Chapter: Business Science : Security Analysis and Portfolio Management : Fundamental Analysis

Industry or Sector Analysis

INDUSTRY OR SECTOR ANALYSIS

The second

step in the fundamental analysis of securities is Industry analysis. An

industry or sector is a group of firms that have similar technological

structure of production and produce similar products. These industries are

classified according to their reactions to the different phases of the business

cycle. They are classified into growth, cyclical, defensive and cyclical growth

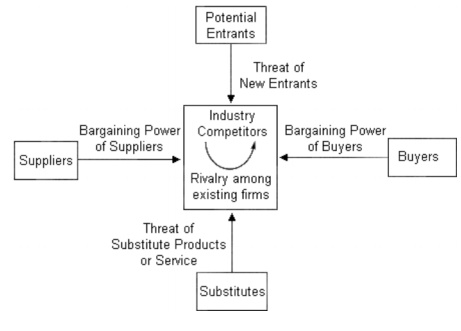

industry. A market assessment tool designed to provide a business with an idea

of the complexity of a particular industry. Industry analysis involves

reviewing the economic, political and market factors that influence the way the

industry develops. Major factors can include the power wielded by suppliers and

buyers, the condition of competitors and the likelihood of new market entrants.

The industry analysis should take into account the following factors.

Characteristics of the

industry: When the demand for industrial products

is seasonal, their problems may spoil the growth prospects. If it is

consumer product, the scale of production and width of the market will

determine the selling and advertisement cost. The nature of industry is also an

important factor for determining the scale of operation and profitability.

Demand and market: If the industry is to have good prospects of profitability, the

demand for the product should not be controlled by the government.

Government policy: The government policy is announced in the Industrial policy

resolution and subsequent announcements by the government from time to

time. The government policy with regard to granting of clearances, installed

capacity, price, distribution of the product and reservation of the products

for small industry etc are also factors to be considered for industrial

analysis.

Labour and other industrial

problems: The industry has to use labour of

different categories and expertise. The productivity of labour as much

as the capital efficiency would determine the progress of the industry. If

there is a labour problem that industry should be neglected by the investor.

Similarly when the industries have the problems of marketing, investors have to

be careful when investing in such companies.

Management: In case of new industries, investors have to carefully assess the

project reports and the assessment of financial institutions in this

regard. The capabilities of management will depend upon tax planning,

innovation of technology, modernisation etc. A good management will also insure

that their shares are well distributed and liquidity of shares is assured.

Future prospects: It is essential to have an overall picture of the industry and to

study their problems and prospects. After a study of the past, the future

prospects of the industry are to be assessed.

When the

economy expands, the performance of the industries will be better. Similarly

when the economy contracts reverse will happen in the Industry. Each Industry

is different from the other. Cement Industry is entirely different from

Software Industry or Textile Industry in its products and process.

Related Topics