Economics - Theories of Interest | 11th Economics : Chapter 6 : Distribution Analysis

Chapter: 11th Economics : Chapter 6 : Distribution Analysis

Theories of Interest

Theories

of Interest

1. Abstinence Theory or Waiting Theory

This

theory was propounded by N.W.Senior. To him, interest is the reward for abstaining

from the immediate consumption of wealth. According to Senior, capital is the

result of saving. But saving involves “abstinence”

or “sacrifice”. It is possible to save only if one abstains from present

consumption. Such abstinence from present consumption involves some suffering.

Hence, it is necessary to reward the saver (capitalist) to compensate for the

sacrifice he has to undergo by abstaining from present consumption. Therefore,

interest is the reward or compensation paid to the saver (capitalist) for his

“abstinence” or “sacrifice”.

Marshall

accepted the Abstinence Theory of interest. But he used the word ‘waiting’

instead of “abstinence”. Saving implies waiting. According to him, interest is

the reward for waiting. Saving involves waiting. But people do not like to

wait. So, in order to make them wait and in turn to save, we have to pay them

some reward. Therefore, interest is the reward paid to the saver (capitalist)

for his “waiting”.

Criticism

According

to this theory, saving involves suffering. But savings may not always involve

suffering to some rich people. Rich people have money for which they do not get

interest. Hoarding of money is to quench the thirst for liquidity.

2. Agio Theory of Interest/ The Psychological Theory of Interest/Time Preference Theory

This

theory was propounded by John Rae in 1834. But credit goes to Bohm Bawerk an

Austrian School economist who has given final shape to the theory. The American

economist Irving Fisher modified and gave a new theory viz Time Preference

theory.

According

to this theory, people prefer present goods rather than future goods. Because

the present goods are more certain than future goods, just “as a bird in the hand is

worth two in the bush”. Ther are

many countries where no one knows what will happen next day.ASEAN crisis of 1996 and American crisis of 2007-08 were not

predicted even for economists, including Nobel Laureats. So, when people save

they have to postpone their present enjoyment or satisfaction. If one postpones

one’s present satisfaction, one has to be paid an “Agio” or “Premium”. This premium is “interest”. People prefer

present consumption than future consumption due to the risk increasing and

uncertainties of the present world.

3. Loanable Funds Theory/ The Neo Classical Theory

The

Loanable Funds Theory, also known as the “Neo–Classical Theory”, was developed

by Swedish economists like Wicksell, Bertil Ohlin, Viner, Gunnar Myrdal and

others.

According

to this theory, interest is the price paid for the use of loanable funds. The

rate of interest is determined by the equilibrium between demand for and supply

of loanable funds in the credit market.

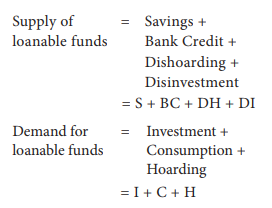

Demand for Loanable Funds

The

demand for loanable funds depends upon the following:

Demand for Investment (I)

The most

important factor responsible for the loanable funds is the demand for

investment. Bulk of the demand for loanable funds comes from business firms

which borrow money for purchasing capital goods.

Demand for Consumption (C)

The

demand for loanable funds comes from individuals who borrow money for

consumption purposes also.

Demand for Hoarding (H)

The next

demand for loanable funds comes from hoarders. Demand for hoarding money arises

because of people’s preference for liquidity, idle cash balances and so on. The

demand for C, I and H varies inversely with interest rate.

Supply of Loanable Funds

The

supply of loanable funds depends upon the following four sources:

1. Savings (S)

Loanable

funds come from savings.

According

to this theory, savings may be of two types, namely,

·

Savings planned by individuals are called “ex-ante

savings”. E.g. LIC premium, EMI payment etc.

·

The unplanned savings are called, “ex-post

savings”. Savings is left out after spending are ex post saving.

2. Bank Credit (BC)

The bank

credit is another source of loanable funds. Commercial banks create credit and

supply loanable funds to the investors.

3. Dishoarding (DH)

Dishoarding

means bringing out the hoarded money into use and thus it constitutes a source

of supply of loanable funds. In India,after 1991,Public sector undertakings are

being sold to private people to mobilize more funds.This is also called

disinvestment.

4. Disinvestment(DI)

Disinvestment

is the opposite of investment.Inotherwordsdisinvestment means not providing

sufficient funds for depreciation of equipment. It gives rise to the supply of

loanable funds.

All the

four sources of supply of loanable funds vary directly with the interest rate.

Classical theory of Interest

The equilibrium interest rate, according to classical theory, is

determined by the intersection of demand and supply curves, Demand for money

refers to investment. Supply of money refers to savings S=I.

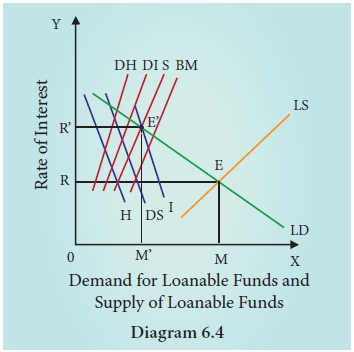

Equilibrium

The rate

of interest is determined by the equilibrium between the total demand for and

the total supply of loanable funds.

Supply of and Demand for Loanable Funds

In

Diagram 6.4, X axis represents the demand for and supply of loanable funds and

Y axis represents the rate of interest. The LS curve represents the total

supply curve of loanable funds. This is obtained by the summation of the Saving

Curve (S), Bank credit curve (BC), Dishoarding curve (DH) and Disinvestment

curve (DI).

