Accountancy - Purchases book | 11th Accountancy : Chapter 6 : Subsidiary Books - I

Chapter: 11th Accountancy : Chapter 6 : Subsidiary Books - I

Purchases book

Purchases book

Purchases

book is a subsidiary book in which only credit purchases of goods are recorded.

When business wants to know the information about the credit purchases of goods

at a glance, the information can be made available if purchases of goods on

credit are separately recorded.

Goods here mean the items in which the business

entity is dealing. In other words, it is the item which is purchased for

regular sales. For example, furniture will be treated as goods in the case of

the firm dealing in furniture. For other firms, which are not dealing in

furniture it will be an asset. Hence, while recording transactions in the

purchases book, it must be ascertained whether the credit purchase is related

to the item in which the firm is dealing. Purchases of assets and purchase of

goods for cash are not entered in purchases book.

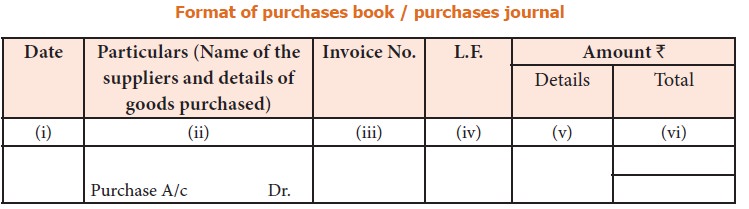

i. Date

In the date

column, the date of purchases of goods on credit is recorded.

ii. Particulars

In this

column the name of the supplier from whom goods have been purchased and details

of goods purchased are given. It contains the name, quantity, quality and rate

of goods purchased, trade discount and any other specification and specialties

of the goods are recorded in this column.

iii. Invoice number

Invoice is

the statement prepared by the seller of goods. It contains details about the

goods, its price and other expenses incurred. The invoice number is entered in

this column.

iv. Ledger Folio (L.F.)

The page

number of the ledger in which the supplier’s account appears is recorded in

this column. Purchases of goods must be posted to the personal accounts of

suppliers. Purchases book contains the page number of supplier’s account in the

ledger. It helps in posting and also in checking the records.

v. Amount column (Details)

Amount column

is divided into two parts, i.e., details and total. The details column is used

to record the amount of various individual items purchased from a particular

supplier. The amount of trade discount allowed is deducted. This column is used

for adjustment of additions and subtractions.

vi. Total amount column (Total)

The net

amount payable to the supplier of goods is recorded in the total amount column.![]()

1. Invoice

Entries in

the purchases day book are made from invoices which are popularly known as

bills. Invoice is a business document or bill or statement, prepared and sent

by the seller to the buyer giving the details of goods sold, such as quantity,

quality, price, total value, etc. Thus, the invoice is a source document of

prime entry both for the buyer and the seller.

2. Trade discount

Trade discount is a deduction given by the supplier

to the buyer on the list price or catalogue price of the goods. It is given as

a trade practice or when goods are purchased in large quantities. It is shown

as a deduction in the invoice. Trade discount is not recorded in the books of

accounts. Only the net amount is recorded. Example: Suppose the sale of goods

for Rs.10,000 was made and 10% was allowed as trade

discount, the entry regarding sales will be made for Rs. 9,000 (10,000 – 10 per cent of 10,000). In the same way, purchaser of

goods will also record purchases as Rs. 9,000).

