Accounts of Not-For-Profit Organisation | Accountancy - Balance Sheet | 12th Accountancy : Chapter 2 : Accounts of-Not-For Profit Organisation

Chapter: 12th Accountancy : Chapter 2 : Accounts of-Not-For Profit Organisation

Balance Sheet

Balance

Sheet

A Balance sheet is a

statement showing the financial position of an organisation. The preparation of

balance sheet of a not–for–profit organisation is more or less similar to that

of a trading concern. Assets and liabilities, as on the last date of the

accounting period are taken to the balance sheet (liabilities are taken on the

left side and assets on the right side of the balance sheet).

Important points in the preparation of a balance sheet of a not–for–profit organisation

(a) Capital fund also

called as general fund or accumulated fund is taken to the liabilities side.

Surplus in the income and expenditure account is added to the capital fund and

deficit is subtracted from the capital fund in the balance sheet.

Tutorial Note

If capital fund of the

organisation is not given in the problem, the opening balance sheet should be

prepared to ascertain the opening capital fund. The difference between the

total of assets and the total of liabilities as at the beginning of the year is

the opening capital fund.

Opening capital fund =

Assets at the beginning– Liabilities at the beginning

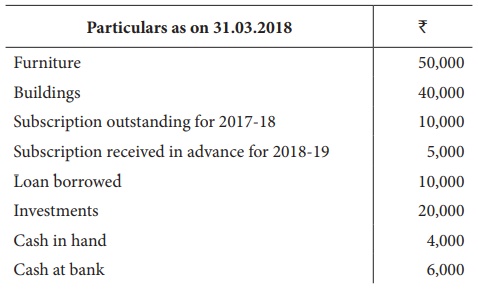

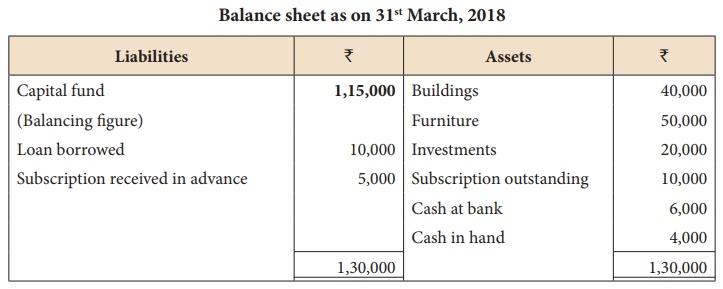

Illustration 16

Compute capital fund of

Karur Social Club as on 31.03.2018.

Solution

(b) While preparing the

balance sheet as at the end of the accounting year, the closing balances of

cash and bank should be taken to the assets side of the balance sheet. If there

is bank overdraft, that should be taken to the liabilities side of the balance

sheet.

(c) Assets appearing in

the previous year’s balance sheet, that is, in the opening balance sheet,

should be taken on the assets side of the current year balance sheet and

adjustments must be made for any change taking place during the year. While

taking such assets, additional assets purchased should be added and assets sold

should be subtracted. Depreciation on such assets should also be adjusted.

Tutorial note: New assets purchased or

assets sold are to be found out by referring to the receipts and payments

account.

(d) Prepaid expenses and

accrued incomes as at the end of the current year should be taken to the assets

side of the balance sheet.

(e) Outstanding expenses

at the end of the current year and any income received in advance during the

current year should be taken to the liabilities side of the balance sheet.

(f) If there are any

specific funds such as tournament fund, prize fund, etc., these funds should be

shown on the liabilities side of the balance sheet separately. Any income to

the fund should be added to the fund account and expenses relating to the fund

should be subtracted from the fund account in the balance sheet.

(g) If there is any

specific fund investment, that should be taken to the assets side of the

balance sheet.