The LD curve represents the total demand for loanable funds;

this is obtained by the summation of the demand for investment curve I, demand

curve for consumption demand or dissaving curve and curve for demand for

hoarding curve H. The LD and LS curves, intersect each other at the point “E”

the equilibrium point. At this point, OR rate of interest and OM is the amount

of loanable funds.

Criticisms

1. Many

factors have been included in this theory.Still ther are many more factors.Two

such factors are 1)Asymmetric Information and 2) Moral Hazard.In practice

larger firms, due to their political powers, are able to get huge bank credit

at lower interest rates.But due to NPAs, (Non-Performing

Assets)small firms and depositors lose their interest income. The loanable

funds theory is “indeterminate”’ unless the income level is already known.

(This can be studied in 12th standard Economics)

2. It is

very difficult to combine real factors like savings and investment with

monetary factors like bank credit and liquidity preference.

4. Keynes’ Liquidity Preference Theory of Interest or The Monetary Theory of Interest

Keynes

propounded the Liquidity Preference Theory of Interest in his famous book, “The

General Theory of Employment, Interest and Money” in 1936.

According

to Keynes, interest is purely a monetary phenomenon because the rate of

interest is calculated in terms of money. To him, “interest is the reward for

parting with liquidity for a specified period of time”.

Meaning of Liquidity Preference

Liquidity

preference means the preference of the people to hold wealth in the form of

liquid cash rather than in other non-liquid assets like bonds, securities,

bills of exchange, land, building, gold etc.

“Liquidity Preference is the preference to have an amount of

cash rather than of claims against others”.

-Meyer

Motives of Demand for Money

According

to Keynes, there are three

1. The Transaction Motive

The

transaction motive relates to the desire of the people to hold cash for the

current transactions (or day–to-day expenses).

The

amount saved under this motive depends on the level of income. Mt and Y are

positively associated. (Say Mt = 0.125Y; that means if income is Rs. 1000, demand for transaction motive is Rs. 125)

2. The Precautionary Motive

The

precautionary motive relates to the desire of the people to hold cash to meet

unexpected or unforeseen expenditures such as sickness, accidents, fire and

theft. The amount saved for this motive also depends on the level of income.

(Say Mp = 0.125Y; it means if income is Rs. 1000, demand for Mp is Rs. 125)

Mp = f (y)

3. The Speculative Motive

The

speculative motive relates to the desire of the people to hold cash in order to

take advantage of market movements regarding the future changes in the price of

bonds and securities in the capital market. The amount saved for this motive

depends on the rate of interest. Ms = f (i). There is inverse relation between

liquidity preference and rate of interest (Say Ms = 450-100i).

Determination of Rate of Interest

According

to Keynes, the rate of interest is determined by the demand for money and the

supply of money. The demand for money is liquidity preference. In fact,

liquidity preference for speculative motive determines rate of interest. The

supply of money is determined by the policies of the Government and the Central

Bank of a country. The total supply of money consists of coins, currency notes

and bank deposits (Say M = 200).

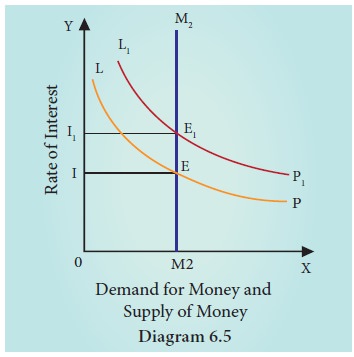

Equilibrium between Demand and Supply of Money

The equilibrium between liquiditypreference

and demand for money determine the rate of interest. In short -run, the supply

of money is assumed to be constant ( Rs. 200).

LP is the

liquidity preference Curve (demand curve). M2 M2 shows the supply curve of

money to satisfy speculative motive. Both curves intersect at the point E,

which is the equilibrium point. Hence, the rate of interest is 2.5. If

liquidity preference increases from LP to L1P1 the supply of money remains

constant, the rate of interest would increase from OI to OI1. Numerical

examples given above can also be used for better understanding. Total demand

for money=Mt+Mp+Ms =0.125Y+0.125Y+(450- 100i).

Total

supply of money= Rs. 200. Mt and Mp are influenced by Y. Hence for the sake of

easy understanding, Ms alone can be considered Demand for money=supply of money

at equilibrium point:450-100i=200;450 - 200=100i;250=100i; i=250/100=2.5.This

is equilibrium interest In reality, interest rate is also influenced by

national income and commodity sector equilibrium.However, they are not included

here for making the understanding easier.

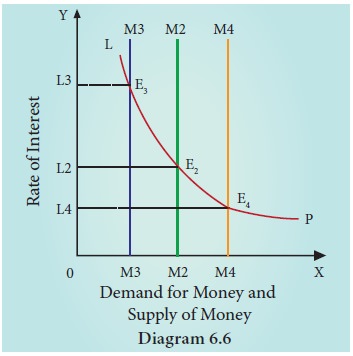

Suppose

LP remains constant. If the supply of money is OM2, the interest is

OI2 and if the supply of money is reduced from OM2 to OM3,

the interest would increase from OI2 to OI3. If the

supply of money is increased from OM2 to OM4, the

interest would decrease from OI2 to OI4.

Criticisms

This

theory does not explain the existence of different interest rates prevailing in

the market at the same time.

It

explains interest rate only in the short-run.

Related Topics