Accountancy - Single column cash book | 11th Accountancy : Chapter 7 : Subsidiary Books - II Cash Book

Chapter: 11th Accountancy : Chapter 7 : Subsidiary Books - II Cash Book

Single column cash book

Single column cash book

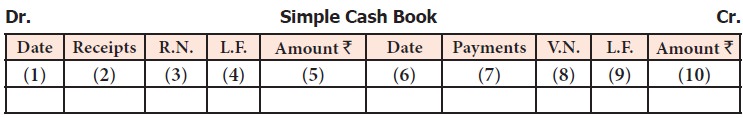

Single column cash book or simple cash book, like a

ledger account has only one amount column, i.e., cash column on each side. Only

cash transactions are recorded in this book. All cash receipts and payments are

recorded systematically in this book. The format of simple cash book is given

as under:

The format of

simple cash book shows that it has been divided into two parts. The left hand

side is ‘Debit’ which represents all cash receipts and the right hand side is

‘Credit’, showing all cash payments.

Columns

(1) and (6) – Date: Date of

receiving cash is recorded in the debit side and date of paying cash is recorded in the credit side.

Column (2) Receipts: Receipts column shows

name of persons or parties from whom cash

has been received, income received, sale of asset like plant, cash sales

and other receipts.

Column (3) Receipt Number (R.N.): This column

contains the serial numbers of the cash receipts.

Columns (4) and (9) – Ledger Folio (L.F.): This column

is provided both on the debit and credit

side of the cash book. It is used for reference. The Ledger page number of

every account in the cash book is recorded in this column. This column

facilitates vouching and verification of transactions recorded.

Columns (5) and (10) – Amount: This is the

last column of the cash book on both the debit and credit sides. In case of cash receipt, the amount of actual

cash receipts and in case of payments, the amount of actual cash payment is

recorded. The opening balance of cash is recorded on the debit side and the closing

balance is the balancing figure on the credit side. Opening balance or capital

contributed by cash in case of new business is the first item on the debit side

and the closing balance is the last item on the credit side.

The word ‘To’

is conventionally used before different accounts at the debit side of cash book

in particulars column. The word ‘By’ is used before the different accounts at

the credit side of the cash book in particulars column.

Column (7) Payments: The accounts to which

payments are made are recorded here such as

names of persons to whom payment has been made, expenses paid, assets

purchased, cash purchases, etc.![]()

Column

(8) Voucher Number (V.N.): This

column contains the serial number of the voucher towards which payment is made.

1. Balancing of single column cash book

Since the cash book serves as cash account, it must

be balanced regularly. The balancing procedure is the same like any other

ledger account. It must be remembered that one cannot pay more cash than what

one has received. Therefore, the total of receipts is always more than (or at

least equal to, but never less than) the credit total (payments) and the cash

book always shows a debit balance (or nil balance, but never credit balance).

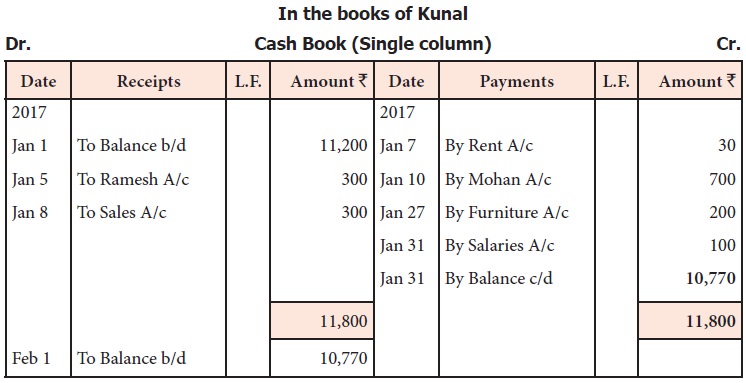

Illustration 1

Enter the following transactions in a simple cash

book of Kunal:

2017

Jan. Rs.