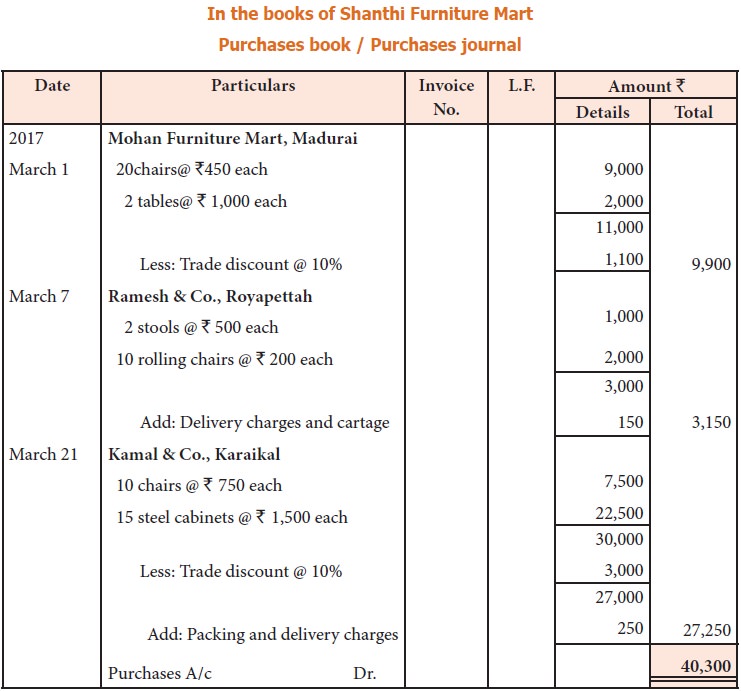

Illustration 1

Record the following transactions in the purchases

book of Shanthi Furniture Mart:

2017

March 1

Purchased from Mohan Furniture Mart, Madurai 20 chairs @ Rs. 450 each

2 tables @ Rs. 1,000 each

Less:

Trade discount @ 10%

March 7

Bought

from Ramesh & Co., Royapettah

2 stools

@ Rs. 500 each

10

rolling chairs @ Rs. 200 each

Delivery

charges and cartage Rs. 150

March 21

Purchased

from Kamal & Co., Karaikkal

10 chairs

@ Rs. 750 each

15 steel

cabinets @ Rs. 1,500

each

Packing

and delivery charges Rs. 250

Less:

Trade discount @ 10%

March 25

Purchased

from Jemini & Sons, Chennai

2

typewriters @ Rs. 7,750

for office use

Solution

Tutorial note

·

Trade discount is allowed on the purchase price of

goods excluding delivery charges and cartage.

·

Delivery

charges and cartage are direct expenses, chargeable from purchaser, so they are

added to the amount payable.

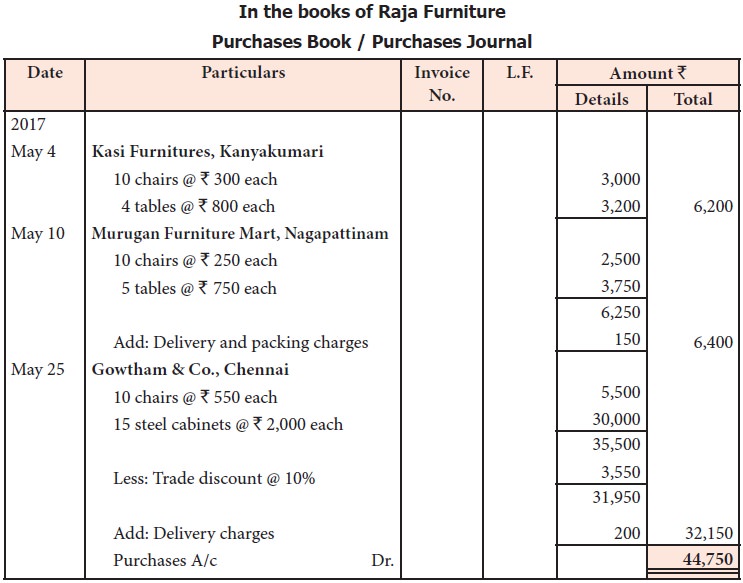

Illustration 2

Record the

following transactions in the purchases book of Raja Furniture:

2017

May 4

Purchased from Kasi Furnitures,Kanyakumari 10

chairs @ Rs. 300 each 4 tables @ Rs. 800 each

May 6

Purchased for cash from Welcome Furniture, Vellore

2 almirahs @ Rs. 2,000 each

4 chairs @ Rs. 200 each

Less: Trade discount 5%

May 10

Bought furniture from Murugan Furniture Mart,

Nagapattinam 10 chairs @ Rs. 250 each

5 tables @ Rs. 750 each

Delivery and packing charges Rs. 150

May 20

Purchased 2 computers for office use from Anandan

& Co., Adyar on credit for Rs.15,550

each

May 25

Purchased from Gowtham & Co., Chennai

10 chairs @ Rs. 550 each

15 steel cabinets @ Rs. 2,000

each

Delivery charges Rs. 200

Less: Trade discount 10%

Solution

Note:

·

Purchases on 6th May, 2017 will not be recorded in

the purchases book, because it is cash purchases.

