Books of Prime Entry | Accountancy - Approaches of recording transactions | 11th Accountancy : Chapter 3 : Books of Prime Entry

Chapter: 11th Accountancy : Chapter 3 : Books of Prime Entry

Approaches of recording transactions

Approaches of recording transactions

There are two

approaches for recording transactions, namely, i) Accounting equation approach

and ii) Traditional approach.

1. Accounting equation approach

The

relationship of assets with that of liabilities to outsiders and to owners in

the equation form is known as accounting equation.

Under the

double entry system of book keeping, every transaction has two fold effect,

which causes the changes in assets and liabilities or capital in such a way

that an accounting equation is completed and equated.

Capital +

Liabilities = Assets

Capital can

also be called as owner’s equity and liabilities as outsider’s equity.

Accounting equation is a mathematical expression which shows that the total of assets is equal to the total of liabilities and capital. This is based on the dual aspect concept of accounting. This means that total claims of outsiders and the proprietor against a business enterprise will always be equal to the total assets of the business enterprise

As the revenues and expenses will affect capital, the expanded equation may be given as under:

Assets =

Liabilities + Capital + Revenues – Expenses

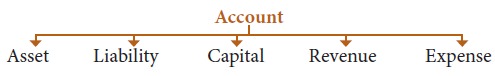

Therefore,

under this approach, accounts are classified into five categories: (i) Asset

account, (ii)

Liability account, (iii) Capital account, (iv)

Revenue account and (v) Expense account as follows:

i. Asset account

Any physical

thing or right owned that has a monetary value is called asset. The assets are

grouped and shown separately; for example, Land and Buildings account, Plant

and Machinery account.

ii. Liability account

Financial obligations of the enterprise towards

outsiders are shown under separate heads as liabilities; for example, creditors

account, expenses outstanding account.

iii. Capital account

Financial obligations of a business enterprise

towards its owners are grouped under this category; for example, capital

contributed by owner.

iv. Revenue account

Accounts

relating to revenues of an enterprise are grouped under this category, for

example; revenues from sale of goods, rent received.

v. Expense account

Expenses

incurred and losses suffered for earning revenue are grouped under this

category; for example, purchase of goods, salaries paid.

A transaction

may have the effect on either side of the equation by the same amount or it may

have the effect on one side of the equation only, by both increasing and

decreasing it by an equal amount.

Recording of

transactions as per accounting equation approach is explained below:

(a) Increase in capital and increase in asset

Commenced business with cash Rs. 1,00,000

Effects:

(i) Cash comes in → Increase in asset

(ii) Capital

provided by the owner → Increase in capital of owner

Capital =

Assets

Capital = Cash

(+) Rs. 1, 00,000 = (+) Rs. 1,

00,000

(b) Decrease in liability and decrease in asset

Paid creditors Rs. 10,000

Effects: (i)

Cash goes out → Decrease in asset

Creditors are

paid → Decrease in liability

Liabilities =

Assets

Creditors = Cash

(–) Rs. 10,000 = (–) Rs. 10,000

(c) Decrease in one asset and increase in another asset

Bought furniture costing Rs. 5,000 by

paying cash

Effects:

(i) Furniture comes in → Increase in asset

(ii) Cash goes out → Decrease in asset

Liabilities = Assets

Liabilities = Cash + Furniture

= (–) Rs. 5,000

(+) Rs. 5,000

(d) Decrease in one liability and increase in another liability

Accepted a bill drawn by creditors for Rs. 20,000

Effects:

(i) Bills payable arises → Increase in liability

(ii) Reduction in creditors → Decrease in liability

Liabilities = Assets

+ Bills payable – Creditors = Assets

(+) Rs.

10,000 (–) Rs. 10,000 = Assets

(e) Transactions affecting more than two accounts:

Goods costing Rs. 30,000

sold for Rs. 40,000

Effects:

(i) Goods go out → Decrease in assets

Cash comes in → Increase in assets

Sold goods at a profit → Increase in capital

Liabilities +

Capital = Assets

Capital = Cash

– Stock

(+) Rs.

