Chapter: Business Science : Enterpreneurship Development : Management of Small Business

Industrial Sickness - Management of Small Business

Industrial Sickness

DEFINITION

BY SICK

INDUSTRIAL COMPANIES(SPECIAL PROVISIONS) ACT, 1985, SEC 3(1) (0)

“Industrial

company(being a company registered for not less than five years) which has at

the end of any financial year accumulated loss equal to or exceeding its entire

net worth and which has also suffered cash losses in such a financial year

immediately preceding such financial year”.

BY THE

COMPANIES(SECOND AMENDMENT) ACT, 2002

Defines a

sick company as one:

Which has

accumulated losses in any financial year to 50 percent or more of its average

net worth during four years immediately preceding the financial year in

question, or

Which has

failed to repay its debts within any three consecutive quarters on demand for

repayment by its creditors.

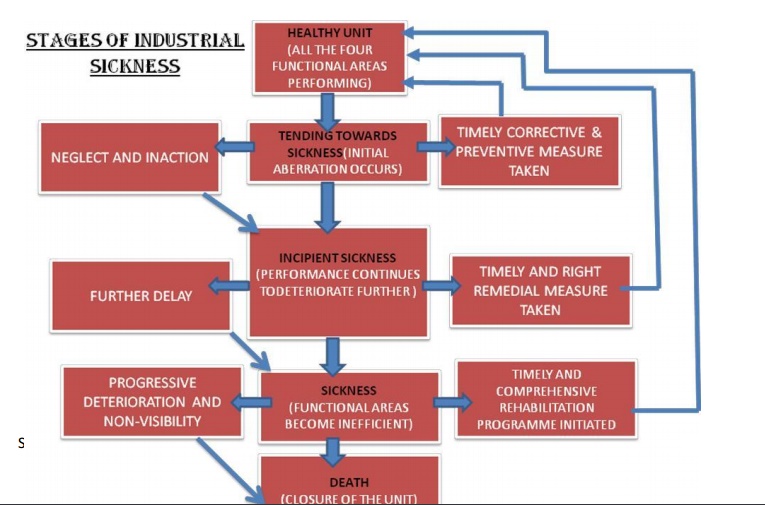

STAGES OF

INDUSTRIALSICKNESS

CRITERIA

TO IDENTIFY INDUSTRIAL SICKNESS

Continuous decline in gross output compared to the

previous two financial years. Delays in repayment of institutional loan, for

more than 12 months.

Erosion in the net worth to the extent of 50 percent of the net worth

during the previous accounting year.

SIGNALS OF INDUSTRIAL SICKNESS

Decline

In Capacity Utilization Shortage Of Liquid Funds

Inventories

In Excessive Quantities

Irregularity

In Maintaining The Bank Accounts Frequent Break Downs In Plant & Equipments

Decline In The Quality Of Products

Frequent

Turnover Of Personnel Technical Deficiency

EXTERNAL

CAUSES

Improper

Credit Facilities

Delay In

Advancing Of Funds

Unfavourable

Investment Climate Shortage Of Inputs

Import

Restrictions On Essential Inputs

Liberal

Licensing Of Projects

Change In

International Marketing Scene Excessive Taxation Policy Of Government Market

Recession

INTERNAL

CAUSES

(FINANCIAL

CONSTRAINTS)

Inappropriate

Financial Structure Poor Utilization Of Assets

Inefficient

Working Capital Management Lack Of Proper Costing And Pricing

Absence

Of Financing, Planning & Budgeting Improper Utilization Or Diversion Of

Funds

Consequences

Huge financial losses to the banks & financial

institutions Loss to employment opportunities

Emergence

of industrial unrest

Adverse

effect on perspective investors and entrepreneurs

Wastages of scarce resources Loss of revenue to

government

Governmental

measures to combat industrial sickness

The Industrial Finance

Corporation of India (IFCI) in 1948 - to

provide medium & long-term credits

to the public sector limited companies in order to facilitate post-war

rehabilitation & development.

2. The State Financial Corporations (SFC)

were established at state level in 1951 to supplement the work of

IFCI by

financing medium and small-scale industrial concerns.

3. Industrial Reconstruction

Corporation of India or (IRCI) was set up with its head quarters at Calcutta in

1971

•

to revive and revitalise the closed and sick

industrial concerns by removing the shortcomings.

•

to reconstruct and restructure the financial base

as well as the management of the assisted units, besides providing financial

assistance and technical/managerial guidance.

The

control measures adopted by IRCI included :

i.

transfer of major shares in the name of IRCI;

ii.

appointment of IRCI nominees in the Board of

Directors of the sick unit;

iii.

appointment of personnel and nominees in key

managerial post and purchase/sales committees;

iv.

frequent plant and factory inspections and so on.

4. Industries (Development &

Regulation) Act, 1951 was further amended in 1971 -empowering the Central Government to take over

industrial undertakings which special emphasis on sick units.

5. By

Amendments in the relevant Act the IFCI

with effect from 1972 was empowered to extend its assistance to Pvt Ltd

Cos.

6 Foreign Exchange Regulation Act (FERA)

1973 – limited the share of foreign companies to 40% of the total

capital.

Governmental

measures to combat industrial sickness

7. The Reserve Bank of India set up

Tandon Committee, in 1975- guideline

was laid down governing the

participation of banks in the management of various sick industries.

8. The RBI

in 1979 conducted a study to identify the causes of sickness in 378 such large

industrial units

9. Further

the government came up with several industrial policies in order to revive the

sick units

These

policies were:

i.

Soft loan

scheme-

•

introduced in 1976 to provide financial assistance

to five selected industries (jute, cotton, cement, textile and sugar) on

concessional terms for modernization & rehabilitation of their old

machineries.

•

Was Being operated by the IDBI in collaboration

with IFCI & ICICI.

