Chapter: Mechanical : Engineering Economics & Cost Analysis : Cash Flow

Present worth method

In most of the practical decision environments, executives will be forced to select the best alternative from a set of competing alternatives.

Let us assume that an organization has a huge sum of money for potential investment and there are three different projects whose initial outlay and annual revenues during their lives are known. The executive has to select the best alternative among these three competing projects.

There are several bases for comparing the worthiness of the projects. These bases are:

1. Present worth method

2. Future worth method

3. Annual equivalent method

4. Rate of return method

PRESENT WORTH METHOD

ü In this method of comparison, the cash flows of each alternative will be reduced to time zero by assuming an interest rate i.

ü Then, depending on the type of decision, the best alternative will be selected by comparing the present worth amounts of the alternatives.

In a cost dominated cash flow diagram, the costs (outflows) will be assigned with positive sign and the profit, revenue, salvage value (all inflows), etc. will be assigned with negative sign.

ü In a revenue/profit-dominated cash flow diagram, the profit, revenue, salvage value (all inflows to an organization) will be assigned with positive sign. The costs (outflows) will be assigned with negative sign.

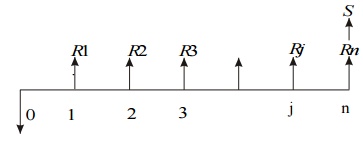

a.Revenue-Dominated Cash Flow Diagram

A generalized revenue-dominated cash flow diagram to demonstrate the present worth method of comparison is presented in Fig.

To find the present worth of the above cash flow diagram for a given interest rate, the formula is

PW(i) = – P + R1[1/(1 + i)1] + R2[1/(1 + i)2] + ...

+ Rj [1/(1 + i) j] + Rn[1/(1 + i)n] + S[1/(1 + i)n]

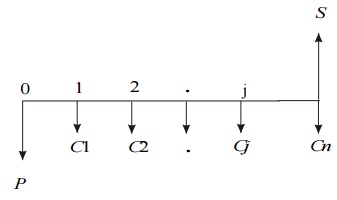

b.Cost-Dominated Cash Flow Diagram

A generalized cost-dominated cash flow diagram to demonstrate the present worth method of comparison is presented in Fig.

To compute the present worth amount of the above cash flow diagram for a given interest rate i, we have the formula

PW(i) = P + C1[1/(1 + i)1] + C2[1/(1 + i)2] + ... + Cj[1/(1 + i) j]

+ Cn[1/(1 + i)n] – S[1/(1 + i)n]

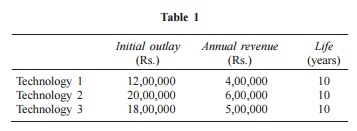

EXAMPLE

Alpha Industry is planning to expand its production operation. It has identified three different technologies for meeting the goal. The initial outlay and annual revenues with respect to each of the technologies are summarized in Table 1. Suggest the best technology which is to be implemented based on the present worth method of comparison assuming 20% interest rate, compounded annually.

Solution

In all the technologies, the initial outlay is assigned a negative sign and the annual revenues are assigned a positive sign.

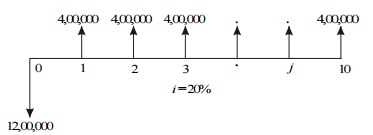

TECHNOLOGY 1

Initial outlay, P = Rs. 12,00,000

Annual revenue, A = Rs. 4,00,000

Interest rate, i = 20%, compounded annually

Life of this technology, n = 10 years

The cash flow diagram of this technology is as shown in Fig. 4.3.

Fig. Cash flow diagram for technology 1.

The present worth expression for this technology is

PW(20%)1 = –12,00,000 + 4,00,000 (P/A, 20%, 10)

= –12,00,000 + 4,00,000 (4.1925)

= –12,00,000 + 16,77,000

= Rs. 4,77,000

TECHNOLOGY 2

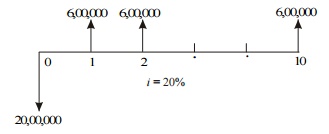

Initial outlay, P = Rs. 20,00,000

Annual revenue, A = Rs. 6,00,000

Interest rate, i = 20%, compounded annually

Life of this technology, n = 10 years

The cash flow diagram of this technology is shown in Fig. 4.4.

Fig. Cash flow diagram for technology 2.

The present worth expression for this technology is

PW(20%)2 = – 20,00,000 + 6,00,000 (P/A, 20%, 10)

= – 20,00,000 + 6,00,000 (4.1925)

= – 20,00,000 + 25,15,500

= Rs. 5,15,500

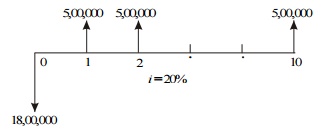

TECHNOLOGY 3

Initial outlay, P = Rs. 18,00,000

Annual revenue, A = Rs. 5,00,000

Interest rate, i = 20%, compounded annually

Life of this technology, n = 10 years

The cash flow diagram of this technology is shown in Fig. 4.5.

Fig. Cash flow diagram for technology 3.

The present worth expression for this technology is

PW(20%)3 = –18,00,000 + 5,00,000 (P/A, 20%, 10)

= –18,00,000 + 5,00,000 (4.1925)

= –18,00,000 + 20,96,250

= Rs. 2,96,250

From the above calculations, it is clear that the present worth of technology 2 is the highest among all the technologies. Therefore, technology 2 is suggested for implementation to expand the production.

2.

Related Topics