10,000 =

(+) Rs. 40,000 (–) Rs. 30,000

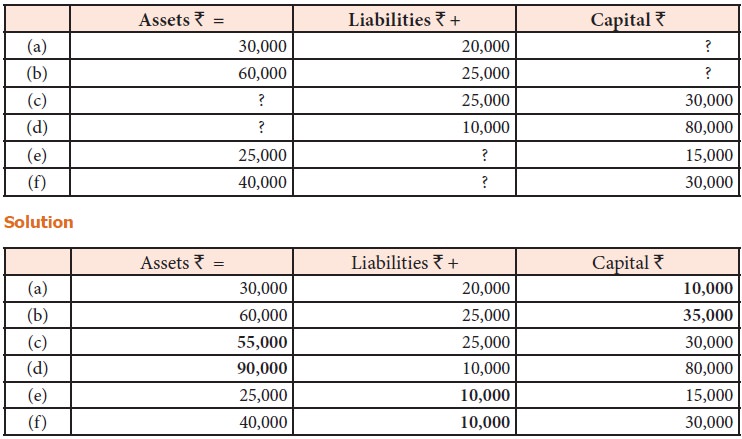

Illustration 1

Complete the missing items.

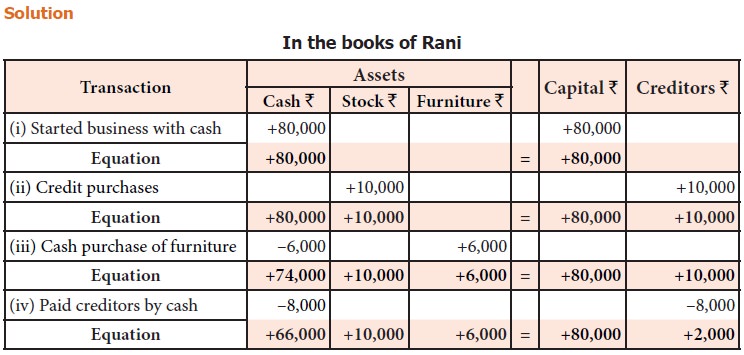

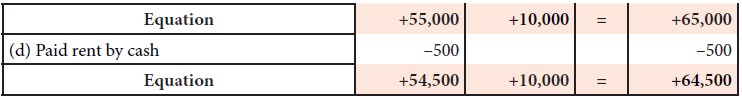

Illustration 2

Show the

accounting equation on the basis of the following transactions for Rani, who is

dealing in automobiles.

(i) Started business with cash 80,000

(ii) Goods bought on credit from Ramesh Rs. 10,000

(iii) Purchased furniture for cash Rs. 6,000

(iv) Paid creditors by cash Rs. 8,000

Solution

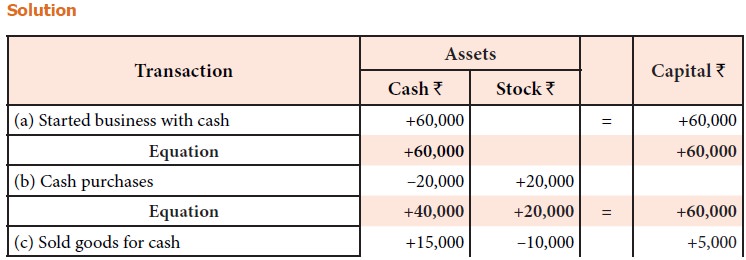

Illustration 3

Show the accounting equation on the basis of the

following:

(a) Started business with cash 60,000

(b) Purchased goods for cash Rs. 20,000

(c) Sold goods for cash costing Rs. 10,000 for Rs. 15,000

(d) Paid rent by cash :

: Rs. 500

Solution

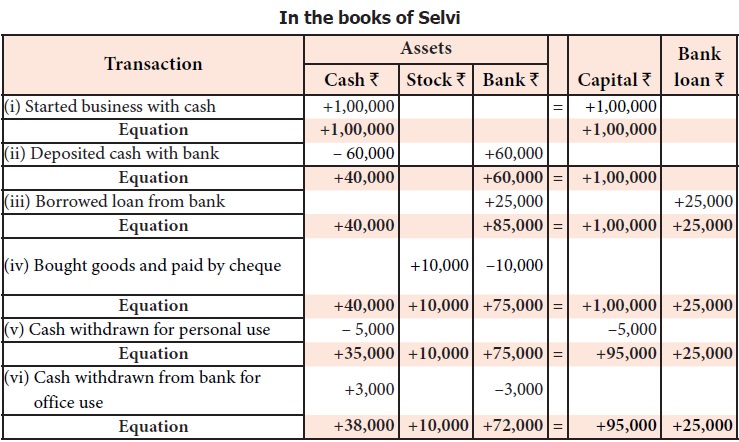

Illustration 4

Selvi is a dealer in furniture. Show the accounting

equation for the following transactions.

