Auditing - Audit of Shares issued for Cash | 12th Auditing : Chapter 10 : Company Audit

Chapter: 12th Auditing : Chapter 10 : Company Audit

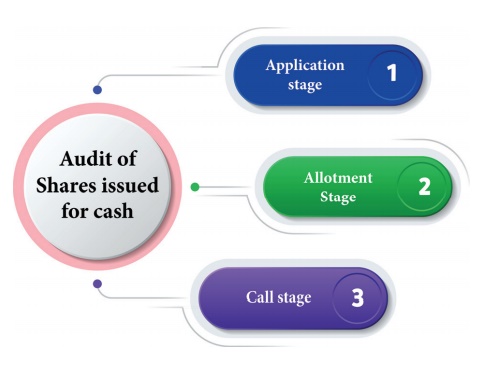

Audit of Shares issued for Cash

Audit of Shares issued for Cash

Shares

issued for cash can be done in three stages as: (a) Application Stage, where

applications were received along with application money; (b) Allotment Stage,

where allotment takes place and allotment money is received subject to the

receipt of minimum subscription; (c) Calls stage, where calls are made on

shares and the amount due is received.

a. APPLICATION STAGE

a)

The auditor should check the original share

application. He should check the entries in Application and Allotment Book.

b)

He should vouch the application money received

with Application and Allotment Book and the corresponding entries in cash book.

He should ensure that application money received was deposited in a scheduled

bank until the certificate of commencement of business is obtained. He should

verify whether application money received is not less than 5% of the nominal

value of shares issued.

c)

He should vouch the money refunded to

unsuccessful applicants with Application and Allotment Book, copies of letters

of regret and bank book.

d) He

should check the total columns of Application and Allotment Book and see that

proper journal entries have been passed in the books.

b. ALLOTMENT STAGE

a)

The auditor should see that allotment begins

only after the receipt of minimum subscription.

b)

He should examine the Directors’ Minute Book to

see that all the allotments have been approved by the Board.

c)

He should compare the copies of Letters of

Allotment and Letters of Regret with entries made in the Application and

Allotment Book.

d)

He should check the amount received on

allotment, by comparing Application and Allotment Book with Cash Book.

e)

He should check the postings in Share Register

of the amount received on application and allotment.

f)

He should see that the relevant RBI and FEMA

requirements, in case of allotment to non-residents.

g)

He should see that appropriate journal entry

debiting Share Allotment and crediting Share Capital Account has been duly

made.

c. CALL STAGE

a)

The auditor should examine the board of

director’s resolution in the Directors’ Minute Book for making calls.

b)

He should verify the amount received with the

counterfoil of receipts.

c)

He should compare the total amount due on calls

with the amount collected and entered in the cash book. He should trace out the

figures of call-in-arrears by comparing the ‘Schedule of Calls in Arrears’ with

Application and Allotment Book, and check the accuracy of the amount.

d) He

should see that appropriate journal entry debiting Calls Account and crediting

Share Capital Account has been duly made.

Related Topics