Comprehensive problems

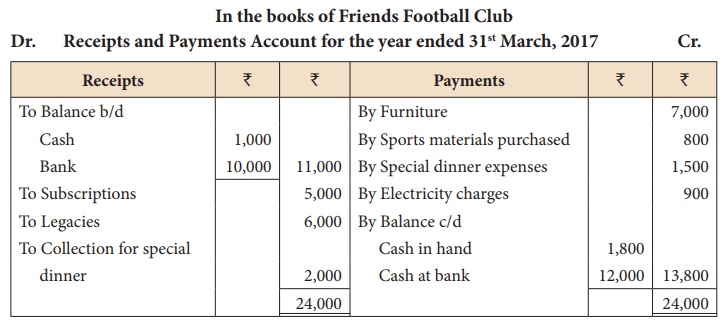

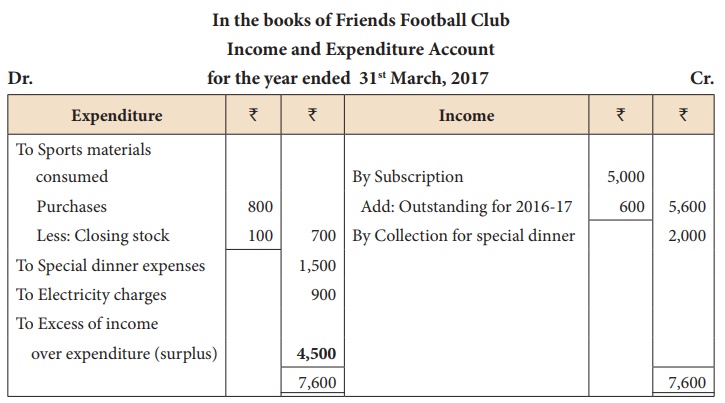

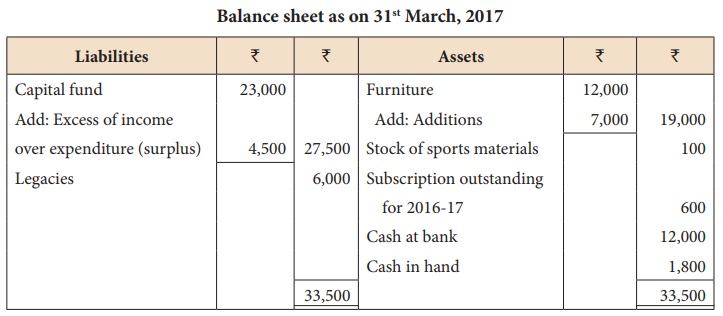

Illustration 17

From the following

Receipts and Payments Account of Friends Football club, for the year ending

31st March, 2017, prepare Income and Expenditure Account for the year ending

31st March, 2017 and the Balance sheet as on that date.

Additional information:

(i) The club had furniture of â‚ą

12,000 on 1st April 2016. Ignore depreciation on furniture.

(ii) Subscription outstanding for

2016-2017 â‚ą 600.

(iii) Stock of sports materials on

31.03.2017 â‚ą 100.

(iv) Capital fund as on 1st April

2016 was â‚ą 23,000.

Solution

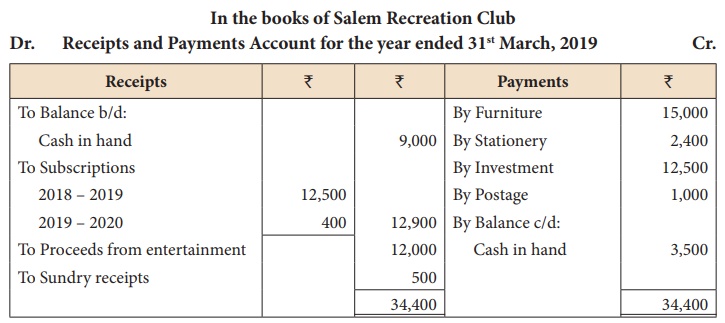

Illustration 18

Following is the

Receipts and Payments Account of Salem Recreation Club for the year ended 31st

March, 2019.

Additional information:

i.

There are 450 members each paying annual subscription of â‚ą 30.

ii.

Stock of stationery on 31st March, 2018 â‚ą 300 and on March 31,

2019 â‚ą 500.

iii.

Capital fund as on 1st April 2018 was â‚ą 9,300.