(i) Started business with cash Rs. 1,00,000

(ii) Deposited cash into bank Rs. 60,000

(iii) Borrowed loan from bank Rs. 25,000

(iv) Bought goods and paid by cheque Rs. 10,000

(v) Cash withdrawn for personal use Rs. 5,000

(vi) Cash withdrawn from bank for office use Rs. 3,000

Solution

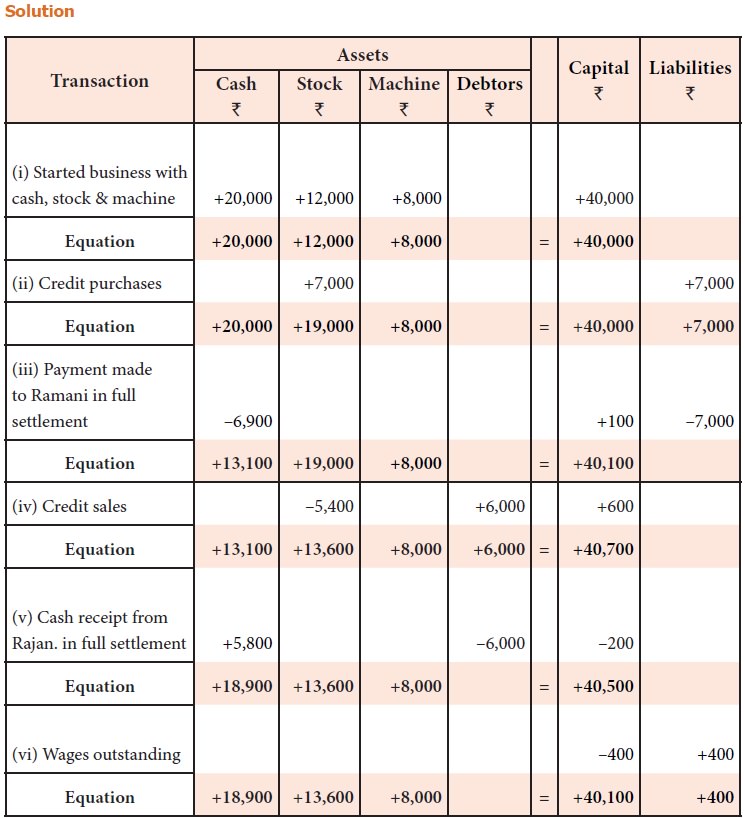

Illustration 5

Show the effect of following business transactions

on the accounting equation.

(i) Anbu started business with cash Rs. 20,000;

goods Rs. 12,000 and machine Rs.

8,000

(ii) Purchased goods from Ramani on credit Rs. 7,000

(iii) Payment made to Ramani in full settlement Rs. 6,900

(iv) Sold goods to Rajan on credit costing Rs.