·

Purchases of computers on 20th May, 2017 will not

be recorded in the purchases book, because computer is an asset for the firm

dealing in furniture and it is for office use.

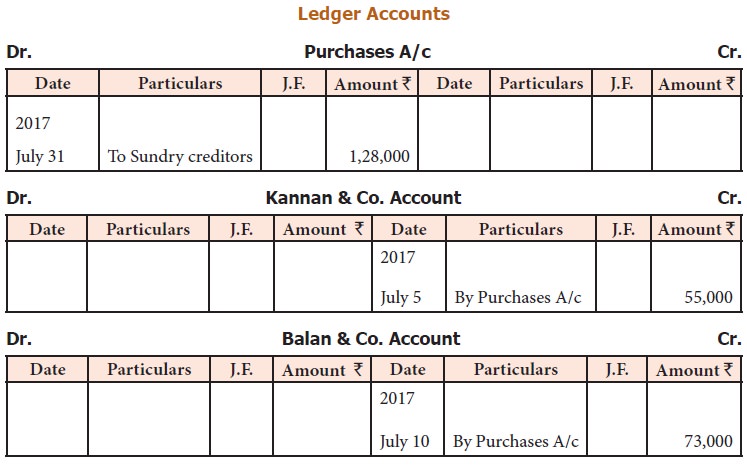

3. Posting from purchases book

After the

transactions are recorded in the purchases book, posting them to ledger

involves two steps:

Step 1: Posting to personal accounts of creditors: Every day, each entry is

posted to the credit side of the respective personal account of the creditor

by entering the words ‘By Purchases account’.

Step 2: Posting to purchases account: Generally, at the end of the month, the purchases book is

totalled. The monthly total of purchases is posted to the debit side of

purchases account by writing the words ‘To Sundry creditors A/c’.

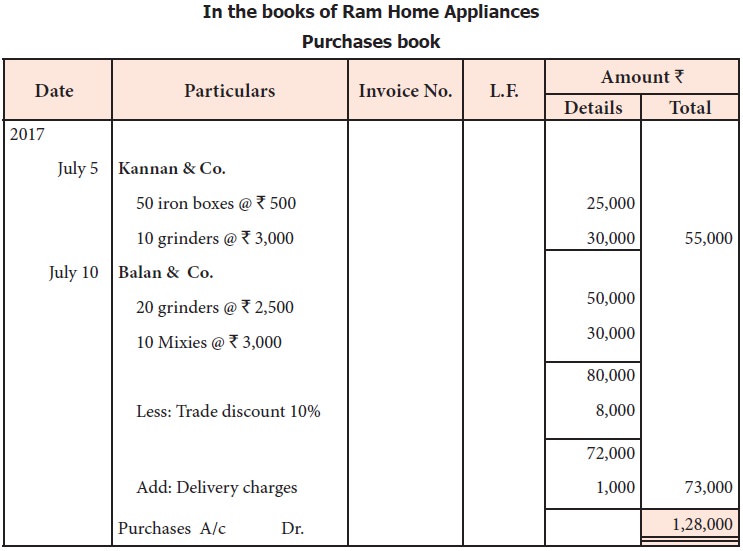

Illustration 3

From the following transactions of Ram Home

Appliances for July, 2017 prepare purchases book and ledger accounts connected

with this book:

2017

July 5 Purchased on credit from Kannan &

Co.

50 iron boxes @ Rs. 500 each

10 grinders @ Rs. 3,000 each

July 6 Purchased for cash from Siva &

Bros.

25 fans @ Rs. 1,250 each

July 10 Purchased from Balan & Co. on credit

20 grinders @ Rs. 2,500 each

10 mixies @ Rs. 3,000 each

Trade discount 10%

Delivery charges Rs. 1,000

July 20 Purchased on credit, one copier machine

from Kumar for Rs. 35,000

Solution

Ledger Accounts

Note: 6th July, transaction is a cash transaction and 20th July, transaction is purchase of an asset. Hence, both will not be recorded in the purchases book.

Related Topics