payment

period (in days) = Number of days in a

year / Trade payables turnover ratio

Credit payment

period (in months) = Number of months in

a year / Trade payables turnover ratio

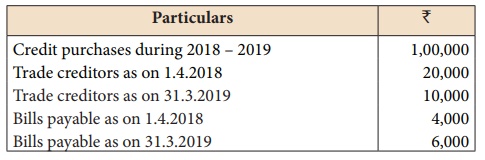

Illustration 10

From the following

figures obtained from Kalpana Ltd, calculate the trade payables turnover ratio

and credit payment period (in days).

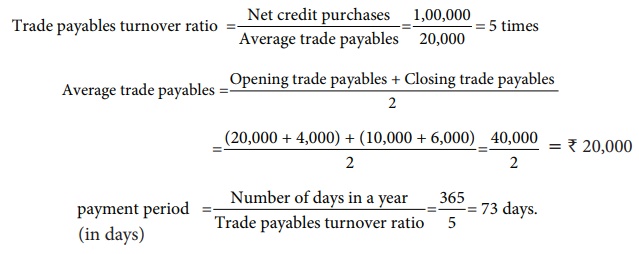

Solution

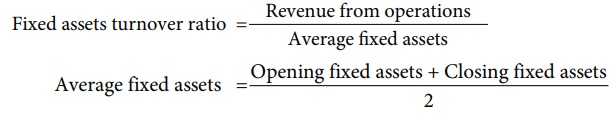

(iv) Fixed assets turnover ratio

Fixed assets turnover

ratio gives the number of times the fixed assets are turned over during the

year in relation to the revenue from operations. This ratio indicates the

efficiency of utilisation of fixed assets.

Fixed assets turnover

ratio = Revenue from operations /

Average Fixed assets

Average fixed assets =

[ Opening fixed assets + Closing fixed assets ] / 2

Greater the fixed assets turnover

ratio better is the efficiency of management in utilisation of fixed assets.

Tutorial note

In the absence of

opening fixed assets, closing fixed assets can be taken instead of average

fixed assets.

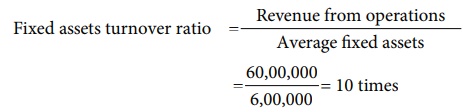

Illustration 11

From the following

information of Ashika Ltd., calculate fixed assets turnover ratio:

i.

Revenue from operations during the year were ₹ 60,00,000.

ii.

Fixed assets at the end of the year was ₹ 6,00,000.

Solution

Fixed assets turnover

ratio = Revenue from operations / Average Fixed assets = 60,00,000 /6,00,000 =

10 times

Tutorial note

As opening fixed assets

are not given, fixed assets at the end are taken instead of average fixed

assets.

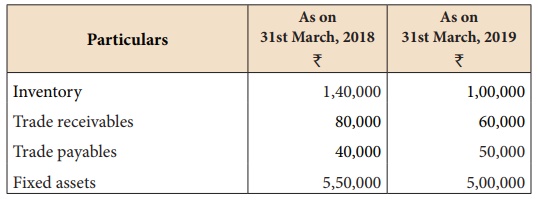

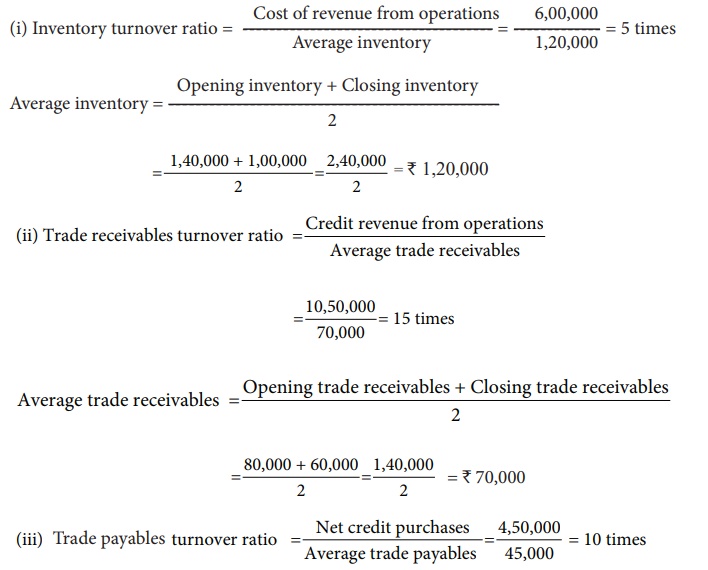

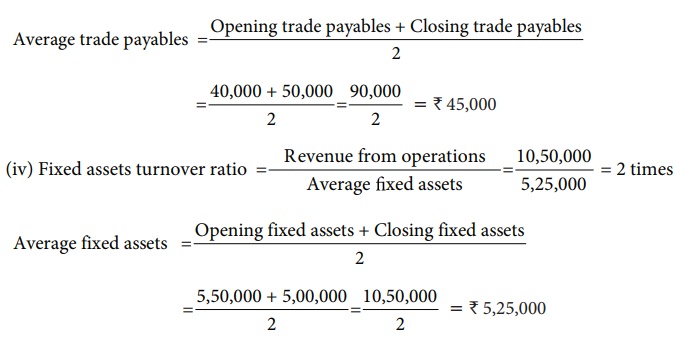

Illustration 12

Calculate (i) Inventory

turnover ratio (ii) Trade receivable turnover ratio (iii) Trade payable

turnover ratio and (iv) Fixed assets turnover ratio from the following

information obtained from Delphi Ltd.

Additional information:

(i) Revenue from operations for the year ₹ 10,50,000

(ii) Purchases for the year ₹ 4,50,000

(iii) Cost of revenue

from operations ₹

6,00,000.

Assume that sales and

purchases are for credit.

Solution

Related Topics