Vouching of Cash Transactions | Auditing - Capital Expenditure | 11th Auditing : Chapter 6 and 7 : Vouching of Cash Transactions

Chapter: 11th Auditing : Chapter 6 and 7 : Vouching of Cash Transactions

Capital Expenditure

Capital Expenditure

Capital expenditure is the amount spent on

acquisition of fixed assets which include purchase of (1) Land and Buildings,

(2) Plant and Machinery, (3) Motor Vehicles, (4) Investments and (5) Patents

and copyrights. The procedures in vouching various items of capital expenditure

are as follows:

Purchase of Land and Buildings

Auditor should examine the title deeds and sale

agreements of the property purchased.

When assets are purchased on leasehold basis, lease

agreement should be verified with regard to lease rent, period, terms etc. In

case of purchase of freehold asset, auditor should examine the correspondence

directly from the seller. He should ensure that all expenses incurred in

connection with purchase of a asset like auctioneers commission, brokerage,

architects fees, registration fees and legal charges, are capitalized. He

should also vouch all such payments with reference to receipts. When asset is

purchased through broker, the auditor should verify the brokers note. When

asset is purchased in auction, the account submitted by the auctioneer should

be examined. Similarly, auditor should ensure that all expenses incurred in

connection with construction of a building like materials purchased, wages

paid, cartage has been capitalized. In case of construction of a building,

auditor should examine the construction contracts and architects certificate.

Documents to be Vouched: (1) Title

Deeds, Sale Agreements, (2) Lease Agreement, (3) Correspondences with Seller,

(4) Auctioneers Statement, (5) Architects Certificate, (6) Contractors

Agreement, (7) Receipts.

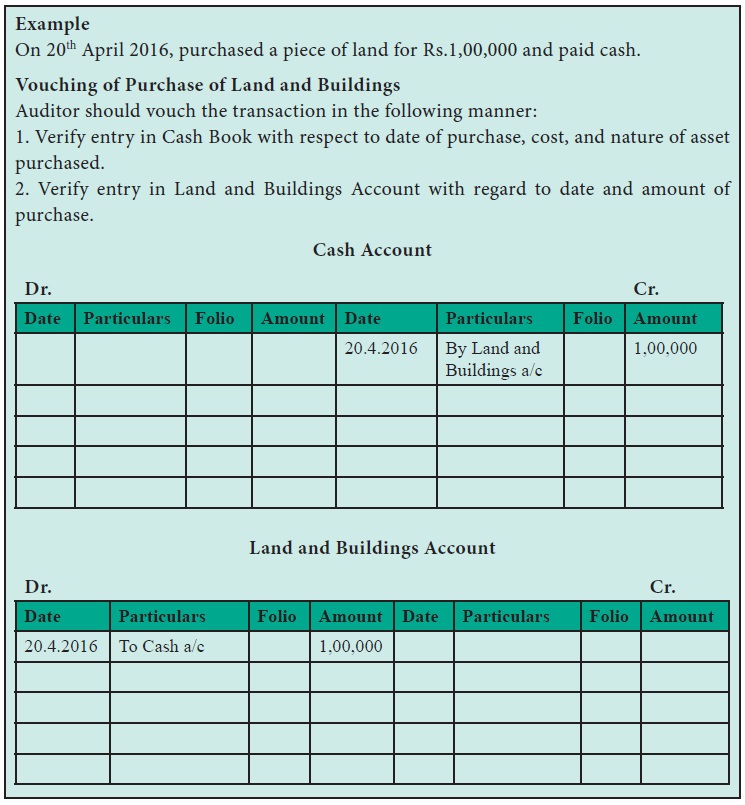

Example

On 20th April 2016, purchased a piece

of land for Rs.1,00,000 and paid cash.

Vouching of Purchase of Land and Buildings

Auditor should vouch the transaction

in the following manner:

1. Verify entry in Cash Book with

respect to date of purchase, cost, and nature of asset purchased.

2. Verify entry in Land and Buildings

Account with regard to date and amount of purchase.

Purchase of Plant and Machinery / Furniture And Fixtures

When plant and machinery are purchased, auditor

should vouch the invoices and receipts received from the vendors. He should

ensure that all incidental charges connected with the asset are capitalized and

added with the cost of asset. He should also carefully scrutinize that expenses

in connection with repairs and maintenance are not capitalized. When the asset

is purchased on Hire purchase, he should verify the Hire purchase agreement and

related vouchers. When the asset is purchased on Auction, Auctioneers statement

of account should be verified. In case of purchase of imported machinery, any

import duty and clearing charges should be debited to asset account.

Documents to be Vouched:

(1) Invoice from Vendors, (2)

Receipts, Auctioneers Statement of Account, Hire Purchase Agreement.

Purchase of Motor Vehicles

Contract of purchase, invoice, broker’s note,

payee’s acknowledgement, asset receiving report and the registration book

showing the ownership in the name of the client should be examined.

Documents to be Vouched:

(1) Invoice, (2) Contract of

purchase, Registration book, (4) Brokers note and (5) Payees acknowledgement.

Purchase of Investments

Auditor should vouch payments made for purchase of

Investments with the Brokers Bought Note. He should verify that investments

purchased are properly authorized and registered in the name of the company. He

should physically examine the actual investment held by the company. In case of

new issue of securities, auditor should examine letters of allotment, bank

receipt for installments paid, share certificates etc. If investments are

purchased cum-dividend, auditor should verify that the expenditure has been

properly apportioned between capital and revenue. In case of inscribed stock,

certificate from the bank in whose books the stock is inscribed should be

obtained.

Documents to be Vouched:

(1) Brokers Bought Note, (2) Schedule

of Investments, (3) Share certificate, (4) Letters of Allotment and Bank

Receipt, Bank Certificate for Inscribed Stock.

Purchase of Patents and Copyrights

Patent is an exclusive right or privilege to make

or produce something and copyright is a right to produce an item of aparticular

design. Incase of purchase of patents and copyrights, auditor should obtain the

patents and copyrights list from the client and examine it with reference to

registration number, date, name of the seller, consideration paid etc. He

should verify the registration certificates, certificates for grant of patent,

documents of assignment, copyright agreements and receipt for renewal fees.

When patent is purchased through broker, brokers commission should be accounted

as capital expenditure and should be included in the cost of patent. Similarly,

when patents are received through research, research expenses should also be

capitalisied. On the other hand, he should ensure that renewal fees paid should

be not be capitalized but instead should be treated as revenue expenditure. He

should also ensure that lapsed patents have been written off from the books of

accounts.

Documents to be Vouched:

(1)List of Patents and Copyrights,

(2) Patent and Copyright Agreement, (3) Registration Certificates, (4) Document

of Assignment, (5) Receipts.

Related Topics