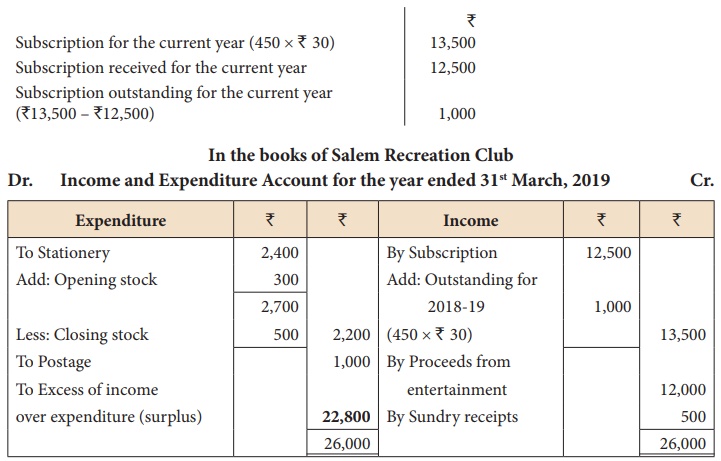

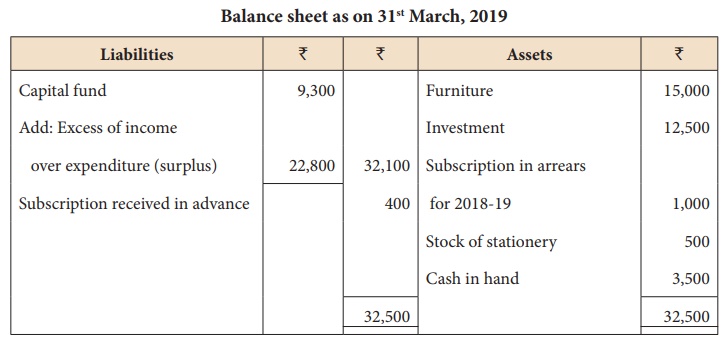

Prepare income and

expenditure account for the year ended 31st March, 2019 and the balance sheet

as on that date.

Solution

Calculation of subscription

to be received for the year 2018-19:

Illustration 19

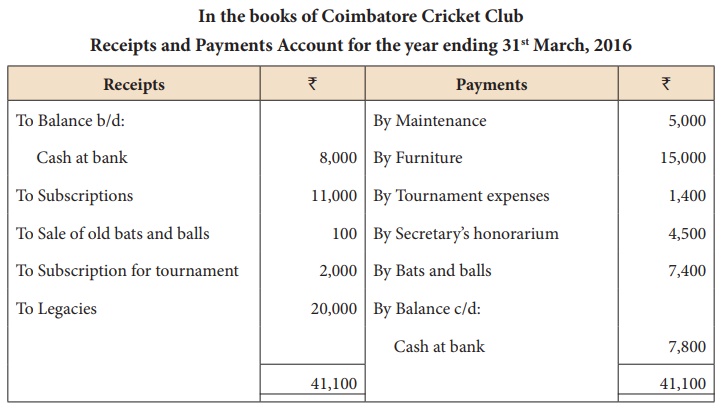

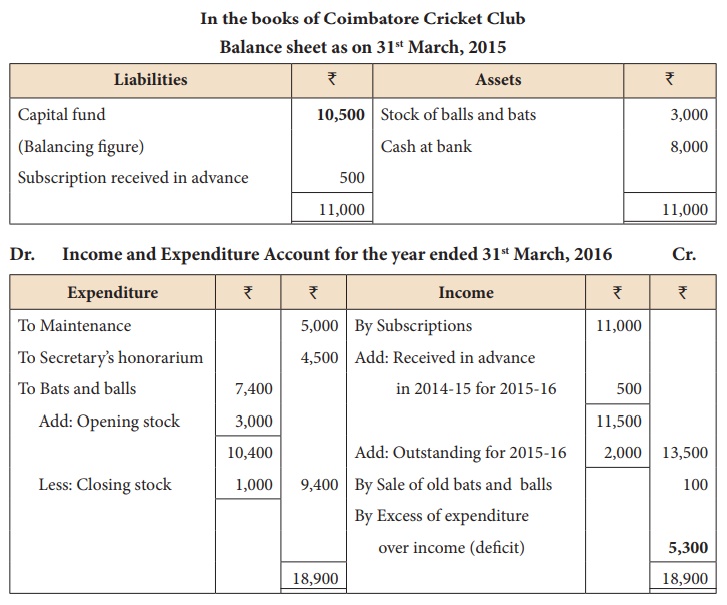

From the following

Receipts and Payments account of Coimbatore Cricket Club for the year ending

31st March 2016, prepare income and expenditure account for the year ending

31st March, 2016 and a balance sheet as on that date.

