Final Accounts of Sole Proprietors | Accountancy - Closing entries and Opening entry | 11th Accountancy : Chapter 12 : Final Accounts of Sole Proprietors - I

Chapter: 11th Accountancy : Chapter 12 : Final Accounts of Sole Proprietors - I

Closing entries and Opening entry

Closing entries and Opening entry

Closing entries

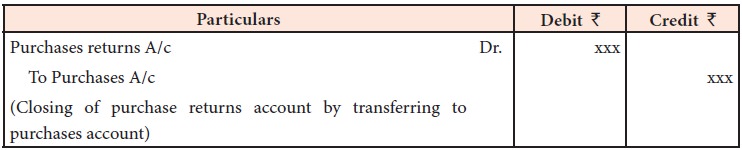

Balances of all the nominal accounts are required to be closed on the last day of the accounting year to facilitate the preparation of trading and profit and loss account. It is done by passing necessary closing entries in the journal proper. Purchases has debit balance and purchases returns has credit balance. At the end of the accounting year, the balance in purchases returns account is closed by transferring to purchases account.

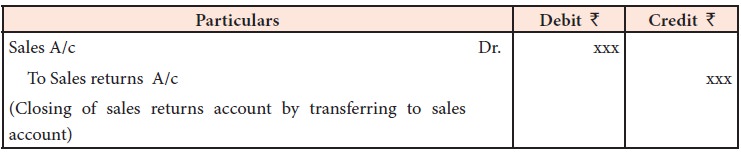

Similarly, sales account has

credit balance and sales returns has debit balance. At the end of the

accounting year, the balance in sales returns account is closed by transferring

to sales account. The various closing entries are as follows:

1. For closing purchases returns account

2. For closing sales returns account

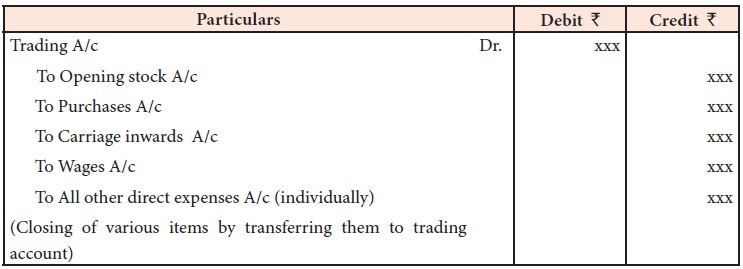

3. For closing opening stock and direct expenses, i.e., items that

appear on the debit side of trading account

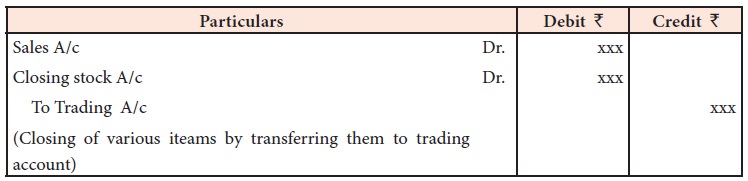

4. For closing sales and closing stock, i.e., items that appear on the

credit side of trading account

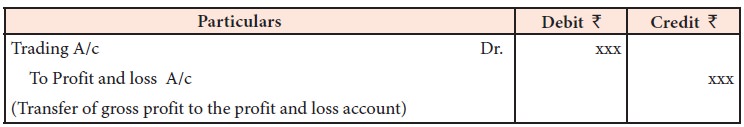

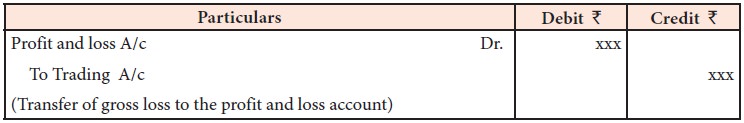

5. For transfer of gross profit or gross loss to profit and loss account

(a) For gross profit

(b) For gross loss

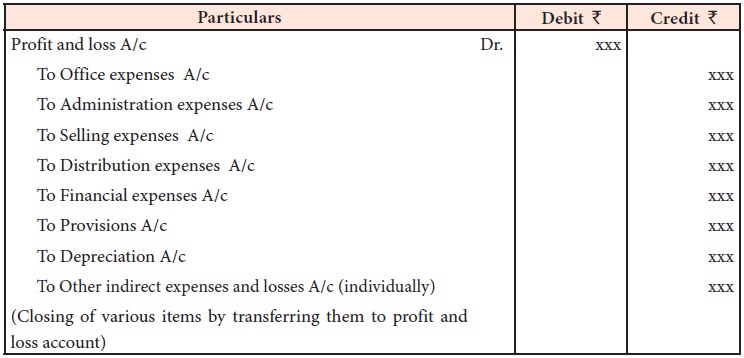

6. For closing indirect expenses and losses, i.e., items that appear on

the debit side of profit and loss account

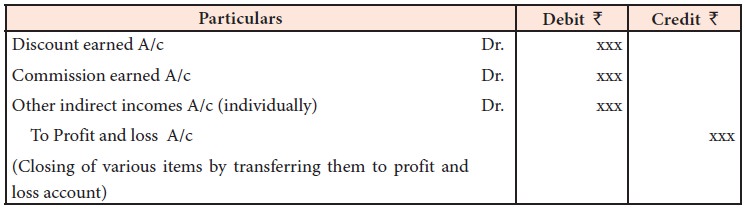

7. For closing the indirect incomes, i.e. items that appear on the

credit side of profit and loss account

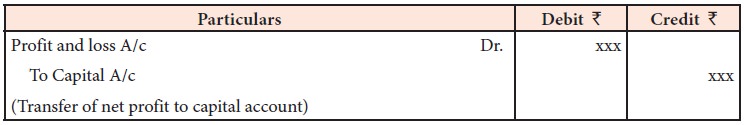

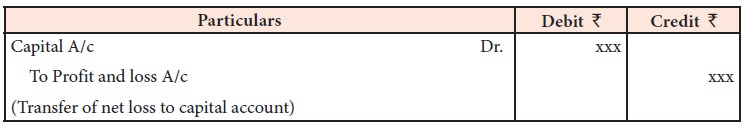

8. For transfer of net profit or net loss to capital account

(a) For net profit

(b) For net loss

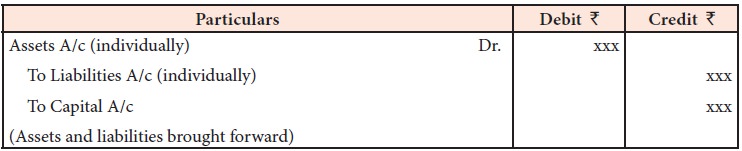

Opening entry

The balances of various accounts which are not closed at the end of the

accounting period are carried forward to the next accounting period. In fact,

the balances appearing in the balance sheet at the end of an accounting period

becomes the opening balances for the next accounting period. Hence, at the

beginning of every accounting year, an opening entry is made in the journal

proper to bring forward the balances in various accounts. The entry passed is

as follows:

Related Topics