5,400 for Rs. 6,000

Received from

Rajan Rs. 5,800 in full settlement of his account

(vi) Wages outstanding Rs. 400

Solution

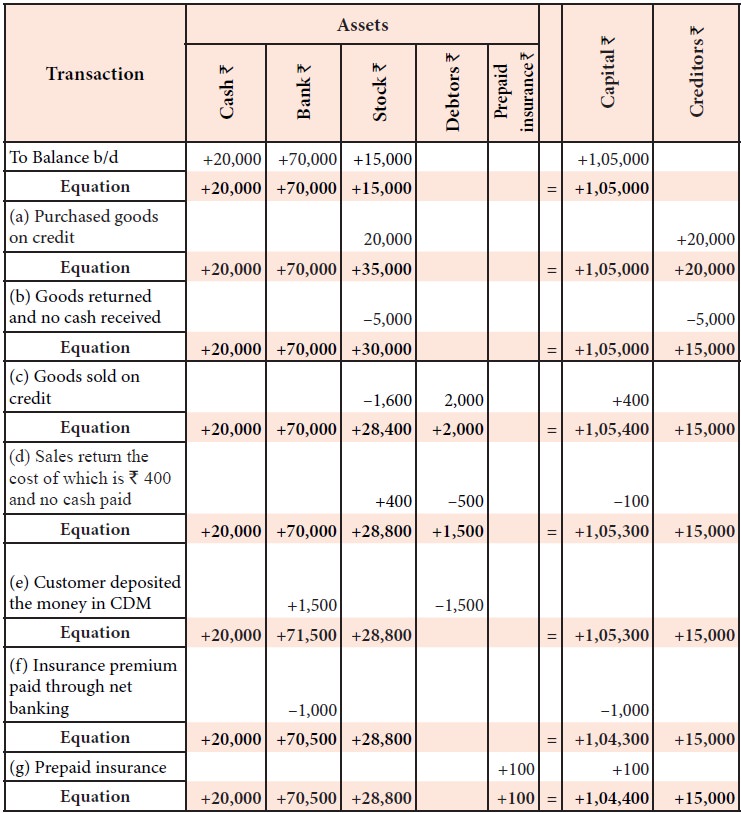

Illustration 6

Veena is a dealer in textiles. On January 1, 2018,

her business showed the following balances: Cash in hand: Rs. 20,000; Bank balance: Rs. 70,000;

Stock: Rs. 15,000. Following are the transactions made during

January 2018. Show the effect of the transactions on accounting equation.

(a) Purchased

goods (readymade shirts) on credit from Subbu Rs.

20,000

(b) Goods

returned to Subbu and no cash is received Rs.

5,000

(c) Goods

(shirts) costing Rs. 1,600 was sold to Janani on credit Rs. 2,000

(d) Janani

returned 1 shirt of sales value Rs. 500

(e) Janani

deposited the money due in cash deposit machine in a bank Rs. 1,500

(f) Insurance

on building paid through net banking Rs.

1,000

(g) Of the

insurance paid, prepaid during the year is Rs.

100

Solution

2. Traditional approach

Under this

approach, the two fold aspects (debit and credit) in each transaction are

recorded in the journal by following double entry system. For the purpose of

recording the transactions, accounts are classified into personal and

impersonal accounts.

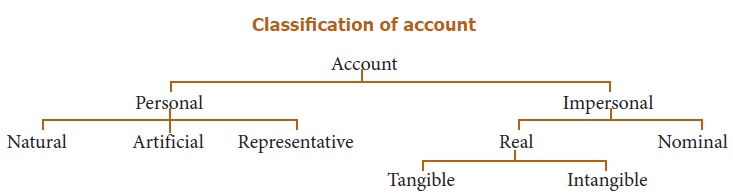

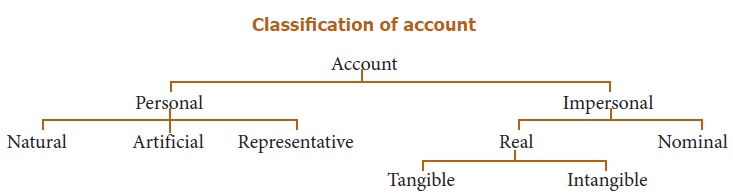

1. Classification of accounts:

Under double

entry system of book keeping, for the purpose of recording the various

financial transactions, the accounts are classified as personal accounts and

impersonal accounts.

i. Personal account: Account relating to

persons is called personal account. The personal account may be natural,

artificial or representative personal account.

·

Natural

person’s account: Natural person means human beings. Example: Vinoth account,

Malini account.

·

Artificial

person’s account: Artificial person refers to the persons other than human

beings recognised by law as persons. They include business concerns, charitable

institutions, etc. Example: BHEL account, Bank account.

·

Representative

personal accounts: These are the accounts which represent

personsnatural or artificial or a group of persons. Example: Outstanding salaries

account, Prepaid rent account. When expenses are outstanding, it is payable to

a person. Hence, it represents a person.![]()

ii. Impersonal accounts: All accounts which do not

affect persons are called impersonal accounts. These are further classified into a)

Real accounts and b) Nominal accounts.

a. Real account: All accounts

relating to tangible and intangible properties and possessions are called real

accounts.

·

Tangible

real accounts: These include accounts of properties and possessions which can be seen and

touched. These have physical existence. Example: Plant, Machinery, Building,

Furniture, Stock.

·

Intangible

real accounts: These include

accounts of properties and possessions which can not be seen and touched. These do

not have physical existence. Example: Goodwill, Patents, Copy rights.

b. Nominal account: The accounts

relating to expenses, losses, revenues and gains are

called nominal accounts. Example: Salaries, wages, rental income,

interest income, etc. These are temporary accounts and are transferred to

Trading and Profit and Loss account depending on whether these are direct or

indirect respectively.

Related Topics