Additional information:

On 1st April, 2015 the

club had stock of balls and bats â‚ą

3,000 and an advance subscription of 500. Surplus on account of tournament

should be kept in reserve for permanent pavilion. Subscription due on

31.03.2016 was â‚ą

2,000. Stock of bats and balls on 31.3.2016 was â‚ą 1,000

Solution

Tutorial note

To find the opening

capital fund, opening balance sheet should be prepared.

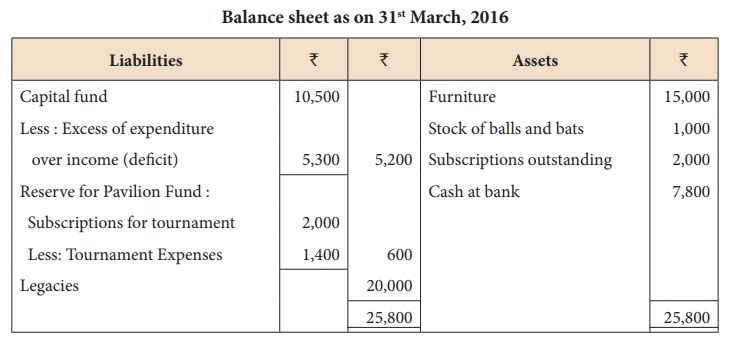

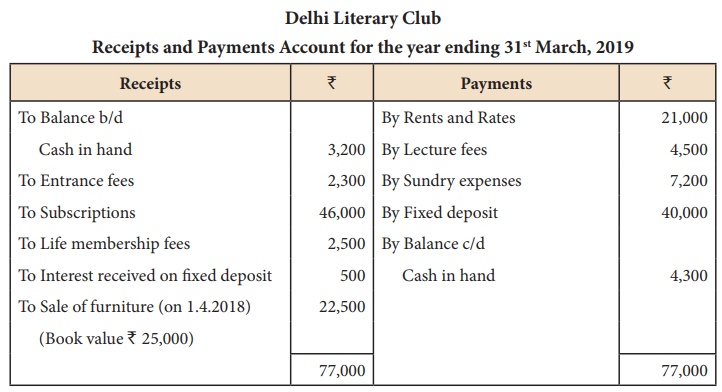

Illustration 20

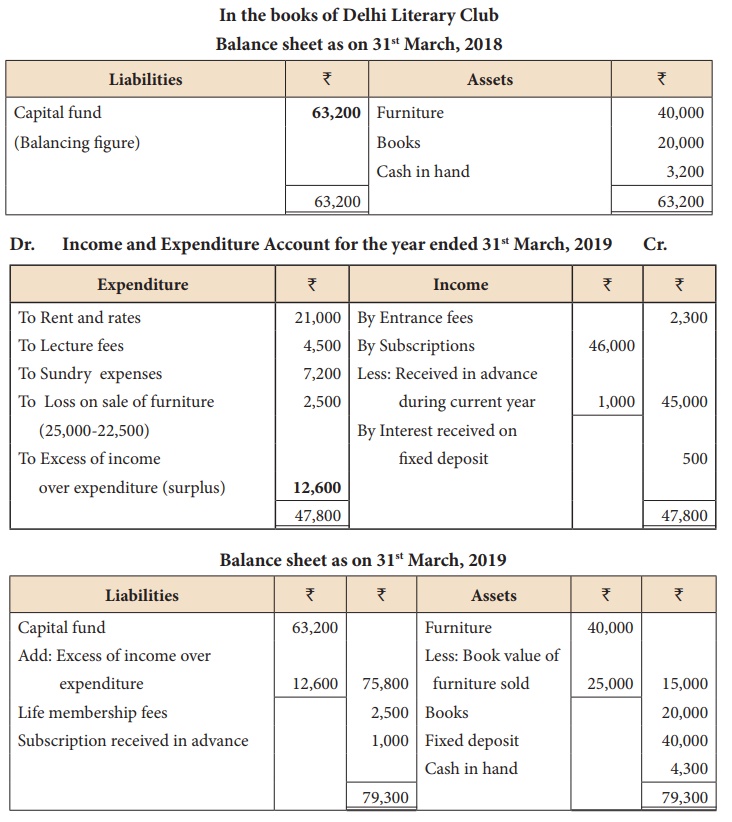

The following is the

summary of cash transactions of Delhi Literary Club for the year ending 31st

March, 2019.

