International Economics - Foreign Direct Investment (FDI) and Trade | 12th Economics : Chapter 7 : International Economics

Chapter: 12th Economics : Chapter 7 : International Economics

Foreign Direct Investment (FDI) and Trade

Foreign Direct Investment (FDI) and Trade

FDI is an important factor in global economy. Foreign trade and

FDI are closely related. In developing countries like India, FDI in the natural

resource sector, including plantations, increases trade volume. Foreign

production by FDI is useful to substitute foreign trade. FDI is also influenced

by the income generated from the trade and regional integration schemes.

FDI is helpful to accelerate the economic growth by facilitating

essential imports needed for carrying out development programmes like capital

goods, technical know-how, raw materials and other inputs and even scarce

consumer goods.

When the export earnings of a country are not sufficient to

finance for imports, FDI may be required to fill the trade gap.

FDI is encouraged by the factors such as foreign exchange

shortage, desire to create employment and acceleration of the pace of economic

development. Many developing countries strongly prefer foreign investment to

imports. However, the real impact of FDI on different sections of an economy

(say India) may differ. It could be a boon for some as well as bane for others.

This may be discussed in the class – room. Large demand for USD, generated by

IMF and World Bank policies (FUND – BANK POLICIES), help the USD to gain value

continuously. This is one of the hidden agenda of Fund – Bank policies.

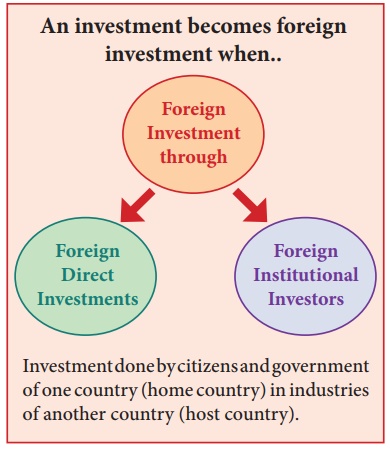

1 Meaning of FDI

FDI means an investment in a foreign country that involves some

degree of control and participation in management. It corresponds to the

investment made by a multinational enterprise in a foreign country. It is

different from portfolio investment, which is primarily motivated by short term

profit and it does not seek management control.

Foreign Portfolio Investment (FPI) means the entry of funds into a

nation where foreigners deposit money in a nation’s bank or make purchase in

the stock and bond markets, sometimes for speculation. FPI is part of capital

account of BoP.

2. Objectives of FDI

FDI has the following objectives.

1. Sales Expansion

2. Acquisition of resources

3. Diversification

4. Minimization of competitive risk.

Foreign Institutional Investment (FII) is an investment in hedge

funds, insurance companies, pension funds and mutual funds. Foreign

institutional investment is a common term in the financial sector of India. For

example, a mutual fund in the United States can make investment in an

India-based company.

3. Advantages of FDI

Foreign investment mostly takes the form of direct investment.

Hence, we deal here with the foreign direct investment.

The important advantages of foreign direct investment are the

following:

1.

FDI may help to increase the investment level and thereby the

income and employment in the host country.

2.

Direct foreign investment may facilitate transfer of technology to

the recipient country.

3.

FDI may also bring revenue to the government of host country when

it taxes profits of foreign firms or gets royalties from concession agreements.

4.

A part of profit from direct foreign investment may be ploughed

back into the expansion, modernization or development of related industries.

5.

It may kindle a managerial revolution in the recipient country

through professional management and sophisticated management techniques.

6.

Foreign capital may enable the country to increase its exports and

reduce import requirements. And thereby ease BoP disequilibrium.

7.

Foreign investment may also help increase competition and break

domestic monopolies.

8.

If FDI adds more value to output in the recipient country than the

return on capital from foreign investment, then the social returns are greater

than the private returns on foreign investment.

9.

By bringing capital and foreign exchange FDI may help in filling

the savings gap and the foreign exchange gap in order to achieve the goal of

national economic development.

10. Foreign investments may

stimulate domestic enterprise to invest in ancillary industries in

collaboration with foreign enterprises.

11. Lastly, FDI flowing into

a developing country may also encourage its entrepreneurs to invest in the

other LDCs. Firms in India have started investing in Nepal, Uganda, Ethiopia

and Kenya and other LDCs while they are still borrowing from abroad. Larger FDI

to India comes from a small country (Mauritius).

4. Disadvantages of FDI

The following criticisms are leveled against foreign direct

investment.

1.

Private foreign capital tends to flow to the high profit areas

rather than to the priority sectors.

2.

The technologies brought in by the foreign investor may not be

appropriate to the consumption needs, size of the domestic market, resource

availabilities, stage of development of the economy, etc.

3.

Foreign investment, sometimes, have unfavorable effect on the

Balance of Payments of a country because when the drain of foreign exchange by

way of royalty, dividend , etc. is more than the investment made by the foreign

concerns.

4.

Foreign capital sometimes interferes in the national politics.

5.

Foreign investors sometimes engage in unfair and unethical trade

practices.

6.

Foreign investment in some cases leads to the destruction or

weakening of small and medium enterprises.

7.

Sometimes foreign investment can result in the dangerous situation

of minimizing / eliminating competition and the creation of monopolies or

oligopolistic structures.

8.

Often, there are several costs associated with encouraging foreign

investment.

5. FDI in India

The early 1990s witnessed reforms in the economic policy. This

helped to open up Indian markets to FDI. FDI in India has increased over the

years. In India, FDI has been advantageous in terms of free flow of capital,

improved technology, management expertise and access to international markets.

The major sectors benefited from FDI in India are:

i.

financial sector (banking and non-banking)

ii.

insurance

iii.

telecommunication

iv.

hospitality and tourism

v.

pharmaceuticals and

vi.

software and information technology.

FDI is not permitted in the industrial sectors like

i.

Arms and ammunition

ii.

atomic energy,

iii.

railways,

iv.

coal and lignite and

v.

mining of iron, manganese, chrome, gypsum, sulphur, gold,

diamonds, copper etc.,

FDI inflow in India has increased from $ 97 million in 1990-91 to

$5,535 million in 2004-2005. It amounted to $32,955 million in 2011-2012.

UNCTAD’s World Investment Report 2018 reveals that FDI to India declined to $40

billion in 2017 from $44 billion in 2016.

Related Topics