Auditing - Duties of an Auditor [Sec.143] | 12th Auditing : Chapter 9 : Qualifications, Rights and Duties of Auditor

Chapter: 12th Auditing : Chapter 9 : Qualifications, Rights and Duties of Auditor

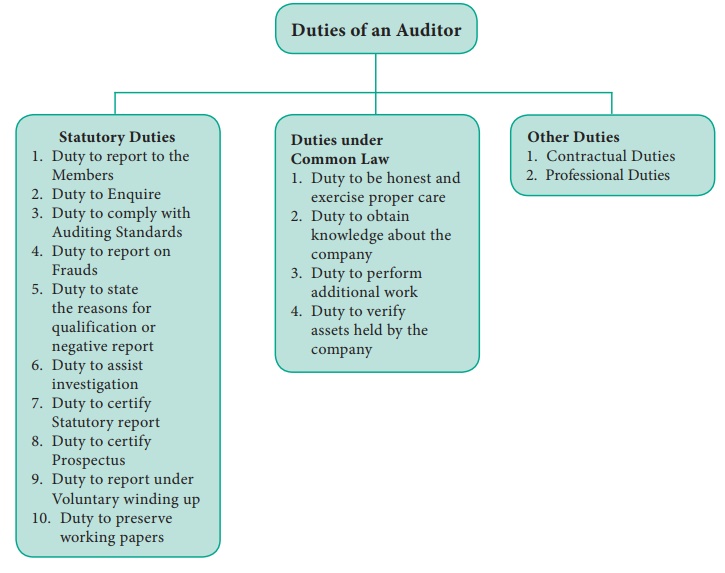

Duties of an Auditor [Sec.143]

Duties of an Auditor [Sec.143]

1. Statutory Duties

1. Duty to report to the Members [Sec.143 (3)]:

The

auditor shall make a report to the members of the company on accounts and

financial statements examined by him.

The

report shall state:

a. Whether

he has sought and obtained all necessary information and explanations.

b. Whether

proper books of accounts has been kept.

c.

Whether company’s Balance Sheet and Profit and Loss account are in agreement

with books of accounts and returns.

2. Duty to Enquire [Sec.143 (1)]:

It is

the duty to inquire into the following matters:

·

Whether loans and advances made by the company

based on security have been properly secured and whether the terms on which

they have been made are prejudicial to the interests of the company or its

members.

·

Whether transactions of the company, which are

represented merely by book entries, are prejudicial to the interests of the

company.

·

Whether loans and advances made by the company

have been shown as deposits.

·

Whether personal expenses have been charged to

revenue account.

·

Whether it is stated in the books and documents

of the company that any shares have been allotted for cash, whether cash has

actually been received in respect of such allotment, and if no cash has

actually been so received, whether the position as stated in the account books

and the balance sheet is correct, regular and not misleading.

3. Duty to comply with Auditing Standards [Sec.143 (9)]:

·

Every auditor shall comply with the auditing

standards.

·

The Central Government shall notify standards

in consultation with National Financial Reporting Authority, (NFRA).

·

The government

shall also notify that auditor’s report shall include a

statement on such matters as notified.

4. Duty to report on Frauds [Sec. 143 (12)]:

When an

auditor suspects an offence involving fraud is being committed by officers or

employees of the company, he shall immediately report the matter to the Central

Government in such manner as may be prescribed.

5. Duty to state the reasons for qualified

or negative report [Sec.143 (4)]:

In case

of negative or qualified report, the reasons must be stated in the report.

6. Duty to assist investigation:

It is

the important duty of the auditor to assist the investigator to investigate the

affairs of the company. Further, it is the duty of the auditor,

·

To provide and preserve the necessary documents

which are in his custody to the investigator, and

·

To assist the investigator by providing all

assistance in connection with the investigation.

7. Duty to certify Statutory Report: The

auditor has to certify statutory report as correct to the extent of –

·

Shares allotted by the company,

·

Cash received in respect of such shares, and

·

An abstract of receipts and payments of the

company.

8. Duty to certify Prospectus:

It is

the duty of auditor to certify a report showing statement of profits or losses

and assets and liabilities of the company and its subsidiaries. The report

shall also include rates of dividend paid by the company for each of five

financial years preceding the issue of prospectus.

9. Duty to report under Voluntary winding up:

When the

company proposes for voluntary winding up, directors of the company have to

make a declaration of solvency. The auditor has to certify a report upon the

solvency based on the Profit and Loss Account and Balance Sheet.

10. Duty to preserve Working Papers: It is

the duty of an auditor to preserve and produce all books and papers relating to

the company which are in his custody and to assist the inspector appointed by

the government for investigation.

2. Duties under Common Law

1. Duty to be honest and exercise proper care:

The auditor

should be straightforward, honest and tactful and must not be influenced by

others in discharge of his duties. He should be careful and cautious in

performing his duties.

2. Duty to obtain knowledge about the company:

He

should obtain detailed knowledge about the activities and affairs of the

company.

3. Duty to perform additional work: The

auditor besides performing the statutory duties is bound to perform additional

work by passing a resolution in the general meeting or making a provision in

the Articles of Association of the company.

4. Duty to verify assets held by the company:

It is

the duty of the auditor to verify assets of the company.

3. Other Duties

1. Contractual Duties:

The

auditor’s duty will depend upon the terms and conditions of his appointment

between him and the party who appointed him.

1. Professional Duties:

The

auditor has to observe the ethics given by the Institute of Chartered

Accountants of India. He should correspond with the previous auditor before

accepting the assignment.

Related Topics