Accountancy - Petty cash book | 11th Accountancy : Chapter 7 : Subsidiary Books - II Cash Book

Chapter: 11th Accountancy : Chapter 7 : Subsidiary Books - II Cash Book

Petty cash book

Petty cash book

Business

entities have to pay various small expenses like taxi fare, bus fare, postage,

carriage, stationery, refreshment and other sundry items. These are small

payments and repetitive in nature. If all these small payments are recorded in

the main cash book, it will be loaded with lot of entries. Hence, all petty

payments of the business may be recorded in a separate book, which is called as

petty cash book and the person who maintains the petty cash book is called the

petty cashier. Thus business concerns may maintain main cash book and petty

cash book separately.

All the small payments must be supported by

vouchers, that is, documentary evidences. The vouchers must be numbered and

filed in order. Petty cashier makes only cash payments. He must not be allowed

to receive any cash except for reimbursement. Petty cashier has to make

payments only within the specified limit. Payments involving large amounts must

be made only by main cashier. At the end of the relevant period, petty cash

book is balanced. Balancing of petty cash book is similar to the balancing of

simple cash book.

1. Imprest system of petty cash

Under this

system, a fixed amount necessary or sufficient to meet petty payments

determined on the basis of past experience is paid to the petty cashier on the

first day of the period. (It may be a week or fortnight or month). The amount

given to the petty cashier in advance is known as “Imprest Money”. The word

imprest means payment in advance. The petty cashier makes payments from this

amount and records them in petty cash book. At the end of a particular period,

the petty cashier submits the petty cash book to the head cashier. The head

cashier scrutinises the petty payments and gives amount equal to the amount

spent by petty cashier so that the total amount with the petty cashier is now

equal to the amount he had received in the beginning as advance. Under the

system, the total cash with the petty cashier never exceeds the imprest at any

time during the period. This method thus provides an effective control over

petty payments.

For example,

On 1st June, 2017, Rs. 1,000 was

given to the petty cashier. He had spent Rs. 940 during the month. He will be paid Rs. 940 on 30th June by the

cashier so that he may again have 1,000 for

the next month i.e., JuLy, 2017.

2. Advantages of maintaining petty cash book

Following are the advantages of maintaining petty

cash book:

i.

There can

be better control over petty payments.

ii.

There is

saving of time of the main cashier.

iii.

Cash book

is not loaded with many petty payments.

iv.

Posting

of entries from main cash book and petty cash book is comparatively easy.

3. Types of petty cash book

There are two types of petty cash books. They are:

i.

Simple

petty cash book

ii.

Analytical

petty cash book

(i) Simple petty cash book

A simple

petty cash book resembles the single column cash book. But the columns are

different. On the debit side, only the advance received from the head cashier

is recorded. On the credit side, all payments are recorded in only one column.

This is known as simple petty cash book.![]()

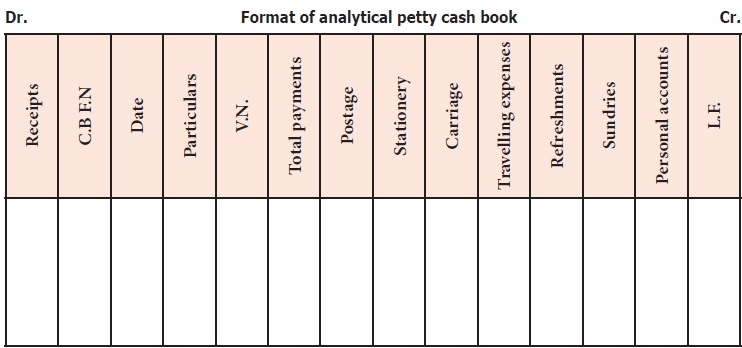

(ii) Analytical petty cash book

In analytical

petty cash book, a separate column is provided for different heads of payments

and one column for total payments. When the petty expenses are recorded in the

total payment column, same amount is also recorded in the appropriate expense

column. This is known as analytical petty cash book.

Details entered in the various columns of the petty

cash book are as follows:

1) Receipts

This is the

first column of the petty cash book. The amount received by the petty cashier

for meeting petty expenses is recorded in this column. Generally, amount is

received once on the first day of every week or month. The opening balance of

petty cash is recorded in this column as the first item. This column shows the

total amount available with the petty cashier.

2) Cash Book Folio Number (C.B.F.N.)

In this

column, the page number of the cash book in which the entry is made is

recorded.

3) Date

In this

column, the date of receipt of petty cash and payment of every petty expense is

recorded.

4) Particulars

The details

of transactions are entered in this column. Cash received in the beginning is

recorded as ‘To Cash A/c’ and all the petty expenses are recorded as ‘By

Concerned Expense A/c” (name of the expense).