•

In 1984 this scheme was modified into soft loan

scheme for modernization –all categories of industries are eligible for financial

assistance for up gradation of process/technologies/product, export

orientation/import substitution,energy saving, anti-pollution measures and

improvement in productivity.

ii.

Merger

policy of 1977 –

•

For merger of sick units with the healthy ones

•

Healthy was allowed to carry forward and set off

the accumulated losses & unabsorbed depreciation of the sick unit against

its own tax incidence.

•

Sick units to be eligible for merger should have

>100 employees & assets worth >50 lakh. Governmental measures to

combat industrial sickness

iii.

Policy

guidelines on sick units-1978

•

Made it clear that financial institutes should

involve themselves in the management of the sick units in which they have

substantial stake by setting up group of professional directors to look after

the management of these units.

• These

directors will be nominated to the board of the sick units and they will be

required to report to the financial institutes regularly regarding the various

measures required to be incorporated.

• Further

the respective state government in collaboration with the financial institutes

should provide financial & managerial assistance for the restructuring and

rehabilitation of the sick units.

iv.

New

strategy 1981-

•

Aimed at preventing industrial sickness, quick

rehabilitation, & early decisions on the future of such units.

•

Units employing >1000employees of having an

investment of 9 crore or more should be nationalised if

The line

of production is critical to the nation‟s economy

Its a

mother unit with large ancillaries

Its

closure would cause dislocation and unemployment of such a large number of

people that allocation of alternative jobs is not possible.

v. Different committees and

industrial sickness-

Government

has from time to time formulated several committees like the Standing Committee

On Industrial Sickness, State Level Inter-Institutional Committee, Guidance

Committee & others to examine the problems of growing industrial Sickness

vi. Legal framework-

Various

provisions for the revival of the sick industries were introduced like The

Relief Undertaking Act,

Sec 72(a)

Of The Income Tax Act, IRBI Act Of 1984,SICA 1985, and others.

The

important provisions of SICA were:-

It

provided for the constitution of two quasi-judicial bodies, that is, Board for

Industrial and Financial Reconstruction (BIFR)

and Appellate Authority for Industrial and Financial Reconstruction (AAIFR).

BIFR was

set up as an apex board to tackle industrial sickness and was entrusted with

the work of taking appropriate measures for revival and rehabilitation of

potentially sick undertakings

and for

liquidation of non-viable companies.

AAIFR was

constituted for hearing the appeals against the orders of the BIFR.

BIFR

would make an inquiry as it may deem fit for determining whether any industrial

company had become sick.

BIFR may

appoint one or more persons as special director(s) of the company for

safeguarding the financial and other interests of the company.

The measures include:-

The financial reconstruction

The

proper management by change in or take over of the management of the company;

The amalgamation of the sick industrial

The sale

or lease of a part or whole of the sick industrial company;

Such

other preventive, ameliorative and remedial measures as may be appropriate;

Such

incidental, consequential or supplemental measures as may be necessary or

expedient in connection with or for the purposes of the measures specified

above.

The

important provisions of SICA were:-

Under the

Act, whosoever violates its provisions or any scheme or any order of the Board

or of the Appellate Authority, shall be punishable with imprisonment for a term

which may extend to three years and shall also be liable to a fine.

Sick

Industrial Companies (Special Provisions) Act,1985 (SICA) was repealed and

replaced by Sick Industrial Companies (Special Provisions) Repeal Act,2003.

The new

Act diluted some of the provisions of SICA & aimed to combat industrial

sickness ,reduce the same by ensuring that companies do not view declaration of

sickness as an escapist route from legal provisions after the failure of the

project or similar other reasons and thereby gain access to various benefits or

concessions from financial institutions.

Under it,

the Board for Industrial and Financial Reconstruction (BIFR) and Appellate

Authority for Industrial and Financial Reconstruction (AAIFR) were dissolved

and replaced by National Company Law Tribunal (NCLT) and National Law Appellate

Tribunal (NCLAT) respectively.

RBI guide

lines…

•

RBI has constituted a standing coordination

committee to consider issues relating to coordination between commercial banks

and lending institutions.

•

A special cell has been set up within the

rehabilitation finance division of IDBI to attend the case of sickness.

•

RBI has issued suitable guidelines to the banks to

ensure the potentially viable sick units receive attention and timely support

from banks.

•

RBI has clarified that units becoming sick on

account of wilful mis-management, wilful

default

should not be considered for rehabilitation.

Rehabilitation

Programme:

a) Change

management

b) Development

of a suitable management information system

c) A

settlement with the creditors for payment of their dues in a phased manner,

taking into account the expected cash generation as per viability study

d) Determination

of the sources of additional funds needed to refinance.

e) Modernization

of plant and equipment or expansion of an existing programme or even

diversification of the products being manufactured.

f) Concession

or reliefs or assistance to be allowed by the state level corporation

,financial institutions and central government.

RECOMMENDATIONS:

I.

A

Financial reorganisation may involve some sacrifices by the creditors

and shareholders of the undertaking

which can be in several forms:-

1.

Reduction of the par value of shares.

2.

Reduction in rates of interest.

3.

Postponement of maturity of debt.

4.

Conversion of debt into equity.

5.

Change in the nature of claim or obligation such as

from secured to unsecured.

6.

Concession by the Government in the form of reduction

or waiving of indirect taxes, electricity dues etc.

II.

Monitoring and nursing the sick units during

infancy

III.

Incentives should be provided to professional

managers helping in reviving sick units

IV. Issuing guidelines on major aspects that

affect the image of the company

V.

Brain storm with a select group to get creative

ideas for improvement

VI. Adopt

better practices, right technology, better work culture and professional

management so that the sick industries can improve their health as well as the

economy.

Related Topics