1 Cash in hand 11,200

5 Received from Ramesh 300

7 Paid rent 30

8 Sold goods for cash 300

10 Paid Mohan 700

27 Purchased furniture for cash 200

31 Paid salaries 100

Solution

Explanation

Jan 1: Cash in hand is the opening balance with the

firm. This would have been the closing balance

on 31st December, 2017. Cash account always has debit balance so it has been

shown in the debit side of the cash book.

Jan 5: It is a receipt from Ramesh, so it has been

recorded in receipt side (debit side) of the cash book.

Jan 7: Payment of rent will decrease cash, so it has

been recorded in payment side (credit side)

of the cash book.

Jan 8: Cash sales of goods will bring cash and increases

the cash balance, so it has been recorded

in the debit side of the cash book.

Jan 10: Payment to Mohan decreases cash, so it has been

recorded in the credit side.

Jan 27: Purchase of furniture for cash reduces cash, so

it has been recorded in credit side.

Jan 31: Payment of salaries in cash reduces cash, so it

has been recorded in the credit side of cash

book.

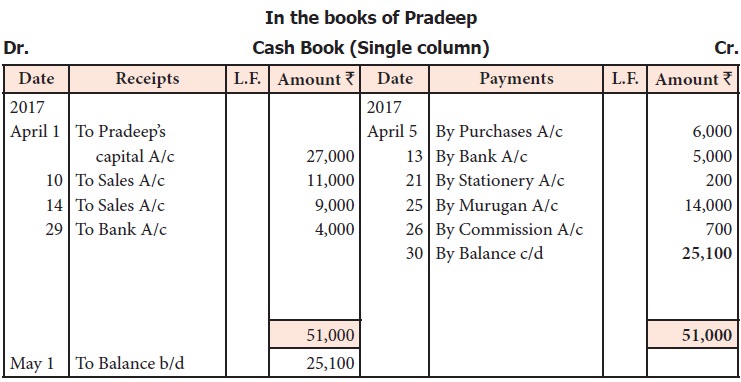

Illustration 2

Enter the following transactions in a single column

cash book of Pradeep for April, 2017

April Rs.

1 Commenced

business with cash 27,000

5 Bought

goods for cash 6,000

10 Goods sold

for cash 11,000

13 Paid into

bank 5,000

14 Goods sold

to Sangeetha for cash 9,000

17 Goods

purchased from Preethi on credit 13,000

21 Purchased

stationery by cash 200

25 Paid

Murugan by cash 14,000

26 Commission

paid by cash 700

29 Drew from

bank for office use 4,000

30 Rent paid

by cheque 3,000

Solution

Note: The

transaction dated April 17th will not be recorded in the cash book as it is a

credit transaction. The transaction on 30th is not recorded as the

payment is made through bank which does not involve cash.

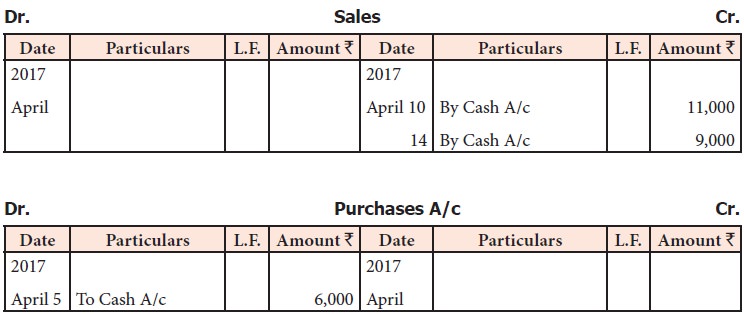

2. Posting from single column cash book

Since cash

book serves as ‘journal’ as well as ‘ledger account’, there is no need for preparing

separate cash account and posting thereto. But entering cash transactions in

cash book means recording only cash aspect of each transaction. The other

aspect of the transaction remains to be posted. When the related accounts are

posted, the double entry will be completed. The procedure for posting is:

·

Credit

the accounts mentioned on the receipts (or) debit side by entering ‘By Cash

account’ and

·

Debit the

accounts mentioned on the payment (or) credit side by entering ‘To Cash

account’.

For example, for illustration 2, posting is made to

sales account and purchases account as follows:

Related Topics