5) Voucher Number (V.N.)

Every

transaction in accounting must be supported by documentary evidence. All the

payments must have vouchers which must be arranged in the chronological order

of payment and serially numbered. Voucher number of every payment is written in

this column.![]()

6) Total

The amount of

every petty expense is recorded in this column. At the end of the week or month

expenses are totalled. The total expenses of the week or the month is compared

with the total of the receipts column and balance is obtained.

7) Postage

Postal

expenses incurred for post card, envelope, inland letter, postage stamps,

registered letter, parcel, etc. are recorded in this column.

8) Stationery

It includes

expenses incurred for purchasing materials such as paper, ink, pencil, eraser,

carbon paper and other similar stationery items.

9) Carriage

It includes

amount paid as wages, transport charges and other expenses.

10) Travelling or conveyance expenses

In this

column fare for auto rickshaw, taxi, bus, train, etc., are recorded.

11) Refreshments

Amount spent

for tea, coffee, snacks, etc., is recorded.

12) Sundries

There may be

certain expenses which are infrequent for which specific columns are not

provided. These are recorded in this column.

13) Personal accounts

Small amount

of money paid to individuals are entered in this column.

14) Ledger Folio (L.F.)

This refers

to the page number of the ledger where the respective account is recorded.

4. Balancing petty cash book

At the end of

the period, i.e., week or month the total of the total column, individual

expenses columns and sundries columns, is obtained. The total of the individual

petty expenses column must be equal to the total in the total column. The sum

of the total column is compared with the total of receipts column and the

balance is obtained. The closing balance is shown as ‘By Balance c/d’. The

closing balance is carried forward to the next week or month. It is shown as

‘To Balance b/d’. Cash received from the main cashier at the beginning of the

next period is entered as ‘To Cash A/c’ and the amount is recorded in the

Receipts column.

5. Posting of entries from petty cash book to ledger

i. When petty cash is advanced at the beginning:

A separate petty cash account is opened in the

ledger. When advance is received by the petty cashier, petty cash account is

debited and cash account is credited.

ii. When individual expenses columns are

periodically totalled:

The total of various petty expenses are debited and the petty cash account is credited with the total of the payments made.

The petty cash account will show the balance of petty cash. This balance will be shown in the balance sheet as part of cash balance.

Tutorial note

Instead of debiting the total of each petty expense

directly, a separate journal entry may also be made and then credited to petty

cash account. The journal entries are:

For receiving petty cash:

Petty cash

A/c Dr.

To Cash A/c

For expenses paid:

Respective

expense A/c Dr.

To Petty cash

A/c

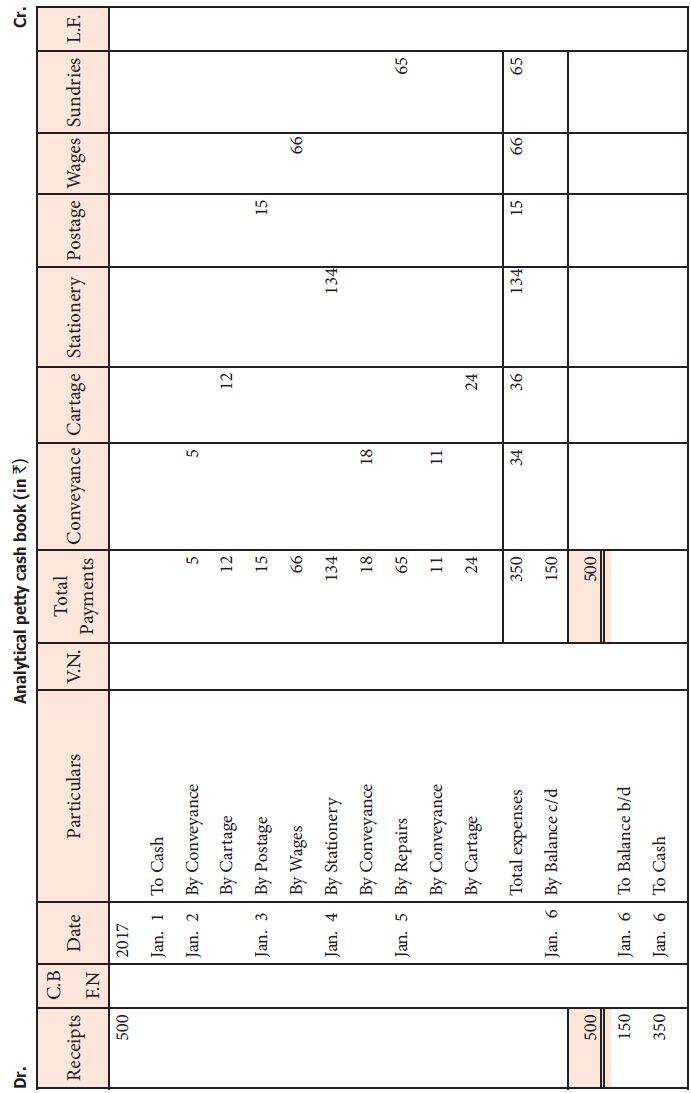

Illustration 8

Prepare a analytical petty cash book from the

following information on the imprest system:

