Economics - Elasticity of Demand | 11th Economics : Chapter 2 : Consumption Analysis

Chapter: 11th Economics : Chapter 2 : Consumption Analysis

Elasticity of Demand

Elasticity

of Demand

The Law

of Demand explains the direction of change in demand due to change in the

price. It fails to explain the rate of change in demand due to a given change

in price. Elasticity of demand explains the rate of change in quantity demanded

due to a given change in price.

“Elasticity

of demand is, therefore, a technical term used by the Economists to describe

the degree of responsiveness of the Quantity demand for a commodity to a change

in its price”.

- Stonier

And Hague

Elastic

demand or More Elastic demand

Demand

for a commodity is said to be “Elastic” when the quantity demanded increases by

a large amount due to a little fall in the price and decreases by a large

amount

due a little rise in the price. To be more scientific, Elastic demand is called

as “More Elastic Demand”.

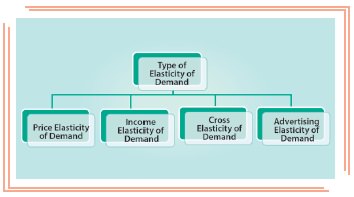

1. Types of Elasticity of Demand

Price Elasticity of Demand

Price elasticity

of demand is commonly known as elasticity of demand. This is because price is

the most influential factor affecting demand. “Elasticity of demand measures

the responsiveness of the quantity demanded to changes in the price”.

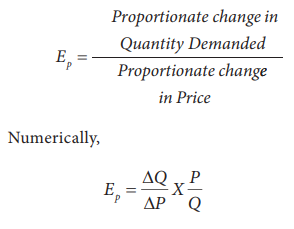

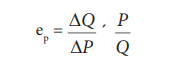

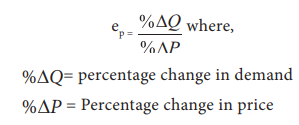

1. Price Elasticity of Demand: The price

elasticity of demand, commonly known as the

elasticity of demand refers to the responsiveness and sensitiveness of

demand for a product to the changes in its price. In other words, the price

elasticity of demand is equal to

where, ΔQ = Q1 –Q0,

ΔP = P1 – P0,

Q1=

New quantity,

Q0= Original quantity,

P1 = New price,

P0 = Original price.

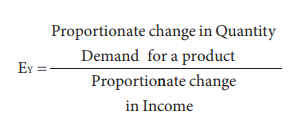

2. Income Elasticity of Demand: The

income is also a factor that influences the

demand for a product. Hence, the degree of responsiveness of a change in

demand for a product due to the change in the income is known as income

elasticity of demand. The formula to compute the income elasticity of demand

is:

For most

of the goods, the income elasticity of demand is greater than one indicating

that with the change in income the demand will also change and that too in the

same direction, i.e. more income means more demand and vice-versa.

3. Cross Elasticity of Demand: The cross elasticity of demand refers to the percentage change in quantity demanded for one commodity as a result of a small change in the price of another commodity. This type of elasticity usually arises in the case of the interrelated goods such as substitutes and complementary goods. The cross elasticity of demand for goods X and Y can be expressed as:

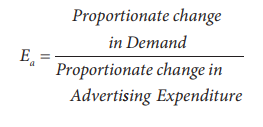

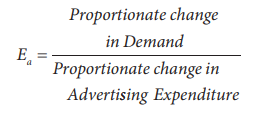

4. Advertising Elasticity of Demand: The

responsiveness of the change in demand due to the change in advertising or other promotional expenses, is known as

advertising elasticity of demand. It can be expressed as:

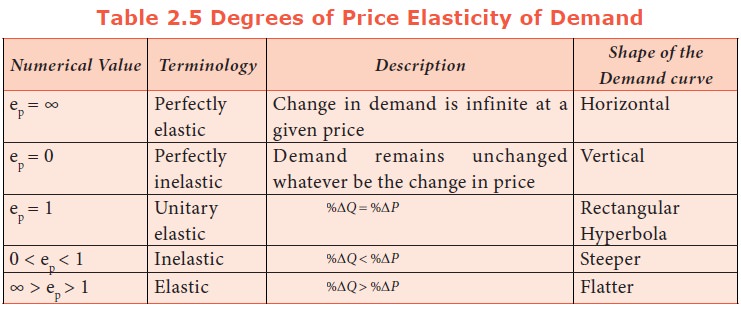

2. Levels or Degrees of Price Elasticity of Demand

Definition: The Price Elasticity of Demand is commonly known as the elasticity of demand, which refers to the degree of

responsiveness of demand to the change in the price of the commodity.

