Chapter: Business Science : Financial Management : Financing and Dividend Decision

Financing Capital Structure

Capital Structure

Introduction

Capital

is the major part of all kinds of business activities, which are decided by the

size, and nature of the business concern. Capital may be raised with the help

of various sources. If the company maintains proper and adequate level of

capital, it will earn high profit and they can provide more dividends to its

shareholders.

Meaning

of Capital Structure

Capital

structure refers to the kinds of securities and the proportionate amounts that

make up capitalization. It is the mix of different sources of long-term sources

such as equity shares, preference shares, debentures, long-term loans and

retained earnings.

The term

capital structure refers to the relations hip between the various long- term

source financing such as equity capital, preference share capital and debt

capital.

Deciding

the suitable capital structure is the important decision of the financial management

because it is closely related to the value of the firm.

Capital

structure is the permanent financing of the company represented primarily by

long-term debt and equity.

Definition

of Capital Structure

The

following definitions clearly initiate, the meaning and objective of the

capital structures.

According to the definition of Gerestenbeg,

―Capital Structure of a company refers to the composition or make up of its

capitalization and it includes all long-term capital resources.

1 Meaning Of Capital Structure

The term

financial structure is different from the capital structure. Financial

structure shows the pattern total financing. It measures the extent to which

total funds are available to finance the total assets of the business.

Financial

Structure = Total liabilities

Or

Financial

Structure = Capital Structure + Current liabilities.

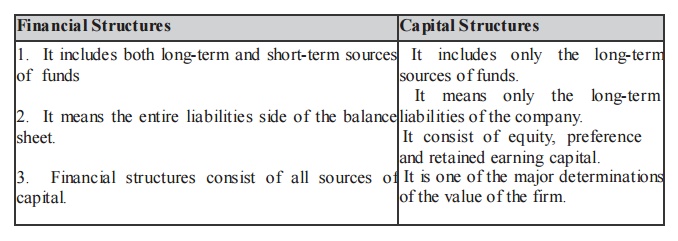

Financial Structures

1. It

includes both long-term and short-term sources of funds

2. It

means the entire liabilities side of the balance sheet.

3.

Financial structures consist of all sources of capital.

Capital Structures

It

includes only the long-term sources of funds.

It means

only the long-term liabilities of the company.

It

consist of equity, preference and retained earning capital.

It is one

of the major determinations of the value of the firm.

Optimum Capital Structure

Optimum

capital structure is the capital structure at which the weighted average

cost of

capital is minimum and thereby the value of the firm is maximum.

Optimum capital structure may be defined as

the capital structure or combination

of debt

and equity, that leads to the maximum value of the fir m.

2 Objectives of Capital Structure

Decision

of capital structure aims at the following two important objectives:

1.

Maximize the value of the fir m.

2.

Minimize the overall cost of capital.

Forms of Capital Structure

Capital

structure pattern varies from company to company and the availability of

finance.

Normally the following forms of capital structure are popular in practice.

o Equity

shares only.

o Equity

and preference shares only.

o Equity

and Debentures only.

o Equity

shares, preference shares and debentures.

3 Factors Determining Capital structure

Leverage

It is the

basic and important factor, which affect the capital structure. It uses the

fixed cost financing such as debt, equity and preference share capital. It is

closely related

To the

overall cost of capital.

Cost of Capital

Cost of

capital constitutes the major part for deciding the capital structure of a

firm. Normally long- term finance such as equity and debt consist of fixed cost

while mobilization. When the cost of capital increases, value of the firm will

also decrease. Hence the fir m must take careful steps to reduce the cost of

capital.

Nature of the business:

Use of fixed interest/divide nd bearing finance depends upon the nature of the

business. If the business consists of long period of operation, it will apply

for equity than debt, and it will reduce the cost of capital.

Size of the company:

It also affects the capital structure of a firm. If the fir m belongs to large

scale, it can manage the financial requirements with the help of internal sources. But

if it is small size, they will go for external finance.

It

consists of high cost of capital.

Legal requirements :

Legal require me nts are also one of the considerations while dividing the

capital structure of a firm. For example, banking companies are restricted to

raise funds from some sources.

Requirement of investors :

In order to collect funds from different type of investors, it will be

appropriate for the companies to issue different sources of securities.

Related Topics