2017 500

Jan. 1

Received for petty cash 5

Jan. 2 Paid rickshaw charges Paid 12

cartage 15

Jan. 3 Paid

for postage 66

Paid wages to casual labourer 134

Jan. 4 Paid for stationery Paid for 18

auto charges 65

Jan. 5 Paid

for repairs Paid for bus 11

fare Paid for cartage 24

Solution for illustration 8

Prepare a

analytical petty cash book from the following information on the imprest

system:

2017

Jan. 1 Received for petty cash 500

Jan. 2 Paid rickshaw charges 5

Paid cartage 12

Jan. 3 Paid for postage 15

Paid wages to casual labourer 66

Jan. 4 Paid for stationery 134

Paid for auto charges 18

Jan. 5 Paid for repairs 65

Paid for bus fare 11

Paid for cartage 24

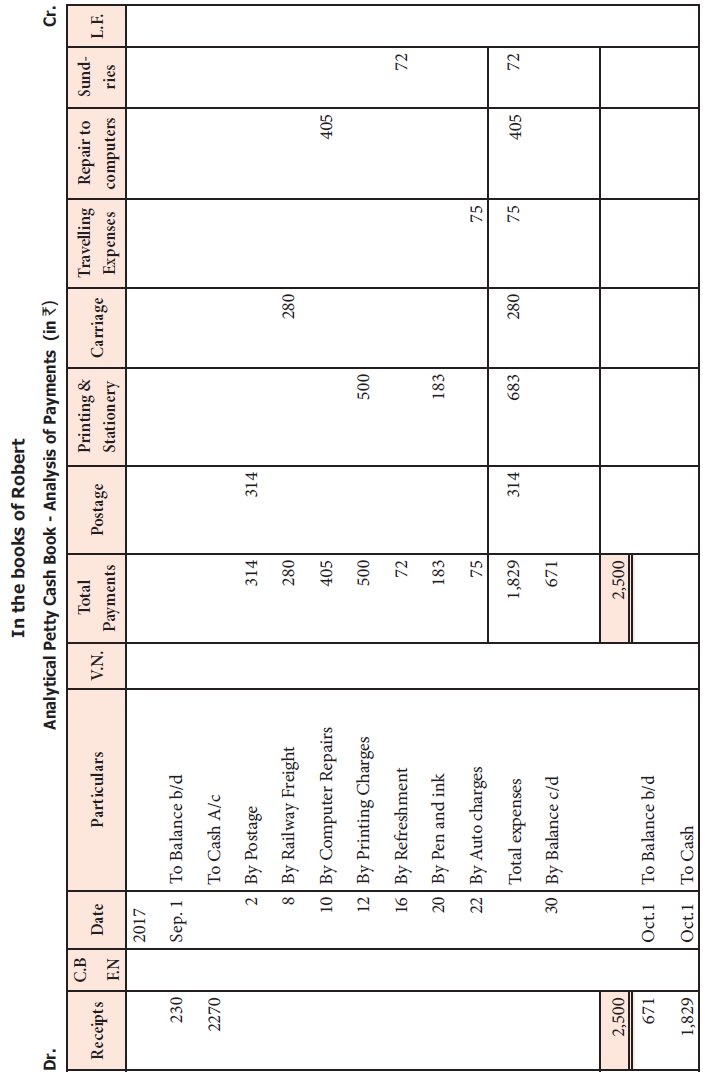

Illustration 9

Prepare analytical petty cash book in the books of

Robert from the following transactions. 2017

Sept Rs.

1 Balance in hand 230

Received a cheque to make the imprest

amount 2,270

2 Postage 314

8 Railway freight 280

10 Repairs to computer 405

12 Printing charges 500

16 Refreshments to customers 72

20 Pen and ink purchased 183

22 Paid auto Charges 75

Solution for illustration 9

Prepare

analytical petty cash book in the books of Robert from the following

transactions.

2017

Sept Rs.

1 Balance in hand 230

Received a cheque to make the imprest amount

2,270

2 Postage 314

8 Railway freight 280

10 Repairs to computer 405

12 Printing charges 500

16 Refreshments to customers 72

20 Pen and ink purchased 183

22 Paid auto Charges 75

Related Topics