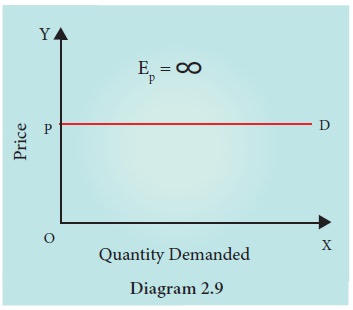

1. Perfectly Elastic Demand (Ep = ∞):

The

demand is said to be perfectly elastic when a slight change in the price of a

commodity causes an infinite change in its quantity demanded. Such as, even a

small rise in the price of a commodity can result in greater fall in demand

even to zero. In some cases a little fall in the price can result in the

increase in demand to infinity. In perfectly elastic demand the demand curve is

a horizontal straight line parallel

to x axis.

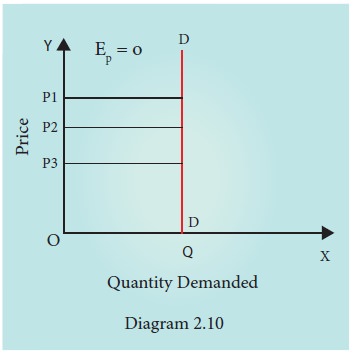

2. Perfectly Inelastic Demand (Ep =0):

When

there is no change in the demand for a product due to the change in the price,

then the demand is said to be perfectly inelastic. Here, the demand curve is a vertical straight line which shows that

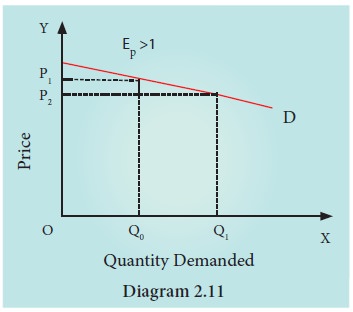

3. Relatively Elastic Demand (Ep>1):

The

demand is relatively elastic when the proportionate change in the demand for a

commodity is greater than the proportionate change in its price. Here, the

demand curve is gradually sloping

which shows that a proportionate change in quantity from 5 to 10 is greater

than the proportionate change in the price from 11 to 10. Change in demand is:

10–5/5 ×

100 = 100%

Change in

price =10%. Hence, it is more elastic demand.

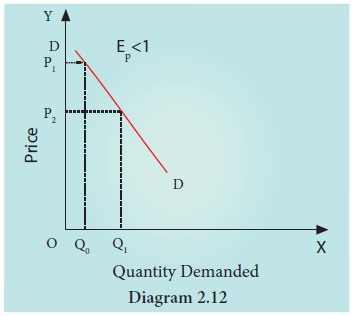

4. Relatively Inelastic Demand (Ep<1):

When the

proportionate change in the demand for

a product

It is also called as the elasticity less than unity. Here the demand curve is steeply sloping, which shows that the change in the quantity from OQ0 to OQ1 is relatively smaller than the change in the price from OP1 to Op2.

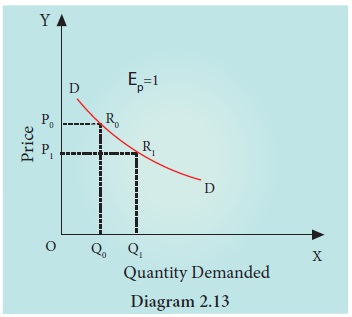

5. Unitary Elastic Demand (Ep =1):

The demand is unitary elastic when the proportionate change in the price of a product results in the same propionate change in the quantity demanded. Here the shape of the demand curve is a rectangular hyperbola, which shows that area under the curve is equal to one.