Additional information

a) At the beginning of the

year the club possessed books worth â‚ą

20,000 and furniture worth â‚ą

40,000.

b) Subscription received in

advance during the current year amounted to â‚ą

1,000.

Prepare Income and

Expenditure account of the club for the year ending 31st March, 2019 and the

Balance sheet as on that date.

Solution

Tutorial note

To find the opening

capital fund, opening balance sheet should be prepared.

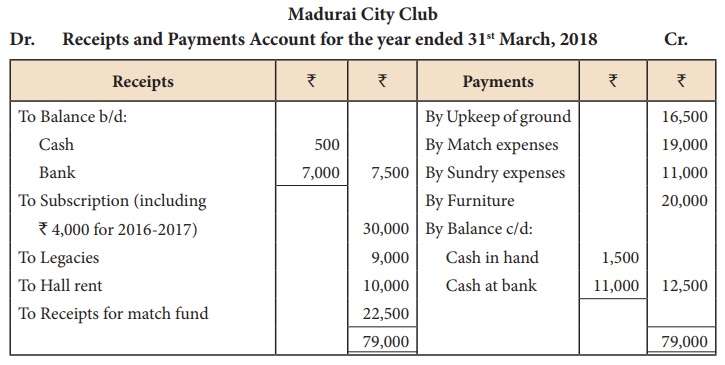

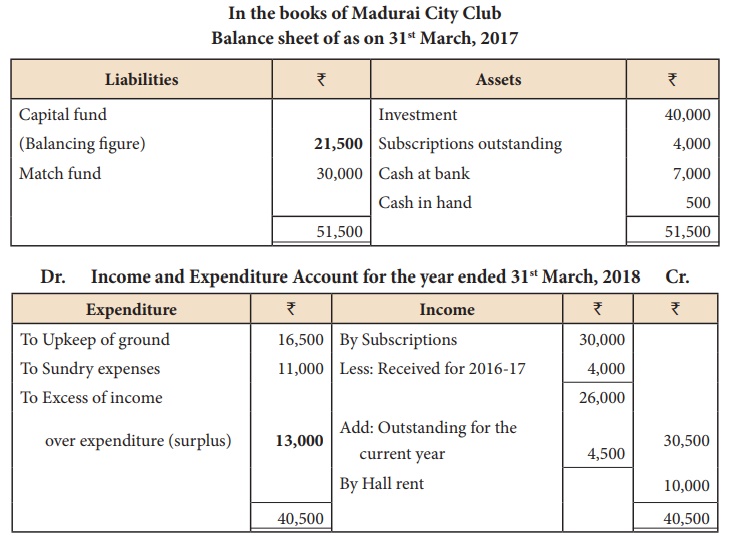

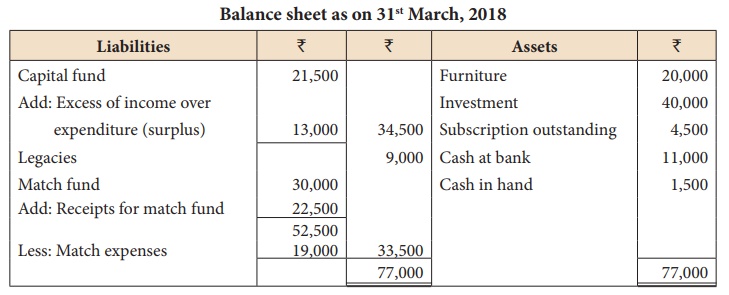

Illustration 21

The following is the

Receipts and Payments account of Madurai City Club for the year ending 31st

March, 2018.

Additional information:

On 1st April, 2017, the

club had investment of â‚ą

40,000. The club also had a credit balance of â‚ą 30,000 in Match fund account. On 31st March, 2017 subscriptions in

arrears were â‚ą 4,000 and the

subscriptions in arrears on 31st March, 2018 were â‚ą 4,500. Prepare the

final accounts.

Solution

Tutorial note

To find the opening

capital fund, opening balance sheet should be prepared.

Related Topics