Here OP0

R0Q0 = OP1 R1Q1

3. Determinants of Elasticity of Demand

There are

many factors that determine the degree of price elasticity of demand. Some of

them are described below:

a. Availability of Substitutes:

If close

substitutes are available for a product, then the demand for that product tends

to be very elastic. If the price of that product increases, buyers will buy its

substitutes; hence fall in its demand will be very large. Hence, price

elasticity will be larger. Eg. Vegetables.

For salt

no close substitutes are available. Hence even if price of salt increases the

fall in demand may be zero or less. Hence salt is price inelastic.

b. Proportion

of consumer’s income spent’ if smaller proportion of consumer’s income is spent

on particular commodity say X, price elasticity of demand for X will be

smaller. Take for example salt, people spend very small proportion of their

income on salt. Hence, salt will have small elasticity of demand, or inelastic.

c. Number of uses of commodity:

If a

commodity is used for greater number of uses, its price elasticity will also be

larger. For example, milk is used as butter milk, curd, ghee and for making ice

cream etc. Hence, even the small fall in the price of milk, will tempt the

consumers to use more milk for many purposes. Hence milk has greater price

elasticity of demand.

d. Complementarity between goods:

For

example, along with petrol, lubricating oil is also used for running

automobiles. Here, a rise in the price of lubricating oil may not reduce the

demand for lubricating oil. Hence, the complementary good, here, lubricating

oil, will be price inelastic.

e. Time:

In the long run, the price elasticity of demand for many goods will be larger.

This is

so because, in the long run many substitutes can be discovered or invented.

Therefore,

the demand is generally more elastic in the long run, than in the short run.

In the

short run bringing out new substitutes is difficult.

4. Measurement of Elasticity of Demand

There are

three methods of measuring price elasticity of demand.

1. The Percentage Method

It is also

known as ratio method, when we measure the ratio as:

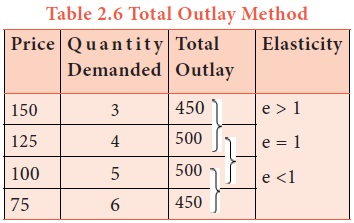

2. Total Outlay Method

Marshall

suggested that the simplest way to decide whether demand is elastic or

inelastic is to examine the change in total outlay of the consumer or total

revenue of the firm.

Total

Revenue = ( Price x Quantity Sold)

TR = (P x

Q)

Where

there is inverse relation between Price and Total Outlay, demand is elastic.

Direct relation means inelastic. Elasticity is unity when Total Outlay is

constant.

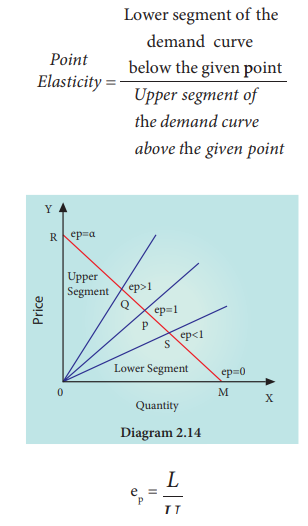

3. Point or Geometrical Elasticity

When the

demand curve is a straight line, it is said to be linear. Graphically, the

point elasticity of a linear demand curve is shown by the ratio of the segments

of the line to the right and to the left of the particular point.

Where ‘ep’

stands for point elasticity, ‘L’ stands for the lower segment and ‘U’ for the

upper segment.

5. Importance of Elasticity of Demand

The

concept of elasticity of demand is of much practical importance.

1.

Price

fixation: Each seller under monopoly and imperfect competition has to take into account elasticity of demand while

fixing the price for his product. If the demand for the product is inelastic,

he can fix a higher price.

2.

Production:

Producers

generally decide their production level on the basis of demand for the product.

3.

Distribution:

Elasticity

of demand also helps in the determination of rewards for factors of production.

4.

International

trade: Elasticity of demand helps in finding out the terms of trade between two countries. Terms of trade

depends upon the elasticity of demand for the goods of the two countries.

5.

Public

finance: Elasticity of demand helps the government in formulating tax policies. For

example, for imposing tax on a commodity.

6.

Nationalization:

The

concept of elasticity of demand enables the government to decide over nationalization of industries.

Related Topics